I will not write much here to avoid stress on some people. But let me tell everyone that the Central Bank of Nigeria (CBN) is planning a huge redesign in the architecture of the financial systems in Nigeria. From my analysis of what is happening, this is the destination: the government wants clear visibility on financial flows in the nation. This is going to become a new dawn in Nigeria. And I think it is a good playbook.

The abolition of the bureau de change is necessary for the upcoming rise of e-Naira. Largely, there is nothing BDCs do that commercial banks cannot do today. Many Nigerians who want to transact in multiple currencies can open domiciliary accounts on top of their naira accounts. Yes, you can buy $100, facilitated by your bank, by merely debiting and crediting the right accounts. If that happens, the nation will have clearer insights on the state of things.

The Director, Information Technology Department, Central Bank of Nigeria (CBN), Mrs. Rakiyat Mohammed, stated at the banker’s committee meeting that the apex bank will be launching a Central Bank Digital Currency (CBDC) before the end of 2021: “As I said, before the end of the year, the Central Bank will be making special announcement and possibly launching a pilot scheme in order to be able to provide this kind of currency to its populace.” This follows a statement by the bank governor a few weeks ago: “Under cryptocurrency and Bitcoin, Nigeria comes 2nd while in the global side of the economy, Nigeria comes 27th. We are still conducting our investigation and we will make our data available.”

The BDCs do not offer that level of insights and as we move to the new age of e-Naira digital currency, the apex bank will like to work with commercial banks who have our full data (biometrics, photos, etc) to begin that transition to a quasi-banking era with the central bank.

The destination is evident: in 3 years, if everything goes as planned, Nigerians can indeed get US dollars directly from the central bank but disbursed via agents like commercial banks. In other words, we will have an account in the CBN headquarters and the bank can ascertain and track what is happening.

The future of Naira has no role for BDCs because the CBN through technology will do what BDCs do today. Expect massive redesigns as the Central Bank of Nigeria goes retail, via e-Naira digital currency. The new digital currency is expected to be piloted in Q4 2021 and will possibly go live at scale in 2022.

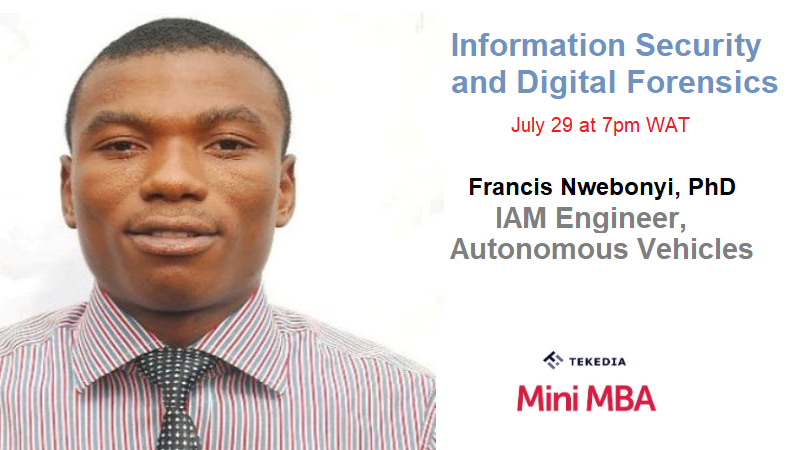

In Tekedia Mini-MBA edition 6, we will discuss these issues through a Special Case Study I have developed: Business Opportunities in the New Era of Sovereign Digital Currencies like e-Naira, e-Euro, e-Yuan and e-Dollars – Prof Ndubuisi Ekekwe. I invite you to join us.

LinkedIn Comment on Feed

Comment #1: This should have been executed generations ago; but a good playbook non the less. And one that can be cheered even if the ramifications on the economy will be significant in the short term and hopefully not long term. If frictions in the banks selling and transacting between the naira and foreign currencies becomes flawless, then this move can be declared a win for the nation.

Unfortunately too many roads lead to and from the CBN that are not visible to the majority of the populace. If political might is stretched, someone may lose their job quite quickly or become an unjust target. I believe the CBN can be extensively innovative with the e-naira if they decide to be and can cause significant progress to be made in the current monetary playbook that has not made the positive impacts that has been expected.

The final quarter may be a bumpy ride in the nation. We hope the light at the end of the tunnel is not another candle light.

Comment #2: This is interesting, thanks for sharing Prof. Ndubuisi Ekekwe It is however pertinent to add that #CBDCs are not without limitations especially as it concern interoperability of the technology for cross-border payments and proactivity in international cooperation by monetary authorities. This is in echoed in the Bank for International Settlements – BIS report on CBDCs. Only time will tell where the road will lead us, game on!