Palantir is rolling out a new fellowship designed for neurodivergent individuals, a move that grew out of a viral moment involving CEO Alex Karp and has quickly evolved into a broader statement about how the company sees the future of talent, creativity, and national problem-solving.

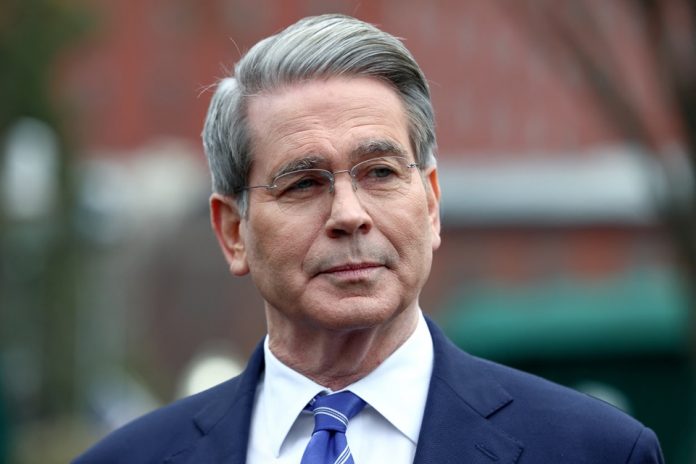

The idea was announced on Sunday in a post on X, where Palantir said it wants to hear from people who recognize themselves in Karp’s own mannerisms — people who struggle to stay still, think far faster than they can talk, or communicate in ways that sit outside traditional corporate polish. Applicants will eventually go through a final interview round conducted by Karp himself, a decision that signals how personally he is tying his identity to the fellowship.

Karp offered a sweeping statement alongside the announcement, calling the “neurally divergent” — his own wording — a group that will play an outsized role in shaping America’s future. He argued that those who process information in unconventional ways often see past what he described as shallow ideological posturing and notice beauty and meaning that others overlook, something he believes both art and technology are uniquely built to reveal. He also said today’s large-scale AI landscape is naturally aligned with people who possess neurodivergent traits.

The decision comes after a week in which Karp became an unlikely trending topic across social platforms. During a long onstage conversation with The New York Times’ Andrew Ross Sorkin at the DealBook Summit, Karp spoke at a rapid clip, frequently shifting in his chair, and moved with restless, looping energy that instantly caught the internet’s attention. The clip gathered millions of views within days. Katherine Boyle, a general partner at a16z, joked on X that pre-school teachers nationwide should watch the video because Karp’s inability to sit still is such a familiar sight.

Rather than distance itself from the online chatter, Palantir embraced it. In the fellowship announcement, the company wrote that the idea occurred to Karp that very morning while he was out cross-country skiing. The tone of the post signaled the company’s intention to flip a viral meme into a moment about inclusion and untapped talent.

Karp did not mention any specific diagnosis in his new statement, though he has been open about being dyslexic. In an interview with Wired that ran last month, he said everyday expectations that seem simple for many people often require extra effort from him. He added that he is fully aware he isn’t universally adored but likes who he is “on most days.” His candor has since drawn interest from those who have spent years pushing for broader recognition of cognitive differences in high-pressure fields like technology and national security.

Neurodiversity covers a wide range of conditions that influence learning, concentration, and communication. The spectrum includes ADHD, autism, Tourette’s syndrome, dyslexia, and dyspraxia, among others. Many in that community have long argued that the pressure to conform in corporate environments pushes talented people out, especially those whose skills flourish in non-linear, creative, or high-intensity cognitive settings.

The new fellowship has generated early buzz because it appears to acknowledge that argument directly. Palantir framed the program as an opportunity for people with unconventional mental frameworks to contribute to what it described as the most urgent problems facing Western democracies. The company added that more information — including the application link — will be released soon.

The move also dovetails with Palantir’s growing public campaign to position its software as critical infrastructure for governments and major institutions. Karp’s high-energy interview at DealBook included a vocal defense of Palantir’s work with US agencies, as well as praise for immigration policies under President Donald Trump. The appearance itself was meant to spotlight Palantir’s influence in Washington, but it was the CEO’s unique presence onstage that unexpectedly widened the spotlight to include a cultural discussion about neurodiversity.

With the fellowship now underway, Palantir appears intent on turning that conversation into a recruitment pipeline built around people who rarely see themselves centered in Silicon Valley programs. The company said applicants should expect details “soon,” and Karp will personally lead the final round — a sign that this initiative is more than just a quick response to a viral clip.