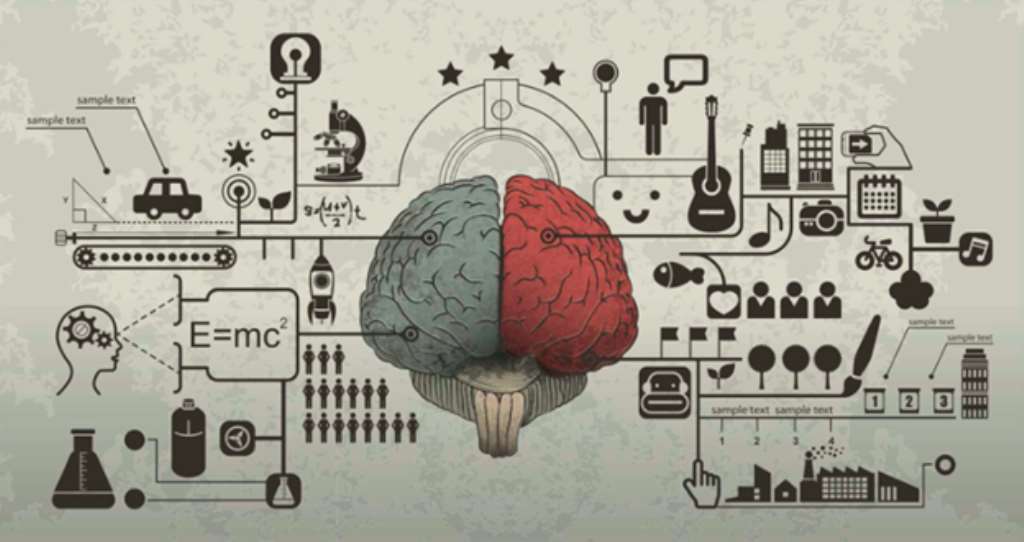

The Information and Communications Technology (ICT) has unannounced seemingly taken over from the human brain.

If the above observation holds water, one would begin to wonder how an artificial possession can override the natural one, knowing full well that the latter unarguably begets the former.

Considering the ongoing trend whereby, for instance, an average student would in most cases prefer to make use of a calculator rather than his or her brain, you might subtly concur that the human brain is gradually going into extinction.

Of course, one may not hesitate to insinuate that the human brain is not anymore needed, since ICT has proven beyond doubts to be the ‘messiah’ when it calls for information sourcing or data storage.

Undoubtedly, the impact of ICT on man’s daily activity cannot be overemphasized, especially when considered that it can carry out a certain work expressly – and at anytime – without causing much stress for any of the beneficiaries of the work done.

On its part, the brain might not be very active at a given time. For example, you cannot wake someone from sleep and therein ask him or her to help you with a certain information or task. The brain needs to be relaxed before carrying out such required task.

An ICT equipment or system is invariably ready to perform its work unless when faulty. This is a verifiable fact and could be proven by any scientific school of thought.

Little wonder, in various Mathematics classes, you would hardly see pupils or students – as the case may be – making use of their brain. They are now quick in using their calculators or handsets when their brain is unreliable, even in cases concerning elementary arithmetic let alone basic algebra or geometry.

Those days, candidates who enrolled for external examinations, such as the Unified Tertiary Matriculation Examination (UTME) currently practised in Nigeria, could not attempt to enter the exam hall with any ICT gadget including calculator, cell phone, or what have you. But nowadays, the exam board itself provides the candidates with such equipment, particularly calculator.

This policy, which doesn’t augur well for our educational system, implies that even the teachers as well as examiners encourage the students to overlook the use of their brains. This is why most students often laugh at others who try to deploy their brain while in classroom or at their respective homes.

Parents and guardians too, would stop at nothing to ensure their wards do not ‘stress’ their brain by providing them with any requested electronic learning material.

It suffices to assert that the ICT has apparently dominated the modern generation, otherwise known as the digital age, and perhaps replaced the human brain.

Lest we celebrate that we need not bother our brain any longer in issues pertaining to learning, routine office works, or as might be the case, let’s not forget in haste that the human brain remains the only endowment that does the thinking – which ICT can never do – not even for a second.

Survey reveals that the brain can engage in an extensive and rigorous thinking towards proffering the required remedy to any given plight, or providing sound and reliable ideas that can stand the test of time.

The human brain can store as much information as possible. Your brain might have only a few gigabytes of storage space similar to the one in your iPod, USB flash drive, or computer hard-disk. But neurons, also known as nerve cells, combine so that each one helps with many memories at a time, thereby exponentially increasing the brain’s memory storage capacity to something closer to around 2.5petabytes – equivalent to a million gigabytes.

Similarly, research indicates that the human brain is thirty times faster than the best supercomputer in existence. One can now imagine how fast the brain could be when deployed by the bearer.

Moreover, knowledge acquired wholly with the use of the brain gives self-confidence, and such is always reliable irrespective of the circumstance. This could be attested to by any intellect or lover of knowledge.

It’s pertinent to acknowledge that ICT itself was invented solely by the brain, and any existing electronic gadget such as computer is programmed mainly by the effort of same human brain.

Inter alia, such IT equipment as any computerized gadget provides information on a daily basis based on what it receives from the human brain. This phenomenon is called ‘garbage in, garbage out’ in the computer world.

It’s noteworthy that whenever an IT gadget or network gets infested or ceased to perform, it is the human brain that would fix the anomaly; needless to say that the day-to-day thrive of ICT cannot be adequately effective and efficient without involving the brain.

The truth is, ICT which remains manmade, can fade at anytime whereas human brain will never. This is the reason we must not make attempt to relegate our brains to the background; else, we shall all live to regret it. There’s, therefore, a compelling need to revisit the existing policies towards mandating the learners to invariably make use of their brains.

Believe it or not, ICT can never be compared to the ‘almighty’ human brain, because the latter is arguably yet to have a rival. Survey shows that no computer can compete with the brain of the dullest human on Earth.

Hence, we are advised to believe so much in ourselves by finding reasonable time to work on our brains, proudly use it always, as well as endeavour to handle it with absolute care.

Though the functions of ICT cannot be overemphasized as earlier stated, the role of the human brain remains limitless. The former was invented to serve as an aid to mankind’s daily activity, and not to replace the latter.