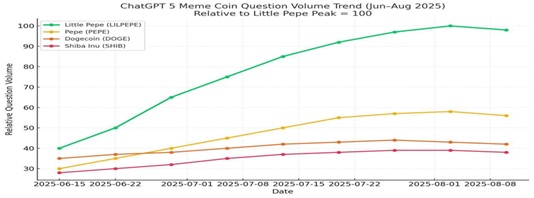

What if the next meme coin didn’t just pump, but rewrote the script of crypto history? From Dogecoin’s rocket ride to Shiba Inu’s kingdom-building, meme coins have grown from internet jokes to multibillion-dollar revolutions. Investors crave the next explosive breakout, the next coin that turns cents into millions, the next chapter in crypto’s degen saga.

But in the shadows of giants, a new titan stirs. BullZilla ($BZIL) emerges with a cinematic presale built like no other, a progressive engine where prices rise every 48 hours or instantly when $100,000 floods in. Side by side, heavyweights like Bitcoin (BTC), the culture-slinging Mog Coin (MOG), the snake-charmer Snek (SNEK), and the turbo-charged Turbo (TURBO) are rewriting the crypto calendar. Each one tells a story, but only one presale promises 1000x gains. The BullZilla Presale is live, and it’s already mutating the market.

For those searching for the best crypto presale to buy, this is the moment. Join early for maximum perks, because once the Bull Zilla presale stages roar forward, there’s no turning back. This listicle dissects five projects dominating 2025’s conversation, with BullZilla at the forefront of the best crypto presales 2025.

1. BullZilla ($BZIL): The Cinematic Mutation Unleashed

The BullZilla Presale has entered its 2nd stage, ominously named “Dead Wallets Don’t Lie.” It’s already raised over $257,000, onboarding 900+ holders who sense the magnitude of this beast. At its current price of $0.00003241, early adopters stand at a staggering 463% ROI compared to Stage 2A, with projections of 16,164% ROI as the token roars toward its listing price of $0.0052. Numbers this bold don’t whisper. They scream.

What sets BullZilla Token apart isn’t just scarcity or hype. It’s the mechanics. Its Mutation Mechanism ensures that price climbs either every 48 hours or the moment $100,000 is raised. There are 24 stages, each building intensity, each closer to unleashing the full creature. It’s not a presale. It’s a narrative.

The HODL Furnace defines BullZilla’s investor culture. With staking rewards as high as 70% APY, weak hands are melted down and reforged into diamond claws. Vesting ensures rewards snowball for the faithful, turning short-term speculators into long-term wealth warriors. Add in the Roar Burn mechanism, where live supply burns ignite with each chapter, and you have a scarcity engine designed for seismic price eruptions.

In a world where meme coins often rely only on vibes, Bull Zilla wields tokenomics like a weapon. A cinematic storyline across 24 lore chapters ensures engagement isn’t just transactional, it’s tribal. According to its whitepaper, half of its 160B supply powers the presale, while the rest fuels staking, ecosystem growth, and live burns. This is community culture hard-coded into Ethereum ERC-20 infrastructure.

Bull Zilla made this list because it isn’t another meme coin. It’s a mutation of crypto mechanics, mythology, and market momentum. For anyone scanning for the best crypto presale to buy, this is the Early Presale Crypto that might just dominate headlines for years.

2. Bitcoin (BTC): The Relentless Reserve Revolution

Bitcoin doesn’t need an introduction, but it demands one. The original cryptocurrency continues to be the yardstick for wealth preservation in a digitized age. In 2025, Bitcoin’s narrative is no longer about novelty. It’s about global adoption, as nation-states pile BTC into reserves faster than central banks can print fiat.

Recent headlines show countries from Latin America to Asia rushing to declare Bitcoin as strategic gold 2.0. This surge underscores its shift from speculative asset to sovereign reserve. Layer-2 innovations, including the Lightning Network, are making BTC transactions faster, cheaper, and more scalable, while institutional investors treat Bitcoin ETFs like blue-chip assets.

The magic is its fixed supply: only 21 million coins will ever exist. Compare this scarcity with inflationary fiat currencies, and Bitcoin looks less like a gamble and more like insurance against economic chaos. It’s digital land, immune to debasement, programmable for the future.

Why does Bitcoin belong on this list? Because no list of Best Crypto Presales 2025 or contenders for the best crypto presale to buy is complete without mentioning the king. While not a presale itself, it sets the foundation on which coins like BullZilla can soar. Its relentless rise proves that digital scarcity has global demand — and that narrative powers markets as much as math.

3. Mog Coin (MOG): The Cultural Wildcard

Crypto isn’t just about charts. It’s about culture. Mog Coin (MOG) embodies this truth, positioning itself as the meme coin of collective identity. Built as a community-driven experiment, Mog embraces degen humor, internet virality, and meme warfare as a growth model.

In 2025, MOG has carved its niche by bridging crypto’s grassroots fun with Web3 tools. The coin leverages viral meme formats, TikTok virality, and community raids to cement itself in the digital zeitgeist. It isn’t about staking APY or burn mechanics. It’s about cultural capital — the currency of attention.

Mog’s smart contract mechanics are simple by design, avoiding the overcomplication that scares off casual investors. What it thrives on instead is community-led launches and ERC-20 accessibility. MOG’s strength is its memetic stickiness, which creates liquidity and trading opportunities for speculators who thrive on volatility.

Mog Coin belongs here because cultural tokens matter as much as technical ones. While BullZilla Presale represents progressive tokenomics and Bitcoin symbolizes digital gold, Mog proves that memes move markets. For anyone eyeing the best crypto presale to buy, MOG is a wild card that keeps degen culture alive.

