There are a number of roads classified as Truck A, B, and C in Nigeria’s six geopolitical zones. Truck A roads are those managed by the federal government, while Truck B and C roads are managed by the state and local governments, respectively.

Apart from the fact that these governments are supposed to build, renovate, and maintain these roads, they are also responsible for ensuring the safety of the users. This has been one of the primary motivations for placing various objects on the roadways in order to ensure the safety of drivers, commuters, and pedestrians. The high reduction projected from road crashes, on the other hand, has never been achieved over the years. Between January and June, 2021, the Federal Road Safety Corps reported 5,320 crashes and 2,471 deaths nationwide. Due to the worrisome nature of these data, the first three quarters of the same year provides an opportunity for debate and consultation across the country on the role of speed bumps in road safety. However, speed bumps are not entirely to blame for collisions.

According to our checks, Nigerian regulations permit the installation of speed bumps and other materials deemed necessary for ensuring safety on rural and urban internal roads and highways. According to Transportation Management Experts and Engineers who spoke with our analyst, the erection is necessary because many drivers exceed the speed limit per hour per kilometer. Several sources also indicate that speed bumps or humps are still the most efficient way to increase road user safety.

Mixed Positions and Impacts

Despite the advantages stated by academics and experts in the transportation and mobility industries, responses from various schools of thought on the usefulness of conical, heaped, hollow, and other types of speed bumps are varied. For example, the government is the best-qualified party to install speed bumps on the three types of roads mentioned previously. Individuals and groups, on the other hand, have erected the bumps in the majority of situations, based on our observations and interactions.

Over-speeding by many drivers is jeopardizing the lives of children, the elderly, and other users, according to the submission of individuals and communities who created the bumps. While some drivers who spoke with our analyst agreed that installing speed bumps is a good idea, others considered that putting bumps on the roads had more disadvantages than benefits. The drivers stated that bumps cause persistent backache, spinal pain, delay, discomfort, and frustration in the majority of situations, similar to what our analyst discovered from academics who have thoroughly investigated the topic in the last ten years.

Aside from that, their automobiles are being harmed. They mentioned wheel damage, wheel misbalancing, and clutch burning as some of the problems they have when driving on bumpy roads, particularly those with a lot of them. According to our findings, speed bumps made of a mixture of cement and concrete and formed in a ‘large form’ pose a greater risk to drivers than those made of rubber and flat in shape.

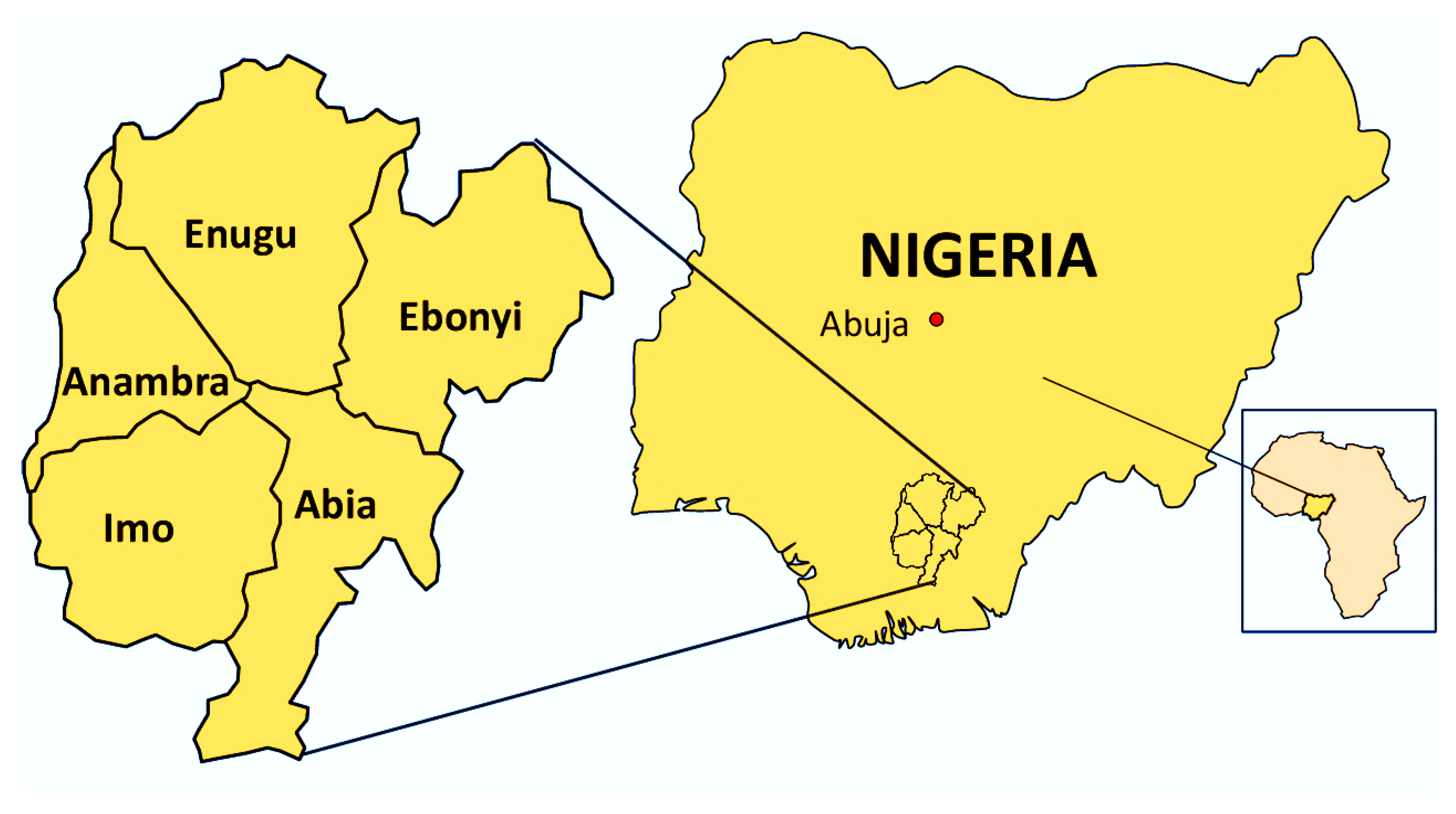

Our analyst recently went on a trip to Saki, a northern town in Oyo state, and what he saw was similar to what scholars have studied over the years. Iseyin-Saki Road has around 90 speed bumps from the freshly completed road at Moniya to the town. Our analyst and others were unconformable for the entire 5-hour ride from Ibadan, believing that the bumps were causing the travel to be delayed. People who have traveled inside Ekiti, Ondo, Rivers, Abia, and other states report similar experiences.

Because concerned stakeholders are constantly seeing the reasons for building speed bumps, the mixed positions and impacts from experience and researches have demonstrated that erection of speed bumps cannot be halted. However, a better technique for their erection is required. When erecting the bumps, the Ministry of Transport and other government entities in charge of road construction and maintenance should always follow best global practices. Rubber types, for example, should be prioritised above concrete types, particularly on intra-city and town roads. Illegal speed bumps built on highways and those installed by communities without regard for regulations must be eliminated.