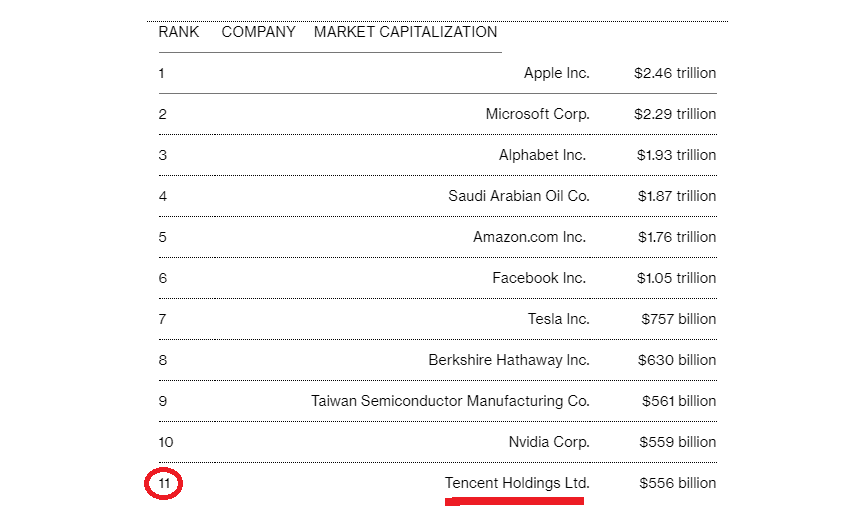

This is the future of the digital economy: aggregation at different levels of operational stacks. The top five leading companies in the United States (on market caps) deploy one element of aggregation in the business. Today, you could be hard working but if your business model has expired for the digital era, you will struggle to capture value.

