Consider the labor market where we have four job seekers, Mr. Dollar, Mr. Euro, Mr. Pounds, and Mr. Naira. They supply their time/service for wages. The wages they earn will enable them to buy consumables for their respective households. Assume everyone is 25 years old and same sex. They all got employed by one firm (the global economy) to do the same job and were provided equal resources.

At the end of the month, to their surprise, each earned differently for the same job description. Mr. Naira, who received the least, protested to the employer thus, “Why should I be paid the poorest wage when we all have the same JD and worked equal hours. I demand an equal wage with Mr. Pounds!”

The employer smiled as he brought out a sheet of paper from his drawer and slides it across the table towards Mr. Naira. “Yes, the four of you were employed under the same terms and conditions, however, the major determinant of your wage is your productivity and you know that. Please read out the daily output for each employee.” Mr. Naira: “Mr. pounds 1.3856kg, Mr. Euro 1.2195kg, Mr. Dollars 1kg, and Mr. Naira 0.0026kg.” The employer added, “1kg equals 1 dollar, therefore there is no limit to what you could earn according to your output. So, Mr. Naira, could you tell me the just wage for all employees?” Mr. Naira with watery eyes read out the respective wages, “Mr. Pound, 41.57 dollars. Mr. Euro, 36.59 dollars. Mr. Dollars, 30 dollars. And Mr. Naira, 0.08 dollars.”

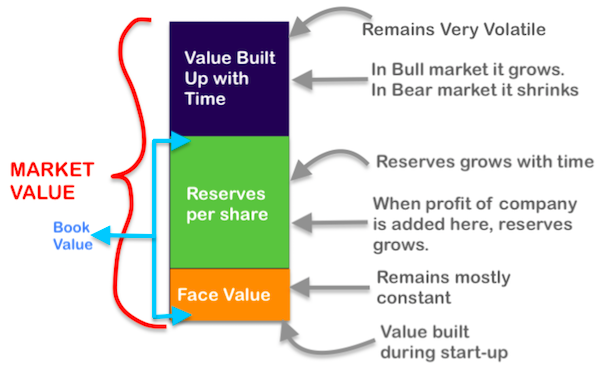

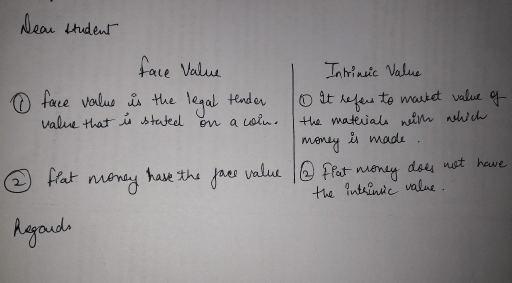

This piece was inspired by a picture I saw on social media where the face values of 100 Pounds Sterling, 100 Euro, 100 Dollar, and 100 Naira were contrasted with their intrinsic value (market value). They all fetched different baskets of goods and services in the market. The Naira could only buy two Gala (a popular snack in Nigeria). This depicts the reality in our individual and national lives. If we consider productivity to be a sole function of time, and time, a function quality education, experience, skills, and training, then we will understand the reason behind the differences in value whether for currencies, national incomes and our individual lives.

So, what value do you command in the marketplace? How are you investing your time? You desire to soar higher, and this is only possible when you acquire greater capacity to produce greater outputs. First you must be mad about your current level and seek a different kind of education, training, skill, and experience. There is a new renaissance called the Tekedia Institute that has been transforming ideas into products, accelerating leadership ascents, imparting businesses to thrive through uncommon business insights.

So, if you want to innovate, grow and transform, capture emerging opportunities, and digitally evolve your business or job, turn disruption into a competitive advantage, master the concepts of building category-king companies and advance; you must enroll in the Tekedia Mini-MBA 4th Edition ASAP!

“A little learning is a dangerous thing; drink deep or taste not the Pierian spring: there shallow thoughts intoxicates the brain.” – Alexander Pope, 1709

In conclusion, to be the best, to increase your intrinsic value with respect to your face value, you must learn from the best. Join Prof Ndubuisi Ekekwe, as lead anchor, leading other great and accomplished minds around the globe in making history at the Tekedia Institute, USA.

See you at the top!