Many US-focused ecommerce startups in Nigeria are struggling and closing. Yes, it is a nice vision: make it possible for Nigerians to buy shoes, bags, shirts, etc from Macy’s, JCPenney, etc as everyone wants quality things. However, when currency runs wild, bad things happen. It takes us to one of my core teachings: Product Minimum Viable Quality (PMVQ).

The deal is this: the construct of quality has no meaning until the price of the product is put into considerations. I always ask entrepreneurs to consider the Minimum Viable Quality (MVQ) bounded by the product target price which the market will respond to. You can build rockets to fly people around the world; that is an engineering possibility. But does that make business sense if no one can afford it? Ask the makers of Concorde Airlines for answers.

As apps mushroomed across Africa to help Africans dress like British and Americans, investors came along. But as currencies struggle, those apps are fading. Why? You may like Mercedes Benz over Toyota but can you pay for it? Etisalat had the best broadband service in Nigeria, but it priced many out – and ended up struggling. A crappy affordable service might have helped it because it is very hard to make money in places with limited money. Until you understand the relationship between price and quality, you will not make progress in the African business scene.

Sure, this does not mean making fake products. But it does mean finding a path to a market with things your target market can afford. It is the same company that makes those electric bulbs they use in airport towers and the ones we use at home. Those airport ones can go for $10k per unit while the home one is about $1.

The airport versions can last for a decade because the real cost is the replacement cost while the crappy ones we use at home can go for 2 months and bust. A company which pursues quality, thinking that families will spend $10k to have an electric bulb that will last for 10 years has no mission! So what happens? You build for a minimum viable quality of $1 because that is what the market can pay!

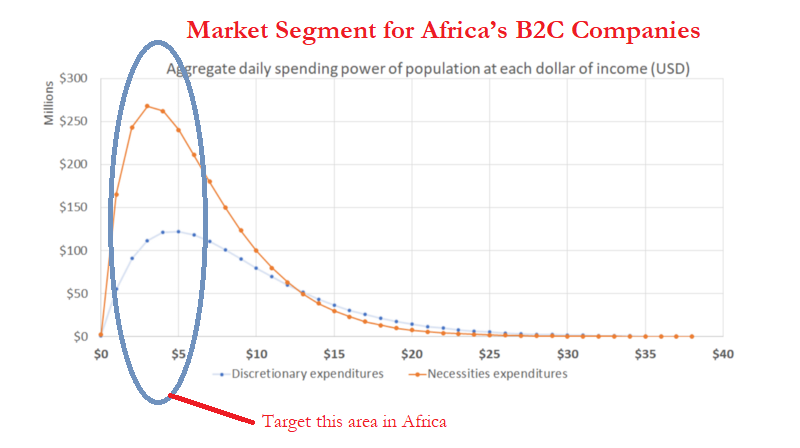

Stretch it, you are outside the sweet spot of spending in Africa (see the plot).

LinkedIn Comment on Feed

Comment: This reminds me of an observation made by one of my lecturers back then in the university. The Chinese by then had started flooding African markets with all sorts of cheap lookalike products to the ones we grew of consuming from Nigeria. Of course the Nigerian products were of better quality but before long, everyone started crying fowl of how quickly the cheaper Chinese products were getting bad. When i asked my lecturer back then why people kept buying the Chinese products only to complain afterwards, he smiled. I probed further…even America is complaining about Chinese products…why do they allow them do this…his response keeps resonating inybears till date. The problem in America is different from the one here in Cameroon. Over there, Americans are complaining of high quality products from China that sells cheaper than American products of the same quality. Here we have products with quality equivalent to what we can pay.

My Response: I have a video on this where I used the Chinese toy industry and how that playbook made it possible for them to win markets across developing regions of the world. Who wants to spend $50 to buy a Christmas race-car toy from Germany when China offers one for $1 even though it may not last more than 2 hours on Christmas day. Because mothers are smarter: China’s $1 will win as they can save money for more important things. The kid has his toy even though it did not work for many hours!