In the industrial age, factories and machines were components of production. In today’s digital economy, your online persona has become one of your most important assets. I call it Webinality – a fusion of web and personality. It is the sum of how you appear, behave, and engage on the internet. In a world where first impressions increasingly happen online, a strong Webinality is not a luxury; it is a competitive advantage.

A well-crafted Webinality signals credibility, competence, and character. It is how you stand out in a noisy digital marketplace and become discoverable for your unique skills and capabilities. Just as companies build brands, professionals must build digital brands.

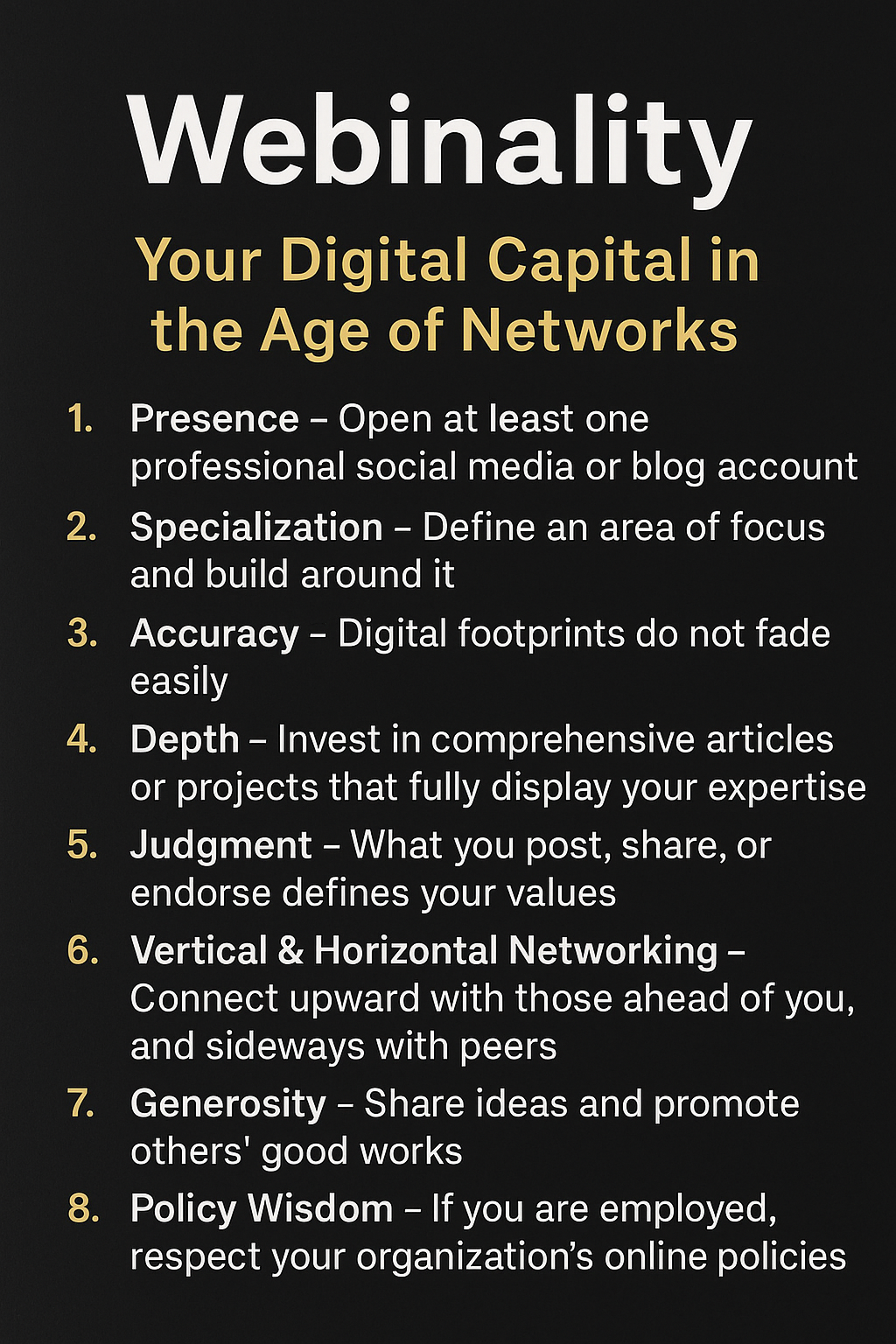

Here are some pillars to strengthen your Webinality:

- Presence – Open at least one professional social media or blog account. If you are invisible online, you may be invisible in opportunity.

-

Specialization – Define an area of focus and build around it. A five-minute online search should tell anyone exactly what you stand for. Differentiation is the beginning of relevance.

-

Accuracy – Digital footprints do not fade easily. If you exaggerate your accomplishments, a former classmate or co-worker can challenge it instantly. Accuracy sustains trust.

-

Depth – While micro-posts keep you visible, also invest in comprehensive articles or projects that fully display your expertise. Expand classwork, create thought pieces, publish deep insights. Half-baked content will not take you far.

-

Judgment – What you post, share, or endorse defines your values. Employers want reliable, ethical team leaders. Let your Webinality reflect reliability.

-

Vertical & Horizontal Networking – Connect upward with those ahead of you professionally, and sideways with peers. A network built in two directions creates opportunities in multiple directions.

-

Generosity – Share ideas. Promote others’ good works. Write professional reviews of books and journals. In time, goodwill compounds into influence.

-

Policy Wisdom – If you work for an organization, respect its online policies. Your personal profile should not become an accidental leak of competitive information. Separate your personal brand from your employer’s, where necessary.

-

Continuity – Webinality is never “done.” It is a living system requiring constant updates of networks, content, and profiles. Nurture it like a garden.

In Igbo, we say “ihe e ji ama onye bu aha ya” – you are known by your name. In the digital age, you are known by your Webinality. Build it intentionally. In a marketplace of billions of IP addresses, that is your foundational factor of production.

LinkedIn Post

Webinality is a portmanteau of web and personality. It refers to your professional digital identity — who you are online, how the world sees your knowledge, values, and capabilities.

It is more than presence: it is how you are known in your absence. If people cannot recommend you when you are not in the room, your Webinality is weak.

Webinality involves building credibility, visibility, and trust via content, networks, and consistent alignment of what you say with what you do. It is about making your expertise discoverable.

In Tekedia Mini-MBA Personal Economy module, I do teach that this refers to your professional online persona or digital identity. In a world where first impressions often happen online, your webinality is considered one of your most important assets.

Indeed, a strong webinality is a competitive advantage that signals credibility, competence, and character. It’s how you stand out in the digital professional marketplace and become discoverable for your unique skills and capabilities.