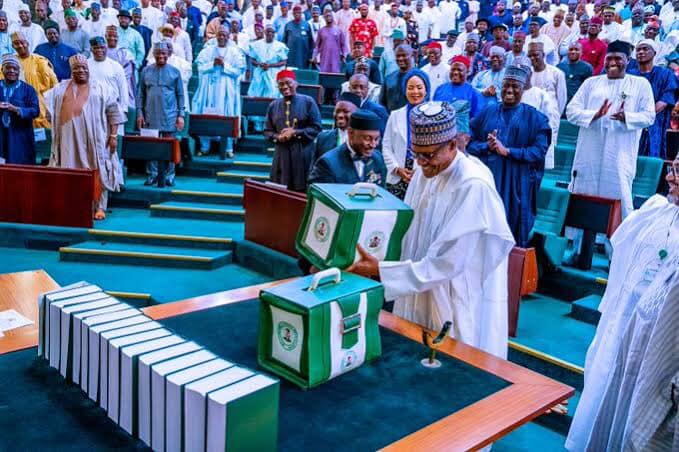

President Buhari presented Nigeria’s 2022 national budget of N16.39 trillion, about US$40 billion using the official exchange rate to the joint session of the National Assembly this week (the figure was updated from N13 trillion to include funds for election, health workers, security, etc),. The crude oil benchmark price used was $57 per barrel and daily oil production is estimated at 1.88 million barrels per day. The exchange rate is pegged at N410 per US dollar! And the total projected revenue is put at N17.7 trillion.

Full speech on click…

The full speech

2022 BUDGET SPEECH

Budget of Economic Growth and Sustainability

Delivered By:

His Excellency, President Muhammadu Buhari

President, Federal Republic of Nigeria

At the Joint Session of the National Assembly, Abuja

Thursday, October 7, 2021

PROTOCOLS

- It is my great pleasure to be here once again to present the 2022 Federal Budget Proposals to this distinguished Joint Session of the National Assembly.

- Distinguished and Honourable leaders, and members of the National Assembly, let me start by commending you for the expeditious consideration and passage of the Supplementary Appropriation Bill 2021. This further underscores your commitment to our collective efforts to contain the COVID-19 Pandemic and address the various security challenges facing our country.

-

I will also take this opportunity to thank you for the quick consideration and approval of the 2022-2024 Medium-term Expenditure Framework and Fiscal Strategy Paper. Our hope is that National Assembly will continue to partner with the Executive by ensuring that deliberations on the 2022 Budget are completed before the end of this year so that the Appropriation Act can come into effect by the first of January 2022.

-

The 2022 Budget will be the last full year budget to be implemented by this administration. We designed it to build on the achievements of previous budgets and to deliver on our goals and aspirations as will be reflected in our soon-to-be launched National Development Plan of 2021 to 2025.

-

Distinguished Senators and Honourable Members, in normal times, I make use of this opportunity to provide an overview of global and domestic developments in the current year, a summary of our achievements, and our plans for the next fiscal year.

-

However, these are exceptional times. The grim realities of COVID-19 and its lethal variants are still upon us. From President to Pauper, the virus does not discriminate.

-

This is why our country still maintains its COVID -19 guidelines and protocols in place to protect its citizens and stop the spread of this disease.

-

Over the past few days, we have consulted with the Presidential Steering Committee on COVID-19 and the leadership of the National Assembly on how best to present the 2022 budget proposal keeping in mind the deep-rooted traditions in place and the guidelines for safe mass gatherings.

-

We ultimately decided that the most responsible and respectful approach was to hold a shorter than usual gathering while allowing the Honourable Minister of Finance, Budget and National Planning to provide fuller details of our proposals in a smaller event.

-

I am sure many of you will be relieved as my last budget speech in October 2020 lasted over fifty minutes.

-

Still, over the next few minutes, I will provide key highlights of our 2021 performance as well as our proposals for 2022.

PERFORMANCE OF THE 2021 BUDGET

- The 2021 ‘Budget of Economic Recovery and Resilience’ is based on a benchmark oil price of 40 US Dollars per barrel, oil production of 1.6m b/d, and exchange rate of 379 Naira to US Dollar. Furthermore, a Supplementary budget of 982.73 billion Naira was recently enacted to address exigent issues in the Security and Health sectors.

