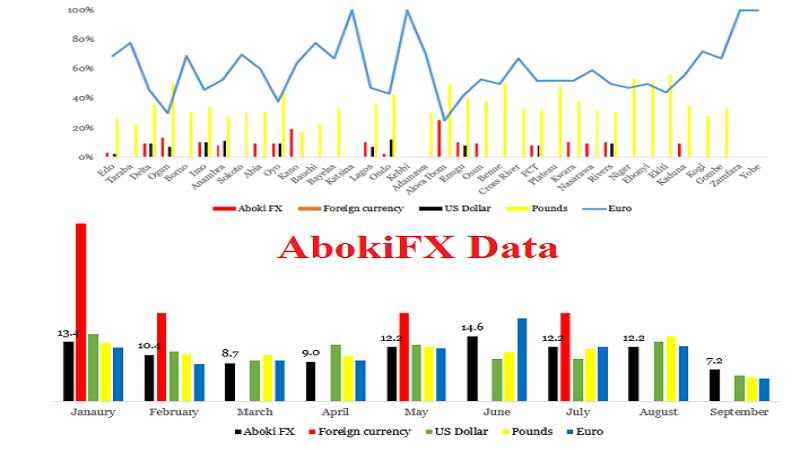

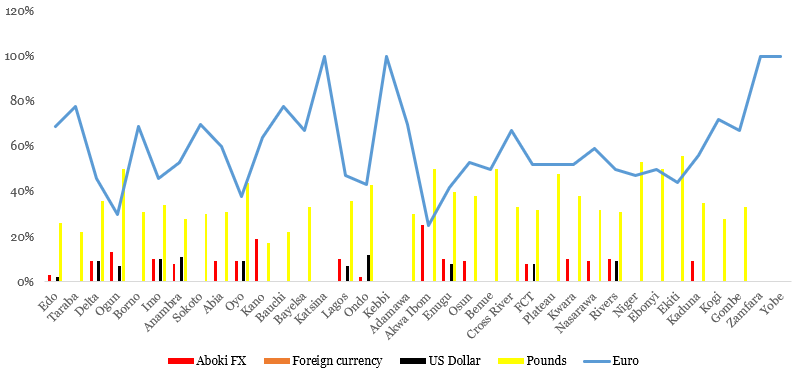

Former deputy governor of the Central Bank of Nigeria (CBN), Kingsley Moghalu, has weighed in on the current FX crisis that has pitied the CBN against Bureau de Change operators, and most recently, FX rates aggregator, AbokiFX.

The CBN Governor Godwin Emefiele, had on Friday, accused AbokiFX, which publishes parallel market exchange rates using its online platform, of sabotaging the naira by its actions. The controversy ignited by the development forced AbokiFX to suspend publishing of FX rates until further notice.

Weighing in on the matter, Moghalu, who was a presidential candidate in 2019, highlighted many factors responsible for the naira’s free-fall, including the plunge in oil prices, rising government debt and speculation. He also suggested steps Nigeria could take to save itself from the FX crisis, including ‘dollarization’ of its economy.

Moghalu, who was the deputy governor of CBN from 2009 to 2014, urged the apex bank to stop subsidizing the naira and allow market forces to determine the currency’s fate.

Read his postulation below:

The most important determinant of the value of the Naira is whether or not the Nigerian economy is productive and competitive in international trade. That is to say, whether it has a diversified base of complex, value added products it exports and earns forex from those exports. I am not talking about diversification to cashew nuts and yam tubers. No. Those are primary commodities, not complex, value added ones that are the product of serious engineering and innovation. Since we obviously don’t have such an economy, our main FX earner is crude oil, which gives us 90% of our FX.

Unfortunately, we don’t control the price of crude. Its pricing is volatile and unstable as a result of various international political and economic factors. This means that because we are essentially a one- product country, a one-trick pony, we are exposed to instability in our main income source. When the price of oil drops, and as the world innovates toward alternative energy sources, the amount of external reserves we have to back up the international value of our legal tender (our reserves) frequently comes under pressure. It’s those reserves, our main defense in a soccer analogy, that determines the value of the Naira.

This is why, among the five main objectives of the central bank we have: “issue the legal tender currency in Nigeria”, and “maintain external reserves to safeguard the international value of the legal tender currency”. So if we don’t diversify but continue to rely on crude oil as a mono -product economy, the Naira crisis will get worse, not better.

