Nollywood makes nice movies but they have not been making ones which go to the heart. Why? Corporate Nigeria makes better movies. The latest episode is that Dangote Sugar and Flour Mills are suing BUA Sugar to get out of the business of running a sugar refinery in Nigeria: “Backed by the Chairman of Flour Mills of Nigeria Plc, Mr. John Coumantaros, Dangote said in a letter sent to the Trade Ministry that the establishment of a new sugar refinery plant in the country poses a threat to the attainment of the National Sugar Master Plan (NSMP) as well as sustainability of the country’s local sugar industry.” You read it well – more supply of sugar will destroy Nigeria!

The BUA Group said the Dangote Group and Flour Mill have not been involved in any backward integration project, rather, they depend on 80% raw sugar allocation which is detrimental to the Nigerian economy in long term. The company said unlike the petitioners, it has been working on backward integration project with BUA’s Lafiagi Sugar BIP, a $250 million sugar refinery set to be completed in 2022.

This Day reported Rabiu, specifically assuring that its sugar export focused project in Port Harcourt, will not affect in any way, the backward integration programme adding that “the only way it will affect Nigerians is that Nigerians will pay lower prices for sugar”.

As a village boy, it was always a happy moment when you put your St. Louis sugar inside your Lipton tea with Ezioma bread ready by the side. It was not luxury because everyone had his or her own big loaf. Ezioma bread was made in Ovim as our industrialists always find a way to take care of home. Then on the big Oriendu Market (every 8 days), Our Society Bread would come from Enugu. That one was always softer – and made by Chief FOC Umunna, the Udo I of Ovum, and one of the men who built Enugu industries. Life was great – yafuyafu even for village kids.

But today, from sugar to bread, everything is a luxury. And yet people are filing court cases to keep it that way. I don’t care whatever any Nigerian government had offered Dangote Sugar and Flour Mills. The deal today is this: we need affordable sugar, and if BUA can bring that, let it be.

My principle remains thus: allow everyone to compete on the same terms. Give BUA the same rights given to Dangote and Flour Mills. There is no need for exemptions.

Finally, Dangote Refinery had made a claim that only those with refinery license should be allowed to import petrol into Nigeria. If the government buys into that, over time, the refinery can even stop production, and focus on imports. That is why exemptions are bad: everyone needs to have the same rules.

Punch had reported that Dangote Group has desired for inclusion in the Petroleum Industry Bill a requirement that the license to import petroleum products should be given only to companies with active refining licenses. The company does think that by having that requirement, companies will invest in local refining business.

So, on this sugar, Nigerian government should allow BUA Sugar to run its show. Possibly, kids in Ovim can enjoy nice tea again.

Yes, they import and it is the same playbook Dangote Refinery is pushing in the PIB bill to make importation of petrol to be exclusive to others running refineries. They always have this: license to refine, and that gives you rights to import, exclusively!

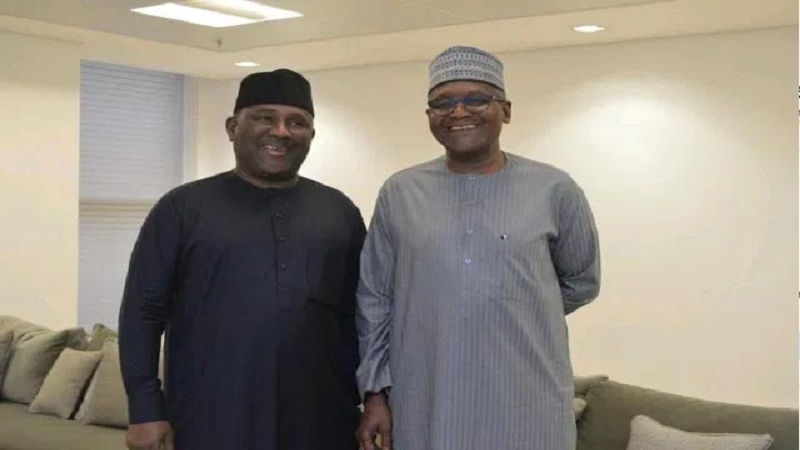

Dangote Group, Flour Mills, File A Petition to Stop BUA from Running A Sugar Refinery