Zenith Bank is now the most valued bank in Nigeria at N810.030 billion. GTCO, the holding company which controls Guaranty Trust Bank is now at N759.324B. OPay remains the most valued financial institution at $2 billion (N1 trillion) according to data from its last raise.

Today, we are learning that Japan’s mega fund, SoftBank, is leading a $400 million raise in OPay, pushing the company to a valuation of $2 billion: “The company, founded in 2018, had an exclusive presence in Nigeria. It provided various digital services ranging from mobility and logistics to e-commerce and fintech at cheap rates for consumers.” Yes, within 3 three years, OPay has a market cap that is bigger than more than 80% of Nigerian banks. This shows the impact of technology in an industrial sector.

This plot created by Nairametrics shows the numbers as at the end of December 2021.

We will get to this destination as this redesign evolves.

In this videocast, I discuss the need to build a truly pan-African digital remittance/transfer banking product which is agnostic of location or currency in Africa. None of the products we have today meets that standard. Largely, I envisage a situation where all you need to buy and sell across Africa is one bank account in just one African Union country. With that, you do not have to even think about the specific currency of that account as technology will seamlessly make it possible to access other African markets for payments, transfer, etc. The banks or fintech companies must still comply with all regulations related to international transfers, forex, etc. The only difference is that customers will not see them as they will be hidden with technology.

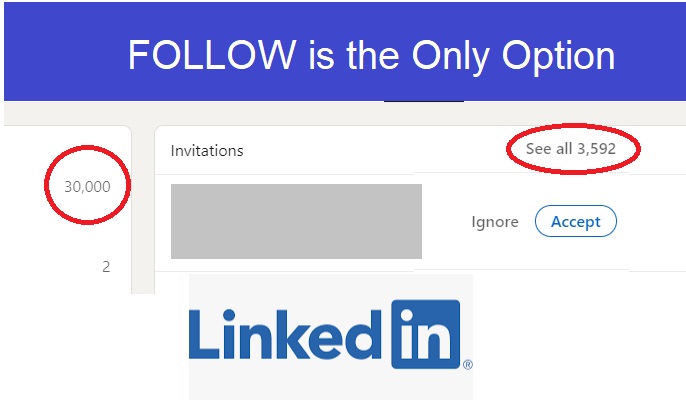

Comment on LinkedIn Feed

In not too distant future, technology will overturn those banks.

The funding for “fintech” is not coming from banks but foreign inflows, this supports the notion that Nigerian banks are not really growing business but only those that are already established.

No matter your good business ideas, banks will not come to your aid when you are starting. When they start to see your growth trajectory, all the bank relationship officers/managers will want to be associated with you. You will see all sorts of Christmas gifts even from those you are not banking with, all in an effort to woo you and get a share of your sweat.