The world has had different narratives about who really invented radio. Some have argued that Guglielmo Marconi was the real inventor. Another group of historians and scholars has equally noted that Reginald Fessenden was the actual inventor.

Either Marconi or Fessenden, what really matters is that the invention enables people to listen to a voice or more through a box. The invention also affords the man or people behind the voice to communicate with a large audience without seeing them and audience, not seeing who is communicating with them too except his or their voice.

Several years later, television was invented, which allows the large audience to see the speakers and also interact with them via telephone like what is obtainable for the radio transmission of voice. In 1997, Six Degrees, the first social media birthed after many years of emergence of the Internet. Six Degrees “enabled users to upload a profile and make friends with other users”. Some of the lapses seen led to the creation of Facebook in 2004 and Twitter in 2006, including several social networking sites after these years.

As these tools or channels of communicating censored and uncensored continue evolving, the need arises for combining one or two of them for synergistic content distribution or communicating the heterogenous audience. This gives birth to media convergence among scholars and professionals in the global news media industry. In the context of radio, according to our checks, convergence “refers to the network architecture that broadcasters have adopted to merge previously distinct media (so-called traditional broadcasting or terrestrial broadcasting) into common interfaces on digital devices.”

Though, there are technological convergence, economic convergence and cultural convergence as the main categories of media convergence, globally, broadcast media establishments have mainly appropriate technological convergence more than other categories. They are using various Internet-enabled devices and leveraging social networking sites for the distribution of their news, programmes and commercials to the targeted audience during different time belts.

Beyond explication of the various inventions and media convergence, this piece examines how select popular radio stations in the city of Ibadan are using the Facebook-radio convergence strategy. Are Ibadan radio stations getting radio-social media convergence strategy, right? As a at the time of writing this piece Ibadan, the capital of Oyo State, has 23 Frequency Modulated radio stations. Majority of these stations were established in the last 10 years, except the Federal Radio Corporation of Nigeria (FRCN) and the Broadcasting Corporation of Oyo State (BCOS), which were founded in 60s and 70s respectively.

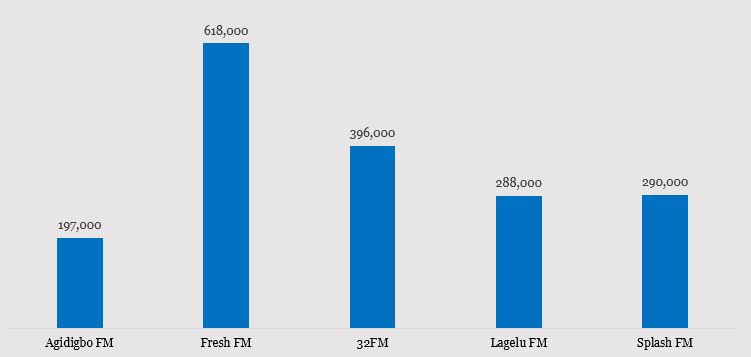

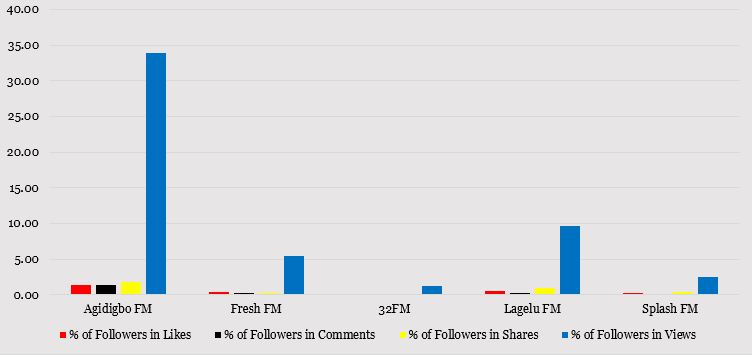

Our analyst considered Agidigbo FM, Fresh FM, 32 FM, Lagelu FM and Splash FM with a total of 1,789,000 followers [August 5, 2021] and chose 5 content categories each; newspaper review, sports, entertainment and issues-focused. Analysis of the number of likes, shares, comments and views each station had for each content category along with the number of followers indicates that Agidigbo FM, despite its lowest number of followers, performs better in all categories than Fresh FM, 32 FM and Splash FM. Our analysis reveals that Lagelu FM largely followed Agidigbo FM.

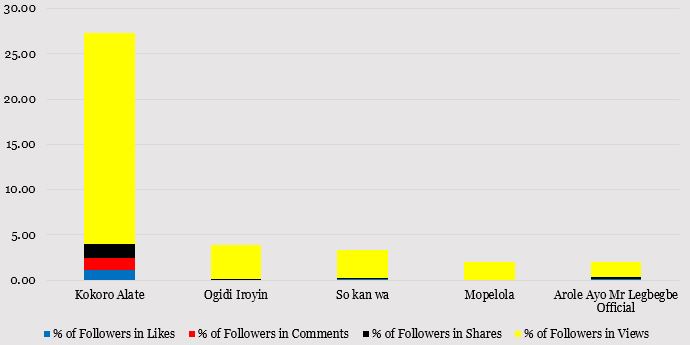

In our analysis, we equally found that issues-focused content, especially Kokoro Alate, had the highest share of followers, liking, commenting, sharing and viewing the content than others content of the station [Agidigbo FM] and other contents from the remaining stations examined by our analyst.

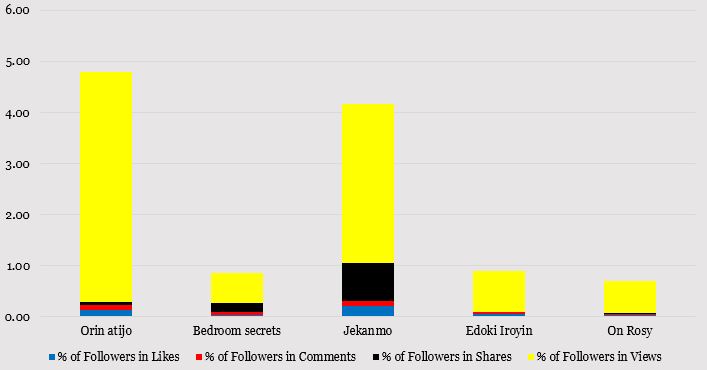

The followers of the radio stations also engaged with entertainment and sports content more than newspaper review and news commentary content. From these insights, our analyst notes that Facebook-radio convergence has not really worked for the Ibadan stations. It is glaring that the large number of followers of the stations’ Fan pages does not translate into large viewers as expected.

Exhibit 1: Stations’ Followers on August 5, 2021

Exhibit 2: Share of Likes, Comments, Shares and Views in Followership

Exhibit 3: Agidigbo FM’s Performance in Select Programmes

Exhibit 4: Lagelu FM’s Performance in Select Programmes

Turning Facebook Followers to Active Listeners

Therefore, these stations and others in the city need to restrategise towards sustainable capturing inherent benefits in Facebook-Radio convergence. The need has emerged for creation of apps that will be notifying those who liked and followed the stations about a particular programme/comment that is being streamed. This will augment Facebook’s feature, which informs followers about live streaming of video and audio content.

Programme producers and presenters also need to work on demographics and psychographics of the followers. For instance, using Facebook Analytics section of the Fan page will help in understanding gender, interest and concerns of the followers. This will be useful in redefining the content being distributed, for example, personalizing entertainment content. This is imperative as radio audience is quite different from social media audience.

Additional reports by Umar Ajetunmobi