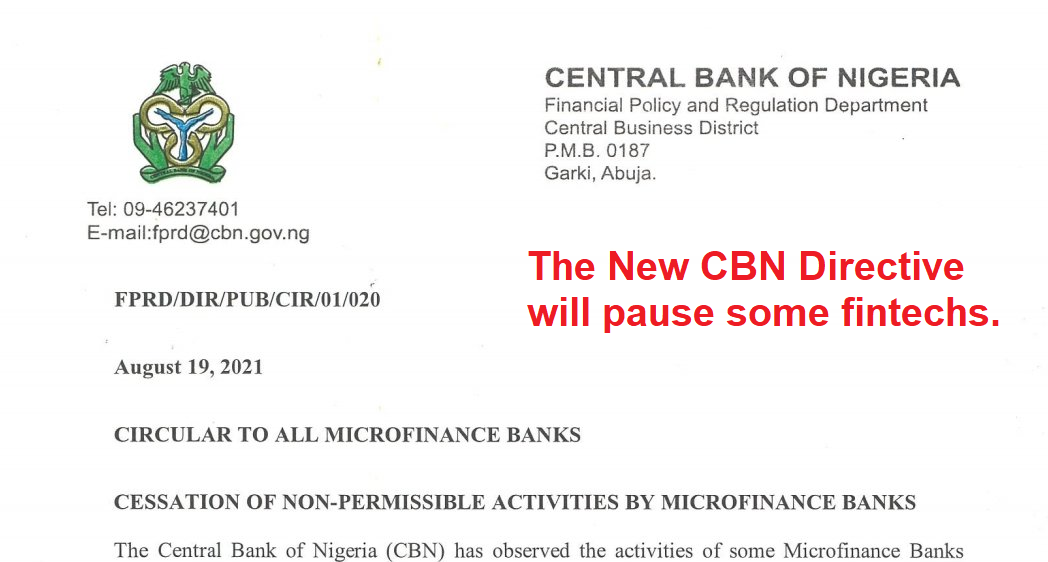

This is the season of regulatory searchlights around the world. China has redesigned its tech sector with an avalanche of new regulations. America is going after Facebook to break it while it looks at Apple, Amazon and Google. Certainly, Nigeria cannot be left behind in this circus. So, today, we are learning that the Central Bank of Nigeria has fired a warning shot to microfinance banks: you are not allowed to handle micro-credit and retail transactions with value more than N1 million per deal!

People, this singular decision will change multiples in the investor cap table.

Innovators, the government also wants you to focus on micro with 80% of loan portfolios to be micro-credits. As you already know: this warning is not for the traditional microfinance banks but rather the fintechs which get the microfinance licenses to run a largely full fledged retail banking services. Most of those fintechs /digital challenger banks must restructure their operations immediately to avoid the CBN shocks.

Yet, looking at this circular, I can see how one can comply 100% without material impact on the current fintech business. CBN is very agile and smart on how it has worded this directive. I do not see a reason to panic. Fintechs/ digital challenger banks need to do a few things and they will be fine. Where they fail, expect a big PAUSE.

What To Expect

First, we could be seeing automatic breaking of transactions by fintechs so that what hits their general ledgers will not exceed N1 million. So, if you want to transfer N2 million, the software will break it into two transactions of N1 million each making sure you stay below the threshold of the N1 million.

Secondly, the way credits are allotted will change. If you approve a loan portfolio of N5 million for a merchant customer as a fintech, you may structure it to be issued over five different transactions, making sure you do not pay out more than N1 million at a time. (Note: the splitting of transactions may contravene other financial regulations depending on the intention. The key thing here is the intention, not necessarily the splitting.)

Besides these two options, I also expect many fintechs to have a relationship with retail banks. Through the relationship, the retail banks could run the back-office making sure that all compliance on sizes of transactions are complied with. In other words, you can have a system where tickets above N1 million are immediately warehoused via a retail bank partner while the small ones stay with you as a digital challenger bank.

More so, I expect tools like Venmo which has a way of breaking transactions to become popular in Nigeria as fintechs work to ensure transactions stay within compliance. As they do this, product pricing will evolve. If you get a loan of N1 million, you can ask for the same loan under the same terms in another 24 hours, if you have in mind to get N2 million in total.

All Together

Software can help fintech companies implement this compliance without material impact on their operations. Yet, I will not necessarily suggest that alone. The best would be to partner with a retail bank as a “holding hand company” to make sure it covers you. While many of these fintechs may not like that option, I do think it is what CBN has in mind: only the traditional banks will run the big transaction tickets in Nigeria. That is the reality based on this directive.

So innovators, you may not like it and it may likely cost you money, but a deal with a traditional bank will protect you from any regulatory shock from the apex bank.

At least, this time, CBN did not do the usual: ban, suspend or freeze. Innovators, recalibrate. Tomorrow at Tekedia Mini-MBA Live, I will be discussing regulatory elements and this new directive has just been added.

Like this:

Like Loading...