Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has projected that interest rates could trend downward in the coming months, citing easing inflation and more efficient capital allocation as key factors.

Speaking at the European Business Chamber (Eurocham Nigeria) C-Level Forum in Lagos, Cardoso acknowledged the burden of today’s high lending rates, which range between 32% and 36% on commercial loans, but assured investors and businesses that macroeconomic stabilization would likely bring relief.

“There was a substantial potential for interest rates to decrease in the future,” Cardoso said during a fireside chat moderated by Andreas Voss, Chief Country Representative of Deutsche Bank Nigeria.

The apex bank chief outlined the CBN’s priorities, stressing macroeconomic stability, banking sector recapitalization, and positioning Nigeria as a competitive investment hub.

Although headline inflation remains elevated, Cardoso noted that it is beginning to soften as policy measures take effect.

“It is decreasing as a consequence of collective efforts. It is anticipated that the advantages of the CBN tightening posture will persist. We will protect the stability that has been re-established in the financial system with the utmost zeal,” he said.

Cardoso reaffirmed that the central bank would continue its tight monetary stance to preserve stability, arguing that the resilience of Nigeria’s financial system is critical for lending, corporate expansion, and long-term investment flows.

“Our primary objective is to maintain that stability while simultaneously addressing inflation and ensuring that the financial system is sufficiently resilient to facilitate corporate lending and investment,” he added.

What the Numbers Show

A report by the National Bureau of Statistics (NBS) last month revealed Nigeria’s headline inflation rate eased slightly to 21.88% in July 2025, down from 22.22% the previous month. On a year-on-year basis, the figure was 11.52% lower than the 33.40% recorded in July 2024.

Urban inflation stood at 22.01% in July 2025, a notable 13.76 percentage points lower compared to the 35.77% logged in July 2024.

While these figures suggest a positive trend, analysts caution against premature policy loosening.

Experts Urge Caution

Dr. Paul Alaje, CEO of SPM Professionals, while commending the CBN’s reforms, warned that the current inflation decline may not yet be sustainable.

“I think the central bank is making some very good policy. This time, I only hope that some of those policies will be sustained. For instance, relaxing MPR shouldn’t be now.

“We may need to wait a bit more, especially because some of the inflation numbers we are seeing are outliers. I didn’t say they are lies. I’m saying they are outliers,” he explained on Channels Television’s Politics Today.

Alaje argued that a full-year cycle of consistent inflation data is necessary before considering easing, otherwise Nigeria risks undoing recent gains.

Political Risks Ahead of 2027 Elections

Beyond monetary policy, Alaje flagged looming political risks as a major determinant of Nigeria’s economic trajectory. With the 2027 elections approaching, he cautioned that reckless handling of foreign exchange during campaigns could destabilize the fragile recovery.

“Even the danger starts more with the pre-election year. The behavior of politicians will determine whether we are going to have another great four years or another horrible four years. And this is what I want President Tinubu to do. Warn politicians, all inclusive, from federal to local government, no exchange of foreign currency, to delegate or for whatever,” he said.

He noted that 80% of Nigeria’s final goods are imported, making the naira highly sensitive to foreign exchange scarcity. Any political abuse of forex, he stressed, would wipe out the little progress made.

“The little sign of positivity that we are seeing will evaporate overnight,” Alaje warned.

Strain on Small Businesses

For Nigeria’s small and medium enterprises (SMEs), the prevailing lending environment has become a chokehold. With commercial loan rates hovering between 32% and 36%, many small business owners say borrowing has become nearly impossible. SMEs — often described as the engine of Nigeria’s economy — have been forced to shelve expansion plans, cut staff, or rely on informal lending at great personal risk.

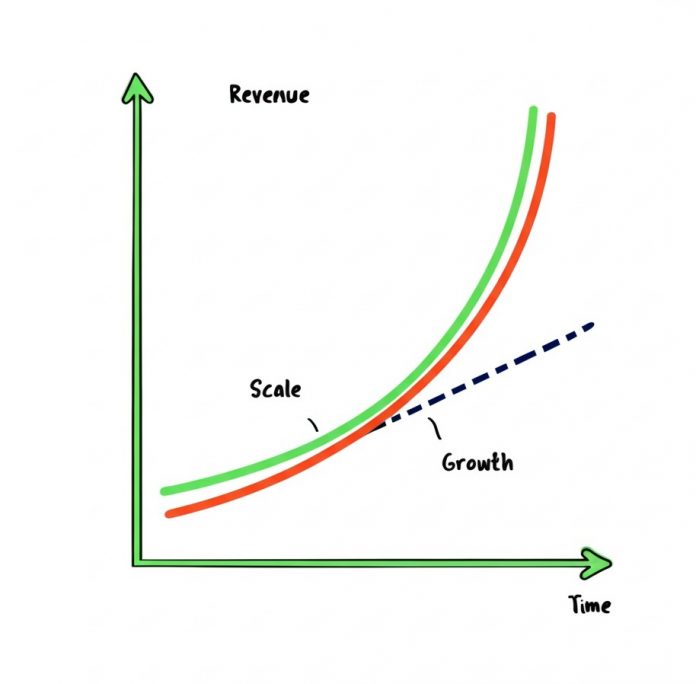

Analysts believe that while the CBN’s tightening stance is necessary to fight inflation, it is also stifling the very businesses expected to drive economic recovery. Cardoso’s assurance of “downward pressure” on rates is therefore being closely watched by entrepreneurs desperate for cheaper credit.