Several months after watching painfully as TikTok sweeps the tide of the short video sharing space, Facebook has launched BARS, an app which allows rappers to create and share their raps using professional tools.

It marks a second music video app created by Facebook recently. Late last year, the social media platform publicly launched its collaborative music video app, Collab, as part Facebook’s Internal R&D group, NPE Team, which tests new ideas that could influence Facebook’s next steps on social media projects.

Collab focuses on making music online with others, while BARS helps would-be rappers to create and share their own videos using an online studio.

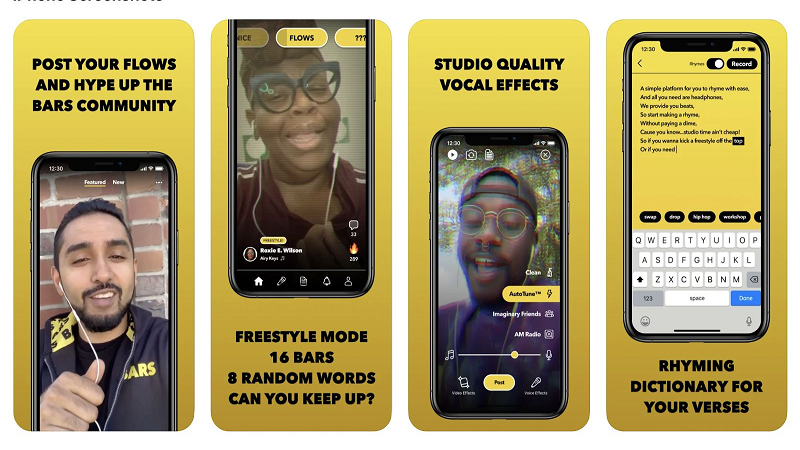

TechCrunch explained that the app helps users to select from any of the hundreds of professionally created beats, then write their own lyrics and record a video. BARS can also automatically suggest rhymes as you’re writing out lyrics, and offers different audio and visual filters to accompany videos as well as an autotune feature.

Among other exciting features of the BARS is the “challenge mode”, where you can freestyle with auto-suggested word cues with a touch of a game-like element.

The app is designed to serve a fun purpose for those who just want to freestyle with auto-suggested word cues. TechCrunch said the videos can be up to 60 seconds in length and can be saved to your Camera Roll or shared out on other social media platforms.

The significant growth recorded by tech companies offering stream, video and teleconferencing services during the COVID-19 lockdowns was undoubtedly a factor in Facebook’s NPE’s push to create new video apps.

“I know access to high-priced recording studios and production equipment can be limited for aspiring rappers. On top of that, the global pandemic shut down live performances where we often create and share our work,” said a member NPE Team, DJ lyler.

Interest in binge-watching content grew significantly in the midst of the pandemic with 70% of marketers looking up their investment in videos.

Besides huge gains recorded by other tech companies during the lockdown, TikTok’s success so far has become an intimidating challenge to Facebook. With its feature that allows users to create video contents, the short video app has captured a diverse crowd of talents who have become popular delivering creative contents on the app.

Despite the controversies that have trailed the app particularly in the US and India, it has recorded tremendous growth that makes Facebook wary.

As of 2021, TikTok is one of the world’s most loved apps, especially among young people. TikTok has a monthly user record of 100 million in the US, more than 689 million internationally and 6 billion lifetime downloads as of December 2020, according to data from Sensor Tower. TikTok recorded 29% over Facebook’s Instagram 25% as young people’s most preferred social media app in 2020.

Facebook, which has been desperately seeking to grab more market share with video apps has been chasing after every successful video idea.

TechCrunch said BARS resembles TikTok in terms of its user interface. It’s a two-tabbed vertical video interface – in its case, it has “Featured” and “New” feeds instead of TikTok’s “Following” and “For You.” And just like TikTok, it places the engagement buttons on the lower-right corner of the screen with the creator name on the lower-left.