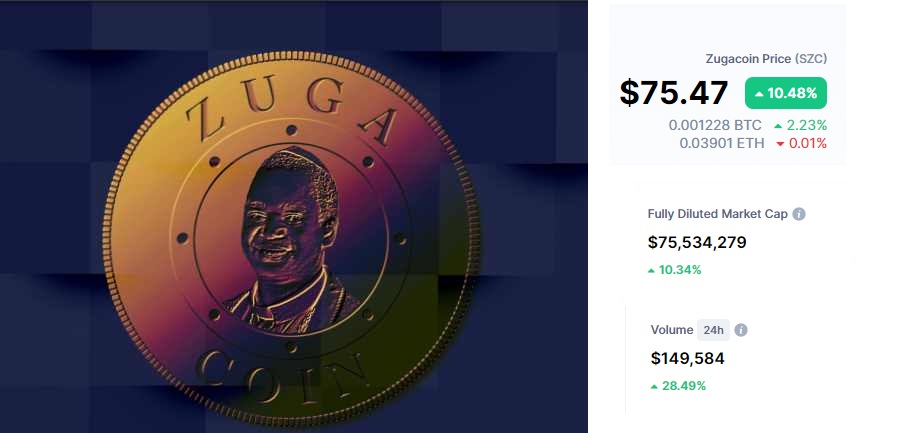

As we do in Tekedia Institute where we add special sessions on moving topics to educate our members, a special Tekedia Live will hold tomorrow to discuss the evolution and potential implications of Zugacoin, which Africas largest indigenous auto manufacturer, Innoson Motors, now accepts as a form of payment, for its vehicles. Zugacoin was created by Nigeria-born Archbishop Sam Zuga.

Franklin Peters Odoemenam, the CEO of Bitfxt, a crypto exchange, which used to employ many people in Lagos, but has since relocated his company to Dubai, after the Central Bank of Nigeria (CBN) restricted crypto exchanges within the Nigerian banking system, will anchor the conversation. Franklin is a Tekedia Institute Faculty.

- Topic: A Changing Continent: Zugacoin, Bitcoin, Fiats and DeFi

- Faculty: Franklin Peters Odoemenam

- Date: Monday, March 15, 2021

- Time: 7pm WAT

- Zoom: Tekedia Mini-MBA Board

NB: If you have registered for Tekedia Mini-MBA edition 5 (June 7 Sept 1, 2021) and want to join, please ask Admin to give you access. If you have not, please pay here and ask Admin to send you a Zoom link to join.

Note: We have spoken with the personal assistant of the creator of Zugacoin, Archbishop Sam Zuga. We are doing everything we can to get him to also join us. Personally, I want to ask him Why Zugacoin when there is Naira? As an archbishop, he is certainly a busy man to be brought in within short notice but we will keep trying. The PA is helping.

Then, most importantly, everything on Zugacoin, BTC, etc is for academic purposes. So, no endorsement. We run a school and not an investment house. So, all is for educating innovators and professionals to understand the changing markets and economics. We have that obligation to do that if we want to be relevant as a school.

Tekedia Team

Boston, USA | Owerri, Nigeria

tekedia@fasmicro.com

Update: Innoson Motors is disputing this but Vanguard Newspapers which broke the news is yet to remove it from its website (see below). We have updated our articles accordingly. This is largely expected as I wrote in my original piece: “This is not going to be the end of this story – I expect the Central Bank of Nigeria to be concerned.” Certainly, Innoson Motors would not like to score an own-goal here. Yet, why it took it more than 100 hours to respond is another story. As always, we see our platform as an education arena – and that does not mean endorsement. Tekedia is a school and teaching something does not mean endorsing it. We will continue to share emerging technologies even if we do not endorse them. Shine your eyes.