Unfortunately, achieving a diversified, complex economy, especially in a resource dependent economy, is not easy. It requires a high level of knowledge, political will and consistency in economic policy and takes decades to achieve. This was the subject of my lecture a few months ago to the 2021Annual Conference of the Nigerian Economics Students Association (NESA) held at the University of Port Harcourt, and will feature in my forthcoming book in 2022, The Pundit’s Mind.

There are other facts as well that affect the value of the Naira. These include the basic factor of supply and demand (if too much Naira is chasing scarce dollars, the dollar gets stronger relative to the Naira, and vice versa). Others are inflation (a high inflation economy such as Nigeria’s weakens the value of the legal tender), high government indebtedness ( again, our case especially relative to our revenues and ability to pay which will be stretched the more we borrow on poor revenues, and 90 kobo out of every N1 goes to debt servicing). Speculation also affects the naira value, as there are currency traders around the world for whom the weakness of a currency is their very good fortune. Such traders “attack” such currencies for profit, especially where the currency is using a fixed, official exchange rate determined by the central bank instead of the market.

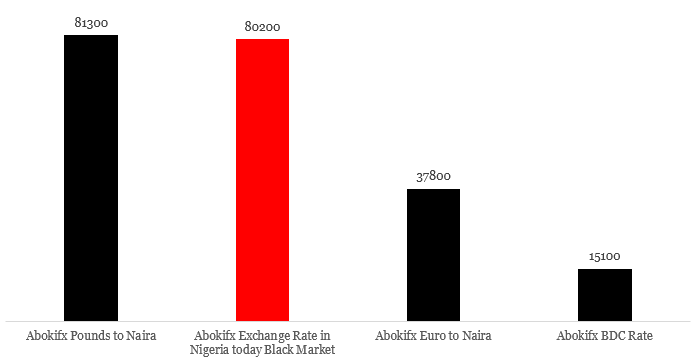

As the Naira is effectively pegged officially to a “reserve” currency (dollars, euros, pound sterling), speculators can attack such a currency for profit if the country (Nigeria in this case) is perceived to have insufficient foreign reserves to meet demand. Because our inflation rates at 17% are way higher than those “reserve-currency” countries, again we are exposed to possible currency attacks. If reserves are weak, and demand for dollars massively outstrips supply, currency devaluation is inevitable, and currency traders who mount speculative attacks profit from this devaluation. Such traders will borrow the Naira from Nigerian banks, convert it to, say, dollars, then buy short-interest paying Nigerian bonds. If, as the speculators anticipate, the central bank devalues the naira, the traders sell the bonds in the foreign currency, convert them into naira, and repay their original loan. The steeper the devaluation the higher the speculator’s profit.

What should we do about all of this?

As I have said before, and say again, we have two options. One is to let the Naira find its level in the market. In order, words, the central bank should stop subsidizing the currency. While there will likely be an immediate spike in the price of the dollar, this move will have two advantages. The first is that, because Nigeria has a big, profitable economy and market, dollars will likely swamp the market seeking profits for investors. When this happens, the laws of demand and supply will work in favor of the Naira. Alongside this, maintaining different exchange rates for different kinds of transactions must end. This is called rate convergence.

The second, and more important benefit is that, since the current practice of the CBN pumping dollars in the FX market (from the reserves, which also depleted them) is essentially a subsidy for imports, which has made Nigeria more and more import dependent, letting go of the subsidy on the Naira will refocus the economy towards exports.

This will create an incentive for complex production of a quality that can be competitive in the international market. Accompanying this must be the right trade policies to support and create such incentives for massive exports of finished, value added goods from Nigeria.

If we don’t want to go this way, perhaps because of the political risk of an immediate further drop in the Naira value (which will recover in the medium to longer term if the right policies are pursued), we can consider dollarization of the Nigerian economy.

Here the dollar officially becomes a legal tender in Nigeria, either replacing the Naira or alongside it. Countries such as Panama, Liberia, Ecuador, Zimbabwe have done this. This’ll lower interest rates and help deepen the financial sector because we are a high inflation country. But this carries serious consequences too. Nigeria will lose monetary autonomy (our central bank will no longer be able to take independent decisions on interest rates for example). The CBN will lose seigniorage, the revenues it earns from issuing currency from the difference between the face value of the Naira and its production cost. And of course, this will involve a loss of national prestige and independence. You could argue, of course, that what value is your prestige when your national economy is in tatters? So, there we are, the simplified A-Z of our FX crisis. Either way, tough decisions have to be made. Politics is easy. Real leadership is not.

Like this:

Like Loading...