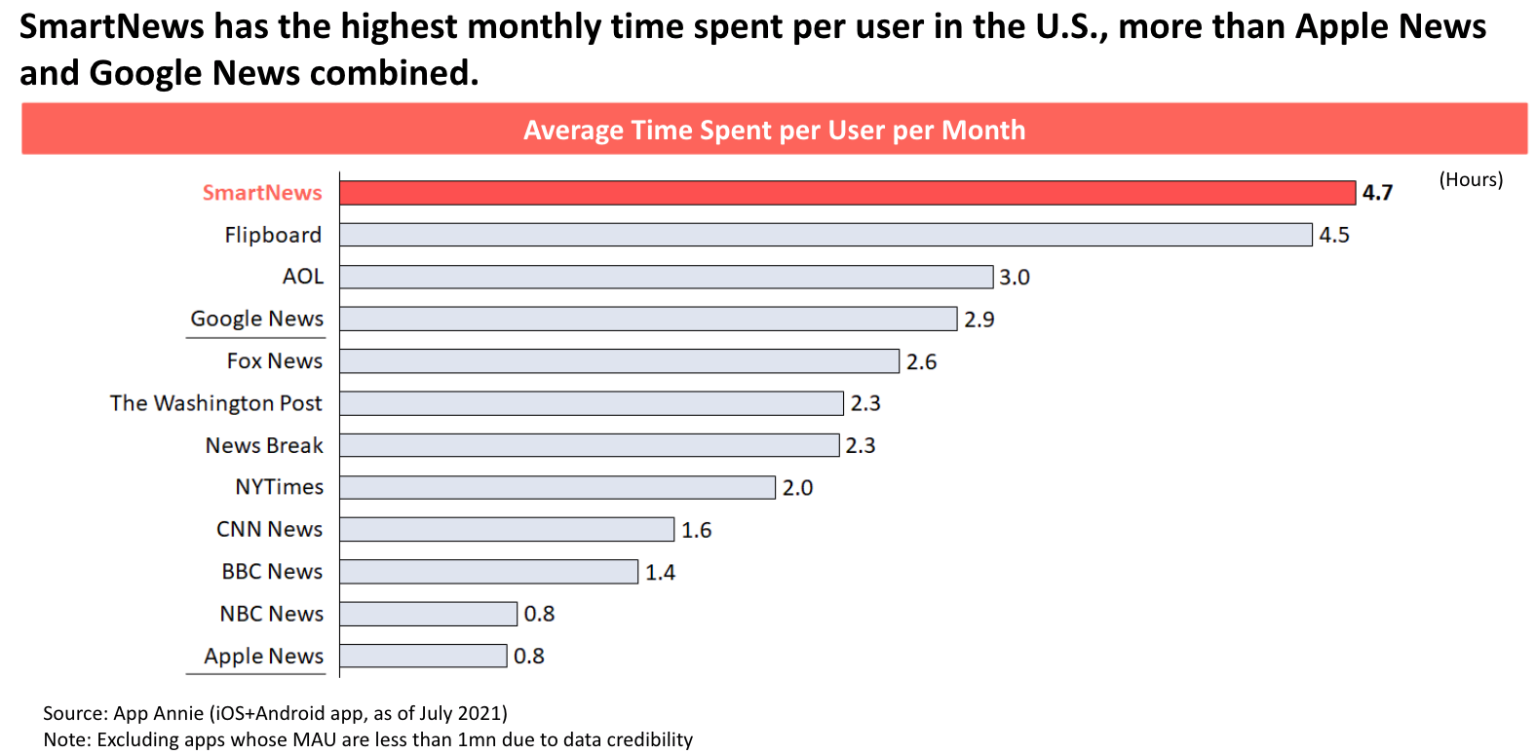

Aggregation is the reason SmartNews, a news aggregator, is now worth $2 billion! (New York Times, the world’s finest journalism, is worth about $8.3 billion)

SmartNews, a Tokyo-headquartered news aggregation website and app that’s grown in popularity despite hefty competition from built-in aggregators like Apple News, today announced it has closed on $230 million in Series F funding. The round brings SmartNews’ total raise to date to over $400 million and values the business at $2 billion — or as the company touts in its press release, a “double unicorn.” (Ha!).

[…]

The aggregator’s business model is largely focused on advertising, as the company has said before that 85-90% of Americans aren’t paying to subscribe to news. But SmartNews’ belief is that these news consumers still have a right to access quality information.

Last week, during the Tekedia Business Growth Playbook, I explained the power of Aggregation Construct in the new economy. Your business model is the most important thing you must spend time to understand and update where necessary. Your newspaper must be a technology company which offers news instead of a news organization that uses tech.

Our world is changing: an aggregator of news is now bigger than most banks.

From Press Release

SmartNews Inc., the global leader in redefining information and news discovery, announced today it has raised $230 million in its Series F round of funding. This brings the company’s total capital raised to date to more than $400 million and secures its status as a “double unicorn” with a valuation of $2 billion, the highest for a standalone news app. The oversubscribed round includes existing investors as well as significant new ones who are aligned with SmartNews’s vision and growth strategy.

“Since the company’s inception in 2012, our vision has been to redefine the way we discover and engage with information by supporting diverse, quality journalistic sources, and serving our users a wide variety of timely and relevant content that helps improve their daily lives,” said Ken Suzuki, CEO and co-founder of SmartNews. “This latest round of funding further affirms the strength of our mission, and fuels our drive to expand our presence and launch features that specifically appeal to users and publishers in the United States. Our investors both in the U.S. and globally acknowledge the tremendous growth potential and value of SmartNews’s efforts to democratize access to information and create an ecosystem that benefits consumers, publishers, and advertisers.”

The Series F funding round represents another significant milestone for SmartNews, which has been the number one news app in Japan for multiple years running. In the U.S. market, SmartNews achieved the highest monthly user time spent among all news apps and saw its monthly active users (MAU) double in 2020. Since its last funding round in 2019, SmartNews has more than doubled its headcount to approximately 500 globally.