Emotional intelligence is the ability of a person to manage his emotions and that of people around him. It involves being able to control your feelings at dire moments. A person is said to be emotionally intelligent if he doesn’t lose his temper at the slightest provocation. Hence, people that lack emotional intelligence are those that pick offences easily and waste no time to react.

The importance of emotional intelligence is too great to be enumerated. Its benefits can never be over-emphasised. People that have mastered this skill have been able to prevent harming themselves and those close to them. The skill is needed by everyone irrespective of who they are or what they do. Some people think that it is not necessary to develop this skill because “if you don’t say ‘I am’, nobody will say ‘you are’”. They believe that tolerating ‘nonsense’ leads to more ‘nonsense’. So they lash out immediately at people that trigger them. But what people with this kind of mindset fail to understand is that exhibiting violence never pays. Instead of this sort of attitude attracting respect for the person, it attracts hate and loneliness.

Developing emotional intelligence helps people to build good relationships, grow their businesses, build their careers, and improve their leadership skills. It also attracts respect, as mentioned previously, and companionship. The simple truth is that no one wants to relate with a person that easily blows his top. No one wants to be cautious while dealing with his fellow man. So, there are only two options open for everybody: to become emotionally intelligent and grow, or to lack the skills and stagnate.

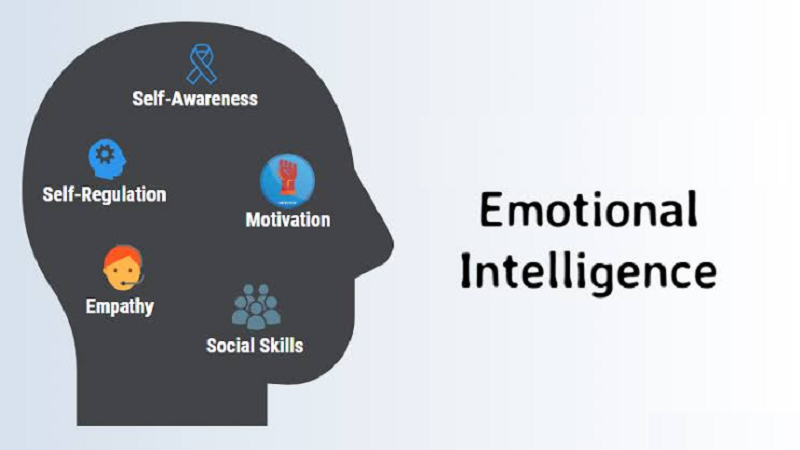

Developing emotional intelligence is not an easy game. It never comes easy. Some people, naturally, keep their cools irrespective of circumstances but some are easily triggered. For members of the latter group to control their outbursts, they need to evaluate themselves critically, regulate their emotions, develop social skills, become empathetic, and find factors that will motivate them.

a. Self-Awareness: This simply means knowing yourself. It means analysing yourself critically to ascertain what you are capable of. This, here, is the first stage towards developing emotional intelligence. If you notice that you are easily “pissed off” by what others say, it means you lack this skill. If you find out you can’t “tolerate bullshit”, this essay is for you. If you don’t understand why you’re easily agitated by other people’s words and actions, you need to develop this skill as soon as possible. So, start by being honest with yourself. Don’t excuse your actions by blaming the other party. Accept your shortcomings and be ready to work on them.

b. Self-Regulation: This stage is where you actually begin to hold yourself accountable for your outbursts. Set values and make efforts to stick to them. For instance, you can tell yourself you will never argue with your supervisor even if he was wrong and make efforts to stick to that. You need to make efforts to develop self-control. But remember, that Rome wasn’t built in a day. So don’t expect you can master this skill by putting in little effort within a short time.

c. Develop Social Skills: You need to learn how to interact and communicate with people. Remember that your facial expressions, tones, gestures, voice pitch, turn-taking skills, listening skills, eye contacts, and so on add to your message. Make efforts to develop these skills so your audience doesn’t misjudge you.

d. Empathy: Sometimes understanding other people’s feelings and perspectives goes a long way in preventing unnecessary drama. This is most important for people that felt they are being insulted or overshadowed when their ideas or submissions are challenged or they are asked for clarifications. The easiest way you can achieve empathy is by putting yourself in someone else’s shoes. If you can feel where it bites them, you may understand where they are coming from.

e. Find your Motivation: Motivation here means finding out why you need to acquire emotional intelligence. If you need that skill because you are tired of losing customers, that’s your motivation. If you need it because you want to maintain good relationships, that’s your motivation too. The good thing about motivation is that it spurs you on when your interests or desires begin to wane. So, find the reason, or reasons, you want to become emotionally intelligent and allow it to stimulate you.