4. Snek (SNEK): The Cardano King of Memes

Slithering its way into the spotlight, Snek (SNEK) represents Cardano’s foray into meme coin dominance. Built on ADA’s blockchain, it offers faster transactions and greener energy profiles compared to many ERC-20 meme projects. This makes Snek both playful and technically appealing.

The coin’s community has been central to its rise. Leveraging Cardano’s reputation for eco-conscious innovation, Snek built a loyal base by branding itself as the serpent of decentralization. Its ecosystem supports staking pools, community swaps, and integrations with ADA-native platforms. For eco-conscious investors, this hybrid of fun and fundamentals makes Snek unique.

Price-wise, SNEK has seen explosive surges since launch, capturing the attention of traders seeking exposure to Cardano’s expanding DeFi world. Unlike Bitcoin’s reserve strategy or BullZilla’s mutation model, Snek thrives on its blockchain’s promise of low fees and sustainability.

Snek belongs on this list because it proves that meme coins don’t have to live solely on Ethereum. By combining Cardano’s tech with meme dynamics, it represents one of the Best Crypto Presales 2025 and earns a spot among the best crypto presale to buy contenders.

5. Turbo (TURBO): AI Meets Meme Coin Mayhem

Imagine a meme coin not dreamed up by a degen but by an AI. Turbo (TURBO) burst onto the scene as a token literally designed with GPT prompts, proving that generative AI can engineer communities and narratives as effectively as humans.

What makes Turbo captivating is its self-aware humor. It embraces the absurdity of AI-designed memecoins while still delivering on fundamentals like liquidity pools, ERC-20 structure, and staking rewards. Its viral narrative hooked a wave of investors eager to bet on the first true “AI-born” meme culture.

In 2025, Turbo continues to surprise. Its roadmap includes AI-driven tokenomics simulations, where supply-and-demand levers are tweaked with machine learning to test market reactions. This experimental flair has created a feedback loop of traders watching AI “play God” with token dynamics.

Turbo earns its spot because it captures crypto’s wild imagination. If BullZilla Token mutates the presale model and Bitcoin hardens into digital gold, Turbo represents crypto’s next frontier: AI-designed culture that blends tech with trading. For risk-takers looking for the best crypto presale to buy, Turbo shows how far meme coins can push innovation.

Conclusion: The Roar of Tomorrow

Based on the latest research, the BullZilla, Bitcoin, Mog Coin, Snek, and Turbo narratives all reveal one undeniable truth: 2025 belongs to projects that fuse scarcity, culture, and technology into seismic opportunities. Among them, the BullZilla Presale is live and roaring louder than all others, promising 1000x gains for early believers.

Presales matter because they are the best crypto presale to buy when looking for exponential wealth multiplication. Unlike late-stage entries, presales offer progressive pricing advantages, early staking access, and community-driven perks. With BullZilla’s Mutation Mechanism, HODL Furnace, and Roar Burn, investors aren’t just buying a token, they’re joining a cinematic ecosystem built to dominate.

The market just got louder. And it’s not a launch. It’s a mutation. Step in now, because tomorrow’s legends are forged today in presale fires.

For More Information:

Follow BZIL on X (Formerly Twitter)

Frequently Asked Questions for Best Crypto Presale to Buy in 2025

What is the best crypto presale to buy in 2025?

BullZilla leads the way, with others like Snek and Turbo offering niche opportunities.

Why are presales important in crypto?

Presales allow early entry at lower prices before tokens list on exchanges.

What makes BullZilla unique?

Its progressive presale, Roar Burn mechanism, and 70% APY staking.

Is Bitcoin still a good investment in 2025?

Yes, as countries adopt it as a reserve asset, Bitcoin continues to rise in relevance.

Are meme coins still profitable?

Yes, coins like Mog, Snek, and Turbo show that culture-driven coins thrive.

How risky are presale tokens?

All presales carry risks, but structured ones like BullZilla provide transparency.

Can meme coins really offer 1000x returns?

History shows Dogecoin and Shiba Inu did — and BullZilla aims to replicate that.

Glossary

- Progressive Presale: A pricing model where tokens rise in cost based on time or funds raised.

- Token Burn: Permanent removal of tokens from circulation, creating scarcity.

- HODL Furnace: BullZilla’s staking system rewarding up to 70% APY.

- ERC-20: Ethereum token standard used for most meme coins.

- Referral System: Incentives for users to bring in new investors.

- Roarblood Vault: BullZilla’s ecosystem fund for rewards and expansion.

- Staking APY: Annual yield earned by locking tokens.

- Supply Scarcity: Limited token supply driving price appreciation.

- Community Vesting: Timed release of tokens to prevent dumping.

- Ethereum Smart Contracts: Code on blockchain executing automated rules.

Disclaimer

This article explores the best crypto presale to buy in 2025, spotlighting BullZilla ($BZIL) alongside Bitcoin, Mog Coin, Snek, and Turbo. It highlights BullZilla’s cinematic presale with progressive pricing, a Roar Burn mechanism, and the HODL Furnace offering 70% APY staking rewards. Bitcoin is framed as digital gold adopted by countries, Mog as a cultural meme experiment, Snek as Cardano’s eco-conscious serpent, and Turbo as an AI-engineered meme coin. Together, they represent the top presale tokens 2025 and best new crypto launches. The piece emphasizes presales as wealth multipliers, with BullZilla presale live now and promising 1000x gains for early adopters.