-

Based on the 2021 Fiscal Framework, total revenue of 8.12 trillion Naira was projected to fund aggregate federal expenditure of 14.57 trillion Naira (inclusive of the supplementary budget). The projected fiscal deficit of 6.45 trillion Naira, or 4.52 percent of GDP, is expected to be financed mainly by domestic and external borrowings.

-

By July 2021, Nigeria’s daily oil production averaged one 1.70million barrels (inclusive of condensates) and the market price of Bonny Light crude averaged 68.53 US Dollars per barrel.

-

Accordingly, actual revenues were 34 percent below target as of July 2021, mainly due to the underperformance of oil and gas revenue sources. Federal Government’s retained revenues (excluding Government Owned Enterprises) amounted to 2.61 trillion Naira against the proportionate target of 3.95 trillion Naira for the period.

-

The Federal Government’s share of Oil revenue totalled 570.23 billion Naira as of July 2021, which was 51 percent below target, while non-oil tax revenues totalled 964.13 billion Naira. The poor performance of oil revenue relative to the budget was largely due to the shortfall in production as well as significant cost recovery by NNPC to cover the shortfall between its cost of importing petrol and the pump price.

-

The National Assembly will recall that in March 2020 the Petroleum Products Pricing Regulatory Agency announced that the price of petrol would henceforth be determined by market forces.

-

However, as the combination of rising crude oil prices and exchange rate combined to push the price above the hitherto regulated price of 145 Naira per litre, opposition against the policy of price deregulation hardened on the part of Labour Unions in particular.

-

Government had to suspend further upward price adjustments while engaging Labour on the subject. This petrol subsidy significantly eroded revenues that should have been available to fund the budget.

-

On a positive note, we surpassed the non-oil taxes target by eleven (11) percent in aggregate. The sustained improvement in non-oil taxes indicates that some of our revenue reforms are yielding positive results. We expect further improvement in revenue collections later in the year as more corporate entities file their tax returns and we accelerate the implementation of our revenue reforms.

Improving Revenue Generation and Administration

- We have stepped up implementation of the strengthened framework for performance management of government owned enterprises (GOEs), with a view to improve their operational efficiencies, revenue generation and accountability. The 50% cost-to-income ratio imposed on the GOEs in the Finance Act 2020 has contributed significantly to rationalizing wasteful expenditures by several GOEs and enhanced the level of operating surpluses to be transferred to the Consolidated Revenue Fund (CRF). I solicit the cooperation of the National Assembly in enforcing the cost-to-income ratio and other prudential guidelines during your consideration of the budget proposals of the GOEs, which I am also laying before you today.

-

On the expenditure side, as at end of July 2021, a total of six point seven-nine (6.79) trillion Naira had been spent as against the pro-rated expenditure of seven point nine-one (7.91) trillion Naira. Accordingly, a deficit of four point one-seven (4.17) trillion Naira was recorded as at end of July 2021. The deficit was financed through domestic borrowing.

-

Despite our revenue challenges, we have consistently met our debt service commitments. We are also up to date on the payment of staff salaries, statutory transfers, and overhead costs. As at (4th of October 2021, a total of 1.732 trillion Naira had been released for capital expenditure.

-

I am pleased to inform you that we expect to fund MDAs’ capital budget fully by the end of the fiscal year 2021.

-

Capital releases thus far have been prioritised in favour of critical ongoing infrastructural projects in the power, roads, rail, agriculture, health and education sectors.

-

We have made progress on the railway projects connecting different parts of the country. I am glad to report that the Lagos-Ibadan Line is now completed and operational. The Abuja-Kaduna Line is running efficiently. The Itakpe-Ajaokuta rail Line was finally completed and commissioned over thirty (30) years after its initiation.

-

Arrangements are underway to complete the Ibadan-Kano Line. Also, work will soon commence on the Port Harcourt-Maiduguri Line and Calabar-Lagos Coastal Line, which will connect the Southern and Eastern States to themselves and to the North.

-

Progress is also being made on several power generation, transmission, and distribution projects, as well as off-grid solutions, all aimed towards achieving the national goal of optimizing power supply by 2025.

