African startups raised $93 million in August 2025 through deals valued at $100,000 or more, excluding exits, marking one of the quietest months for the continent’s venture funding this year, according to a report by Africa; The big deal.

The figure reflects a slowdown compared to July’s surge. Recall that last month, 61 start-ups announced at least $100k in funding, which is much higher than what was seen in the first half of the year when the number was hovering around 40 a month.

According to recent data, August was the second-slowest month for funding this year, following March. However, August 2025 funding still surpasses the amount raised in August 2024, signaling steady investor interest. Despite the dip, analysts remain optimistic about the rest of 2025, citing a strong pipeline of deals and growing confidence in Africa’s tech ecosystem.

Analysts say there is no cause for concern, as the number of startups securing funding remained consistent with figures from the same month in both 2024 and 2023.

In total, 33 startups across the continent raised $93 million. Roughly 75% of the funds were raised through equity, while the remainder came from debt financing, including a $9 million securitized bond issuance by valU in Egypt.

Some of the most notable rounds in August included:

- Koolboks – $11 million Series A

Koolboks, a Nigeria- and France-based cleantech startup, raised $11 million in Series A funding to expand its solar-powered refrigeration solutions across Africa and establish its first assembly plant in Nigeria.

The round, announced in August 2025, was co-led by KawiSafi Ventures, Aruwa Capital, and All On. The funding brings Koolboks’ total raised to $15.4 million, per Crunchbase.

The capital will support scaling its cooling-as-a-service model, which uses IoT-enabled, solar-powered freezers to serve small businesses, particularly women-led enterprises, in markets like Nigeria, Côte d’Ivoire, and Senegal.

- Hewatele – $10.5 million raise

Hewatele, a Kenyan medical oxygen producer, secured $10.5 million from AfricInvest’s Transform Health Fund to build East Africa’s largest high-purity oxygen plant, producing oxygen at 99.6% purity.

This investment is part of a broader $20 million funding package, including earlier debt and equity from investors like Finnfund, U.S. International Development Finance Corporation (DFC), Soros Economic Development Fund, UBS Optimus Foundation, and Grand Challenges Canada.

The funding aims to address East Africa’s medical oxygen crisis by financing a liquid oxygen (LOX) manufacturing facility near Nairobi and doubling hospital-based production capacity.

- Breadfast – $10 million Series B

Egyptian grocery delivery platform Breadfast raised $10 million from the European Bank for Reconstruction and Development (EBRD) as part of its Series B2 funding round, led by Novastar Ventures.

The investment, announced in August 2025, pushes Breadfast’s valuation to approximately $382–400 million, making it one of Egypt’s highest-valued startups.

The funds will support the expansion of fulfillment centers, entry into new Egyptian cities, and the growth of its fintech arm, Breadfast Pay, which offers savings, withdrawals, and branded payment cards.

- Chowdeck – $9 million Series A

Chowdeck, a Lagos-based on-demand delivery platform for food, groceries, and essentials, raised $9 million in a Series A funding round in August 2025.

The round was led by Novastar Ventures, with participation from Y Combinator, AAIC Investment, Rebel Fund, GFR Fund, Kaleo, HoaQ, and angel investors like Paystack co-founders Shola Akinlade and Ezra Olubi.

The funds will support Chowdeck’s quick commerce strategy, leveraging dark stores and hyperlocal logistics to enhance delivery speed and efficiency. The company plans to expand into more cities in Nigeria and Ghana, targeting 40 dark stores by the end of 2025 and 500 by 2026.

Egypt, Kenya, And Nigeria Dominate Funding

Egypt, Kenya, and Nigeria emerged as the top-performing markets, collectively attracting 75% of the total funding raised in August across the African continent.

Sector-wise, funding was fairly balanced, with at least five sectors each accounting for 10% or more of the month’s total, largely driven by these sizable deals.

The month also saw notable exit activity, with Nedbank’s acquisition of iKhokha in South Africastanding out. The deal, valued at over $93 million, marked one of the most significant acquisitions in the African startup ecosystem this year.

Despite the slower pace in August, the continent’s fundraising momentum remains positive.

Future Outlook

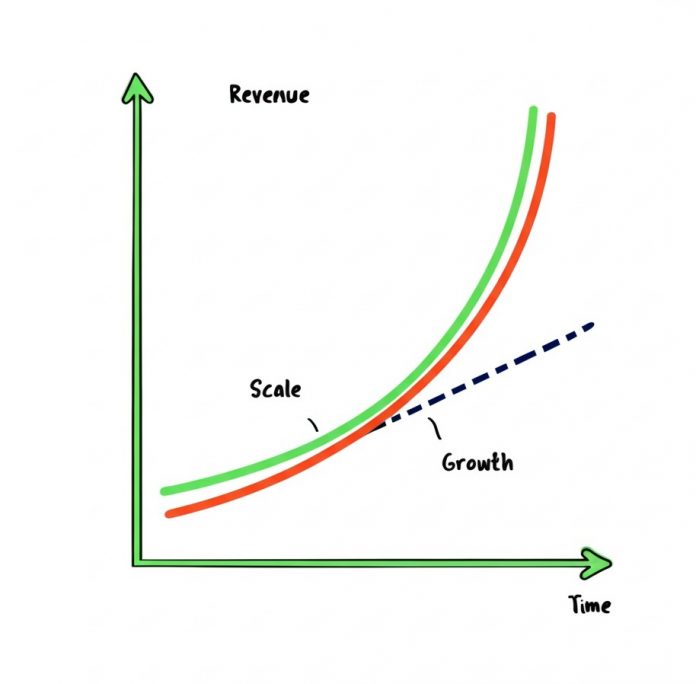

So far, African startups have already raised $2 billion in 2025, including $1 billion in equity funding. Analysts are optimistic that 2025 will outperform 2024, marking the first year of positive year-on-year growth after two consecutive years of decline.

Current numbers suggest that 2025 is on track to match or even exceed 2023’s performance. If anticipated mega-deals materialize in the coming months, total funding could approach $3 billion by year-end, signaling a strong rebound for Africa’s startup ecosystem.