It’s worthwhile for one to, from time-to-time, re-examine his or her personality value towards making amends where need be. It equally helps to know the qualities or features to be sustained thereof.

Such a step, as mentioned above, isn’t only wholesome for an individual, but also in the case of an entity. It’s, therefore, needless to state that every creature requires scrutiny.

Herein, as the topic implies, we are specifically concerned about the tech value of the acclaimed giant of Africa. In other words, we’re dissecting how far and well she has hitherto fared in tech-driven matters and activities.

One might wonder if Nigeria really has technology, let alone its value. The truth is that the country could currently boast of over ninety tech hubs across the federation, the highest on the African continent.

In recent years, Nigeria has ostensibly become an incubator for some of the continent’s biggest start-ups, including online marketplace such as Jumia and Konga; and these digital outlets are unarguably driven by tech expertise.

It’s noteworthy that Nigeria reportedly has the largest economy in Africa with a Gross Domestic Product (GDP) of about $448.12 billion compared to its closest rival, South Africa whose present GDP is about $320 billion.

However, it’s worthy of note that the real wealth of any nation is calculated by its GDP per capita, and Nigeria ranks 140 out of 186 in GDP per capita global ranking.

Per capita GDP is a financial metric that breaks down a country’s economic value (output) per person, and is calculated by dividing the whole GDP by the country’s overall population.

In Economics, it’s widely accepted that technology is the key driver of economic growth of countries, regions or cities. Technological progress allows more efficient production of goods and services, in which prosperity depends on.

Technology brings skills, knowledge, process, technique, and tools together, toward solving problems concerning human existence, thereby making their life secure and happy.

It’s very pertinent in today’s world, because it is driving the global community as well as making it appear better. In fact, it is gradually becoming inevitable in our various homes, offices, and workplaces.

Nigeria’s tech patent has grown to be an envy of all who understands its real content. In terms of human and material attributes, it has over the years remains significant in the global society and market.

Take a walk round the world, you would comprehend that, most recent tech inventions and innovations across the globe were mainly as a result of contributions from Nigerians. Similarly, Nigerians remain the reason several countries’ tech sectors have grown beyond limits.

Ironically, Nigeria’s tech sector is presently nothing to write home about. As the days unfold, the sector continues to decline in its value, hence taking the country’s name to a state of ridicule.

Each day, the governments at all levels come up with empty promises and policies as regards tech-driven activity and innovation. The politicians at the country’s helm of affairs have unequivocally, over the donkey’s years, failed us in this regard.

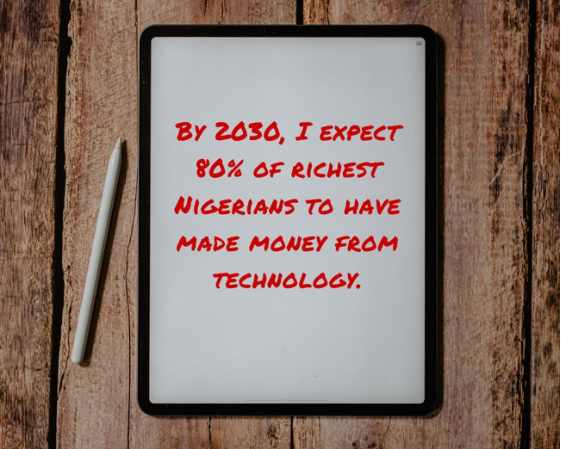

The good news is that, in spite of the lingering hurdles and challenges, the prospects of the country’s tech value remain obviously great, perhaps owing to the fathomless resources lying fallow.

It’s worth noting that countless factors are behind the ongoing impediments in Nigeria’s tech sector. For us to get it right as a people, these barriers continually posing a threat must be severely tackled by the concerned authorities at all cost.

A certain tech-driven contract might be awarded by the government. In the long run, we would be greeted with a myriad of untold stories attributed to paucity of funds. In such case, it could be either the fund made available for execution of the project had been squandered or that insufficient fund was approved ab initio.

The steady economic fluctuation is another glaring factor that cannot be swept under the carpet. This particular plight has left Nigerians tech experts with no choice than to cloud their reasoning with uncertainties and fear of the unknown.

More so, those who – amidst the tough times – insisted on putting something together, would not find the apt market to sell their products or patents. This could be as a result of infrastructural decay occasioned by lack of maintenance culture, or the required physical infrastructures have never been in existence from the onset. The cost of running a tech firm in Nigeria is too high, to say the least.

Poverty has also on its part really posed a great danger to Nigeria’s tech value. The individuals who have the zeal and ability to invest in their expertise might end up being frustrated, due to lack of capital. This is why the country’s GDP per capita has to be fixed or elevated if she actually wants her tech sector to excel headlong.

Nigerians do not trust made-in-Nigeria goods. The mentality of seeing foreign products as superior while branding domestically-made ones inferior, must be tackled. Aside from sensitization, apt policies can properly assist in eradicating the social menace, which could best be described as a cankerworm that has eaten deep into our collective bone marrow.

The governments must not necessarily invest in technology for their respective tech values to grow. In most countries where technology is seriously thriving, the individuals domiciled therein remain the key players, not the government. But such a phenomenon can never be witnessed if the enabling environment is conspicuously missing.

To fix this anomaly, we must be ready and determined to address the quagmire in the political system. The country’s political instability is so intense, and continues to skyrocket by the day, that one cannot possibly say what the nearest future entails for our indigenous tech patent.

The policies are so weak that they can’t even initiate a project, let alone accomplish it. To get things rightly done, we need to acknowledge that a country’s growth in any sector depends majorly, if not solely, on her extant policies.

To be on the same page with me, take a look at any nation that has grown in a certain sector, and then take time to painstakingly x-ray the policies guiding the area in question. Just a research and adequate analysis would make you understand where exactly I’m coming from.

Growth is not rocket science; it takes some processes. For such processes or procedures to occur, there must be existing principles. The moment the rules (principles) are thwarted, it marks the beginning of the end of the procedures. There are no two ways about it.

Lest I forget, we need to equally take into cognizance that the reason most of the needed policies cannot exist in countries like Nigeria is that our corrupt political leaders have realized that technology exposes corruption. Read my lips.

They are apparently of the view that if tech is deployed in any area, it would certainly expose their corrupt practices. Take for instance, a situation where technology is fully implemented in the country’s electoral system as well as using forensic audit patterns in the finance sector.

The above factors are the reason we ought to clamour for overhaul. The country is in damn need of total overhaul of the system. To achieve this, we need to realize the full benefits of investing in technology.

We are not here to reiterate the numerous merits of technology but to point out the goals and lapses in the said sector, in a bid to do the needful. If we spend time to highlight the outpouring merits, three editions of this column might not be sufficient.

Artificial intelligence is deeply gaining momentum on a daily basis, signifying it has come to stay. Ease of access to information cannot be overestimated. Ease of mobility is another overwhelming experience. Better communication means and improved banking have, beyond reasonable doubts, made the world seem not unlike a minute village.

Learning has been digitized, thereby silencing any form of impediment, owing to the presence of technology. Cost efficiency and apt time management are being assured in all tech-driven activities. These are verifiable facts.

Countless innovations are springing up by the day in every facet of human endeavour. The ‘disabled’ are now abled, because of tech-driven tools, yet Nigeria and her likes seemingly await more prophets to tell them that technology has come to take the planet to the promised land.

Understanding that the presence of an adequate tech hub drastically changes the economic outlook of any country involved, is enough reason to place its content ahead of others.

Like this:

Like Loading...