-

I am again happy to report that we continue to make visible progress in our strategic road construction projects like the Lagos – Ibadan expressway, Apapa – Oworonsoki expressway, Abuja – Kano expressway, East-West Road and the second Niger bridge. We hope to commission most of these projects before the end of our tenure in 2023.

-

The Pandemic revealed the urgent need to strengthen our health system. Towards this end, we constructed 52 Molecular labs, 520 bed intensive care units, 52 Isolation centres and provision of Personal Protective equipment across 52 Federal Medical Centres and Teaching Hospitals.

-

We continue to push our expenditure rationalization initiatives which we commenced in 2016. For example, on personnel costs, the number of MDAs captured on the Integrated Payroll and Personnel Information System increased from 459 in 2017 to 711 to date.

-

The recent passage of the Petroleum Industry Act 2021, and consequent incorporation of the Nigeria National Petroleum Corporation should also result in rationalisation of expenditure, as well as increased investments and improved output in the oil and gas industry.

-

Distinguished Senators and Honourable Members, you will agree with me that a lot has been accomplished over the last year but there is still much to be done. I will now proceed with a review of the 2022 Budget proposal.

THEME AND PRIORITIES OF THE 2022 BUDGET

- The allocations to MDAs were guided by the strategic objectives of the National Development Plan of 2021 to 2025, which are:

a. Diversifying the economy, with robust MSME growth;

b. Investing in critical infrastructure;

c. Strengthening security and ensuring good governance;

d. Enabling a vibrant, educated and healthy populace;

e. Reducing poverty; and

f. Minimizing regional, economic and social disparities.

- The 2022 Appropriation therefore is a Budget of Economic Growth and Sustainability.

-

Defence and internal security will continue to be our top priority. We remain firmly committed to the security of life, property and investment nationwide. We will continue to ensure that our gallant men and women in the armed forces, police and paramilitary units are properly equipped, remunerated and well-motivated.

-

The 2022 budget is also the first in our history, where MDAs were clearly advised on gender responsive budgeting. These are part of critical steps in our efforts to distribute resources fairly and reach vulnerable groups of our society.

PARAMETERS AND FISCAL ASSUMPTIONS

- Distinguished Members of the National Assembly, the 2022 to 2024 Medium Term Expenditure Framework and Fiscal Strategy Paper sets out the parameters for the 2022 Budget as follows:

a. Conservative oil price benchmark of 57 US Dollars per barrel;

b. Daily oil production estimate of 1.88 million barrels (inclusive of Condensates of 300,000 to 400,000 barrels per day);

c. Exchange rate of four 410.15 per US Dollar; and

d. Projected GDP growth rate of 4.2 percent and 13 percent inflation rate.

2022 REVENUE ESTIMATES

- Based on these fiscal assumptions and parameters, total federally-collectible revenue is estimated at 17.70 trillion Naira in 2022.

-

Total federally distributable revenue is estimated at 12.72 trillion Naira in 2022 while total revenue available to fund the 2022 Federal Budget is estimated at 10.13 trillion Naira. This includes Grants and Aid of 63.38 billion Naira, as well as the revenues of 63 Government-Owned Enterprises.

-

Oil revenue is projected at 3.16 trillion, Non-oil taxes are estimated at 2.13 trillion Naira and FGN Independent revenues are projected to be 1.82 trillion Naira.

PLANNED 2022 EXPENDITURE

- A total expenditure of sixteen point three-nine (16.39) trillion Naira is proposed for the Federal Government in 2022. The proposed expenditure comprises:

a. Statutory Transfers of 768.28 billion Naira;

b. Non-debt Recurrent Costs of 6.83 trillion;

c. Personnel Costs of 4.11 trillion Naira;

d. Pensions, Gratuities and Retirees’ Benefits 577.0 billion Naira;

e. Overheads of 792.39 billion Naira;

f. Capital Expenditure of 5.35 trillion Naira, including the capital component of Statutory Transfers;

g. Debt Service of 3.61 trillion Naira; and

h. Sinking Fund of 292.71 billion Naira to retire certain maturing bonds.

