When Senator Ademola Jackson Adeleke took office as governor of Osun State in November 2022, expectations for rapid development were high. Almost immediately his administration announced water provision in all 332 wards, a promise designed to signal that even the most remote communities would feel a change in daily life. Within his first year, a N100 billion infrastructure plan was rolled out. It included new flyovers, forty-five township roads, rehabilitation of thirty-one schools and extensive upgrades of primary health centres across the state.

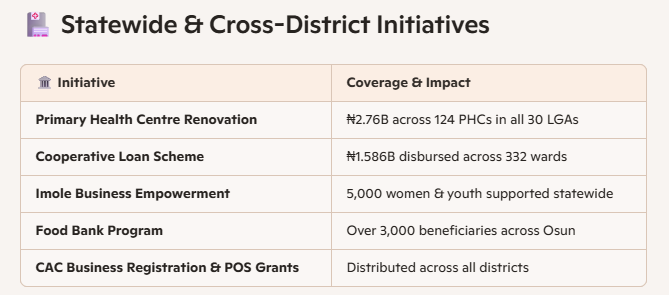

In March 2025 the government unveiled Phase Two of its infrastructure programme valued at N159 billion. This second phase earmarked over N101 billion for road construction, N2.76 billion for the refurbishment of 124 primary health centres and precise figures for a handful of high-profile schools. Ede High School Hall and Pavilion was allocated N50.2 million, Agbonran School of Science in Ede South N200 million, Ogedengbe School of Science in Ilesa N137 million and Oranmiyan Memorial Grammar School in Ile-Ife N149.5 million. The Imole Agropreneur initiative, launched in late 2024, promised to open 31,000 hectares to mechanised farming and agro-processing, a signal that agriculture remains central to Osun’s long-term economic vision.

Distribution Across the State

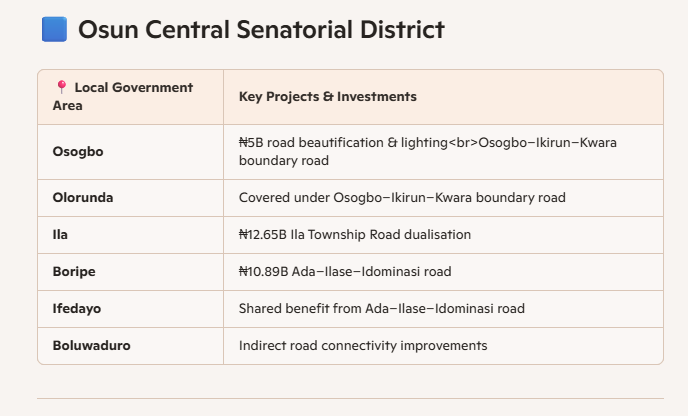

A closer look at where projects are sited reveals both a wide reach and recognisable patterns. Osun Central has benefited from significant carriageway work. The Osogbo–Ikirun–Ila-Odo road remains the flagship corridor linking the capital to key markets, while township arteries such as Oja-Oba and John Mackay Street have been resurfaced. In Boluwaduro the Iresi Township road has been rehabilitated, providing relief for agrarian communities.

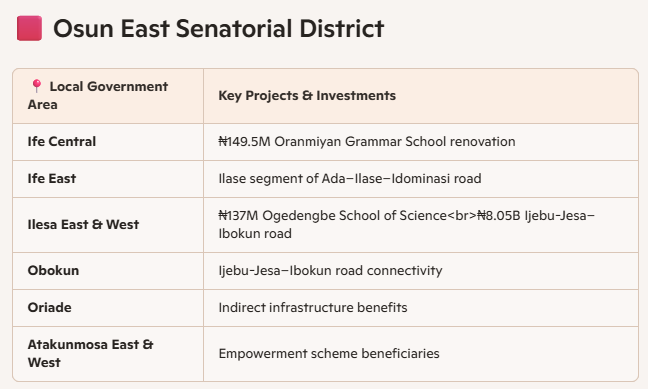

Osun East has witnessed improvements on a smaller but notable scale. In Ile-Ife, the Enuwa–Oniyangi–Ita-Osun link has improved local traffic, while Ilesa has seen work on the Atakunmosa Market road and Obiteni–Omo Ofe route. Two major secondary schools in this zone, Ogedengbe and Oranmiyan, have secured explicit allocations for full renovation.

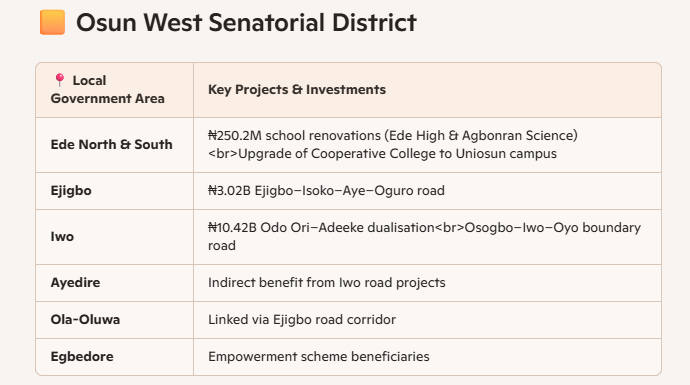

Osun West has attracted dense urban attention. Ede North and South boast a cluster of resurfaced roads, including Akankan–Obada, Anu-Olu–Obada–Alusekere and Ogberin–Akala–Oloki, alongside the Akoda–Ido-Osun dual carriageway stretching roughly twenty-three kilometres. Iwo has received the Ansarudeen Junction–Hospital Road upgrade and a planned dualisation linking Odo-Ori to the palace area. The borehole initiative claims to touch every ward across all thirty local government areas, though assessments of functionality have been mixed.

Balancing Equality and Equity

On paper these investments suggest that the administration has attempted an even hand. In practice the distribution reflects population density and political calculus. Osogbo, as the capital, absorbs the lion’s share of major carriageways and beautification. Ede, the governor’s hometown, is heavily represented in road resurfacing and school renewal. Iwo and Ila benefit from new dualised corridors while some smaller local governments appear only in aggregated project lists with few headline announcements.

Equity sometimes justifies unequal spending when economic hubs require heavier investment. However, perceptions of fairness matter in a state with diverse constituencies. Residents in Oriade or Ifedayo occasionally point to limited visible footprints, fuelling quiet concerns that resource flows tilt toward the inner ring of LGAs. A statewide commitment to balanced visibility will determine whether the narrative remains one of inclusion or of quiet grievance.

Transparency and the Way Forward

One persistent gap is the lack of detailed contract disclosure. Apart from select school figures and the primary health centre totals, there is little itemised cost information per kilometre of road or per project site. Citizens are left to piece together press statements rather than access a public dashboard of spending and completion rates. In an era when open governance strengthens trust, such opacity can erode otherwise genuine achievements.

Adeleke’s administration deserves credit for packaging road, education, health and agricultural interventions into coherent phases. The focus on Osogbo’s urban competitiveness and the bold agricultural pivot can create long-term growth if consistently funded. Yet the next frontier is evidence-based equity. Publishing ward-by-ward audits of borehole functionality, real-time road progress reports and transparent contract sums would convert political messaging into verifiable fairness.

The governor’s first three years prove that ambition is not lacking. The real test lies in demonstrating that every naira has translated into concrete, evenly spread development. Equality of access will not be declared by press releases alone but by clear, accessible data showing that communities from Iwo to Ifedayo share in the dividends of public investment.