Three weeks after missing its scheduled launch, the Central Bank of Nigeria (CBN) has said that President Muhammadu Buhari will unveil the e-Naira on Monday, October 25.

The unveiling of e-Naira, the much touted Nigerian Central Bank Digital Currency (CBDC) was shelved on October 1, after the CBN said the launch could not possibly go alongside key Independence Day activities.

The financial regulator cited Independence Day for the cancelation, although a cease and desist letter issued to the central bank over the name, e-Naira, later surfaced, suggesting that there could be another reason while the e-Naira launch was postponed.

Enaira Payment Solutions Limited, a business entity incorporated since 7th April 2004, had approached the court alleging infringement of trademark and violation of corporate name. The company had prayed to the court to stop the apex bank from unveiling the digital currency.

However, the Federal High Court, presided over by Justice Taiwo Obayomi Taiwo, ordered that the unveiling should proceed in national interest and economic advancement. The court had expressed the view that the aggrieved company stands the chance to be adequately compensated in damages.

With the dust settled, a statement signed by CBN’s Director of Corporate Communications, Osita Nwanisobi, said the e-Naira is now expected to be activated on Monday.

“President Muhammadu Buhari is scheduled to formally unveil the Nigerian Central Bank Digital Currency (CBDC), known as the eNaira, on Monday 25 October 2021, at the State House, Abuja.

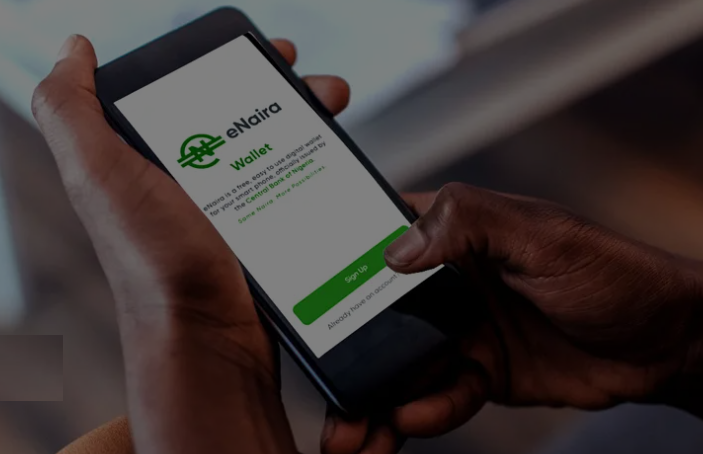

“The launch of the eNaira is a culmination of several years of research work by the Central Bank of Nigeria in advancing the boundaries of payments system in order to make financial transactions easier and seamless for every strata of the society.

“Following series of engagements with relevant stakeholders including the banking community, fintech operators, merchants and indeed, a cross section of Nigerians, the CBN designed the digital currency, which shall be activated on Monday, October 25, 2021.

“The eNaira therefore marks a major step forward in the evolution of money and the CBN is committed to ensuring that the eNaira, like the physical Naira, is accessible by everyone.

“Given that the eNaira is a journey, the unveiling marks the first step in that journey, which will continue with a series of further modifications, capabilities and enhancements to the platforms.

“The CBN will continue to work with relevant partners to ensure a seamless process that will benefit every user, particularly those in the rural areas and the unbanked population.

“Since the eNaira is a new product, and amongst the first CBDCs in the world, we have put a structure to promptly address any issue that might arise from the pilot implementation of the eNaira.

“Accordingly, following Monday’s formal launch by the President, the Bank will further engage various stakeholders as we enter a new age consistent with global financial advancement.

“The theme of the eNaira is: “Same Naira, more possibilities,” the statement said.

Like this:

Like Loading...