Fiscal Balance

- We expect the total fiscal operations of the Federal Government to result in a deficit of 6.26 trillion Naira. This represents 3.39 percent of estimated GDP, slightly above the 3 percent threshold set by the Fiscal Responsibility Act 2007. Countries around the world have to of necessity over-shoot their fiscal thresholds for the economies to survive and thrive

-

We need to exceed this threshold considering our collective desire to continue tackling the existential security challenges facing our country.

-

We plan to finance the deficit mainly by new borrowings totalling 5.01 trillion Naira, 90.73 billion Naira from Privatization Proceeds and 1.16 trillion Naira drawdowns on loans secured for specific development projects.

-

Some have expressed concern over our resort to borrowing to finance our fiscal gaps. They are right to be concerned. However, we believe that the debt level of the Federal Government is still within sustainable limits. Borrowings are to specific strategic projects and can be verified publicly.

-

As you are aware, we have witnessed two economic recessions within the period of this Administration. In both cases, we had to spend our way out of recession, which necessitated a resort to growing the public debt. It is unlikely that our recovery from each of the two recessions would have grown as fast without the sustained government expenditure funded by debt.

-

Our target over the medium term is to grow our Revenue-to-GDP ratio from about 8 percent currently to 15 percent by 2025. At that level of revenues, the Debt-Service-to-Revenue ratio will cease to be worrying. Put simply, we do not have a debt sustainability problem, but a revenue challenge which we are determined to tackle to ensure our debts remain sustainable.

-

Very importantly, we have endeavoured to use the loans to finance critical development projects and programmes aimed at improving our economic environment and ensuring effective delivery of public services to our people. We focused on;

a. the completion of major road and rail projects;

b. the effective implementation of Power sector projects;

c. the provision of potable water;

d. construction of irrigation infrastructure and dams across the country; and

e. critical health projects such as the strengthening of national emergency medical services and ambulance system, procurement of vaccines, polio eradication and upgrading Primary Health Care Centres across the six geopolitical zones.

Innovations in Infrastructure Financing

- In 2022, Government will further strengthen the frameworks for concessions and public private partnerships (PPPs). Capital projects that are good candidates for PPP by their nature will be developed for private sector participation.

-

We will also explore available opportunities in the existing ecosystem of green finance including the implementation of our Sovereign Green Bond Programme and leveraging debt-for-climate swap mechanisms.

Enhancing Revenue Mobilisation

- Our strategies to improve revenue mobilisation will be sustained in 2022 with the goal of achieving the following objectives:

a. Enhance tax and excise revenues through policy reforms and tax administration measures;

b. Review the policy effectiveness of tax waivers and concessions;

c. Boost customs revenue through the e-Customs and Single Window initiatives; and

d. Safeguard revenues from the oil and gas sector.

- Distinguished Senators and Honourable Members, I commend you for the passage of the Petroleum Industry Act 2021. It is my hope that the implementation of the law will boost confidence in our economy and attract substantial investments in the sector.

Finance Bill 2022

- In line with our plan to accompany annual budgets with Finance Bills, partly to support the realization of fiscal projections, current tax and fiscal laws are being reviewed to produce a draft Finance Bill 2022.

-

It is our intention that once ongoing consultations are completed, the Finance Bill would be submitted to the National Assembly to be considered alongside the 2022 Appropriation Bill.

CONCLUSION

-

Mr. Senate President, Mr. Speaker, Distinguished and Honourable Members of the National Assembly, this speech would be incomplete without commending the immense, patriotic, and collaborative support of the National Assembly in the effort to deliver socio-economic development and democracy dividends for our people.

-

I wish to assure you of the strong commitment of the Executive to strengthen the relationship with the National Assembly.

-

Nigeria is currently emerging from a very difficult economic challenge. We must continue to cooperate and ensure that our actions are aimed at accelerating the pace of economic recovery so that we can achieve economic prosperity and deliver on our promises to the Nigerian people.

-

The fiscal year 2022 is very crucial in our efforts to ensure that critical projects are completed, put to use and improve the general living conditions of our people.

-

It is with great pleasure therefore, that I lay before this distinguished Joint Session of the National Assembly, the 2022 Budget Proposals of the Federal Government of Nigeria.

-

I thank you most sincerely for your attention.

-

May God bless the Federal Republic of Nigeria.