In language, culture, traditions and norms, Nigeria is one of the diverse countries in the world. It is a country that has hundreds of minority ethnicities within the major ethnic groups [Yoruba, Igbo and Hausa]. Each of the dominant ethnic group has over the years claimed to be the only group capable of solving socioeconomic and political challenges. However, recent activities showed that the minority ethnic groups have seen reasons for uplifting their specific traditions and norms within and beyond their domains in reference to the political and the economic domineering of the main ethnic groups.

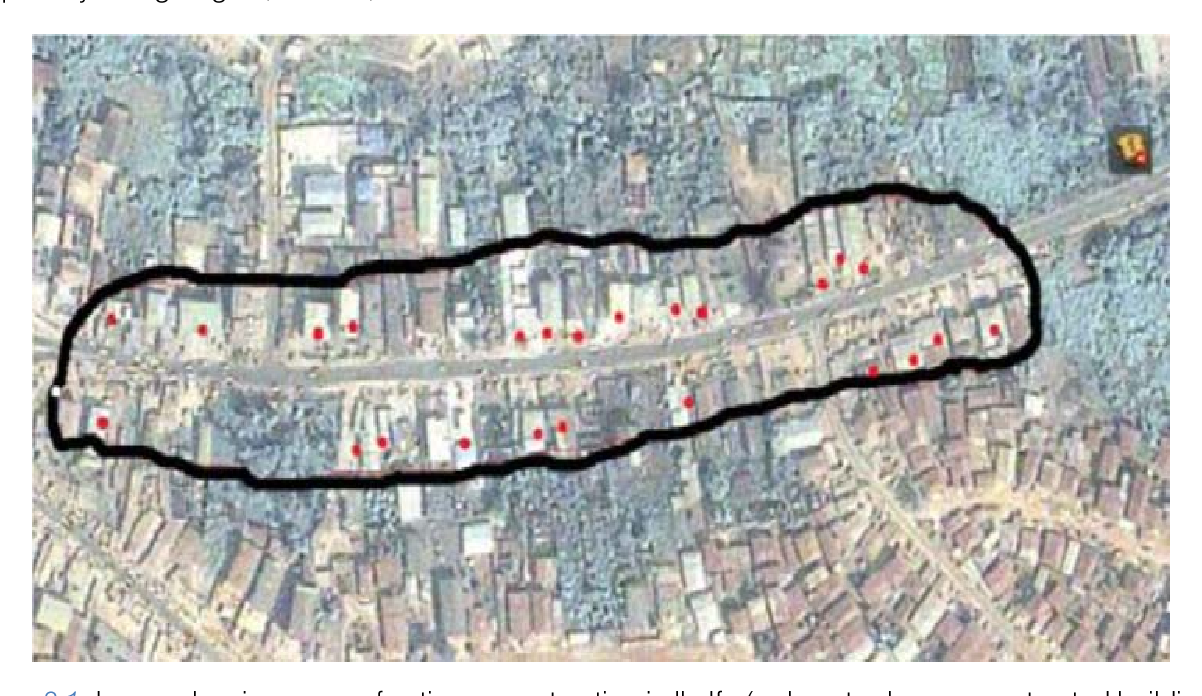

In our experience, we have seen how it is difficult to determine the starting point of a particular town or city from another one. For example, Labaka-Ojo and Omi-Aro are two rural towns in Kwara State, a central Nigerian state. The population and number of houses in the two towns are not up to 15,000. Yet, the duo has different names and deriving solace in being independent towns, politically and economically. But in terms of culture and language they are the same. Over 1 years of staying in one of the towns by our analyst reveals that no significant differences in the land boundary. In spite of this, people and businesses always find it difficult to interact economically and politically.

Away from these towns, Ife and Modakeke are city and town in Osun State, a southern Nigerian state. Erin-Ile and Offa are city and town in Kwara State. Like the picture painted earlier, it is not really clear where a particular city boundary starts and end. This is also applicable to the town. In terms of language, culture and social activities, these towns and cities are not quite different. Despite that they have been engrossed and still being in varied wars over the years.

Information has it that the Erin Ile and Offa boundary crisis has caused over fifty years of recurring waves of violent clashes that have resulted in many human and material casualties. The first intra-community conflict between the Modakekes and the Ifes broke out in 1835. A recent research notes that “land issues, Ife East Local Government issue, debate about Modakeke’s sovereignty or staying with Ife, masquerade (Egungun) crossing into each other’s territory, boundary disagreement.”

According to our analyst, the feuds in the towns and cities remain chronic threats to sustainable peace because political, traditional and mediation institutions have not been able to find lasting solutions to the conflicts. Our analyst points out that the conflicts could be described as Abiku. In 2018, a report has it that Offa and Erin-Ile end age-long rift. Less than two years later, another report indicates violent activities of the two communities, which led to the deployment of the security operatives. In Ife, the traditional ruler of the city recently debunked news reports that the city and Modakeke are at war again.

From the reports on the conflicts analysed by our analyst it emerged that both the print and broadcast media are failing in their social responsibilities of ensuring sustainable mediation and peace in the towns and cities. It is, however, imperative that the media practitioners and owners consider solutions and restorative journalism practice more than sensationalism which has caused mayhems and impeding peace building processes and sustainability.

It is high time that the media see the need for reporting events that would foster hope, healing and resilience. The public have the right to know who among the actors making significant efforts towards peace restoration. They equally need to know categories of solutions being proffered by the actors, especially those at the communal level and political institutions. Restoring peace into the towns and cities, according our analyst, rests mostly on the media because selecting and framing certain aspects of any activity related to the conflicts have a propensity of increasing or decreasing tensions among the participants.

Like this:

Like Loading...