Saturday 16 January, 2021 was a date when the memories of the late Canada-based Nigerian Professor, Pius Adesanmi, was brought back to life. It was not only the memory of his personality alone that was resurrected, but also his ideals, the strivings he was committed to, preached, lived and eventually died for. It was not yet March 10, that horrible date on which Pius flew away from the rest of us, still January 16 captured an attempt by the community of people across Africa he left behind to engrave his memory and concretize his developmental agenda to up the scales of knowledge production, empirical investigations, cutting edge research and nurture a young, vibrant, energetic present and future for the continent.

It was the day a professional development seminar series was held to kick-start a webinar series aimed at continuing the legacy of Professor Pius Adesanmi whose passion for higher education in Africa was arguably unrivalled. Speaking with me earlier, Tope Oriola, an Associate Professor at the University of Alberta, said “the idea was to leverage the African Doctoral Lounge (ADL) platform to organize professional development workshops for members. We also wanted to continue the legacy of Professor Pius Adesanmi whose passion for higher education in Africa was immense. The ADL was Adesanmi’s brainchild as you may be aware.” Oriola further stated that “the Pious Adesanmi Webinar Series (PAWS) emanated from Adesanmi’s vision for the African Doctoral Lounge (ADL) as a centrepiece of scholarly discourses among Africans and Africanists. We opted for an online format due to the restrictions of the pandemic, the geographic spread of our members and the need to adapt to a changing environment.”

Appropriately titled Building Your Academic Community: The Role of Mentors and Networks, the webinar indeed lived up to its billing with its focus on Prof Adesanmi’s passion to help young, early and middle career African academics and researchers find their paths on a continent whose myriads of challenges are capable of cutting dreams short. It is also worthy to note that the webinar came in the middle of a crossfire between Africa-based scholars and their colleagues in Diaspora on how to make tertiary education serve the continent in solving some of her problems through quality and functional education, cutting edge research as well as robust mentorship system that provides a sustainable future for the continent. In my own perspectives, the webinar (and its future editions) is a reflection of how to confront a problem beyond the rhetoric.

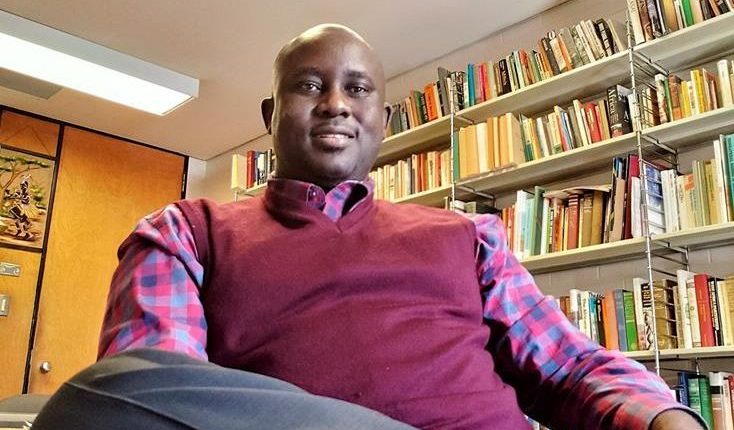

The programme, segmented into three sections, had two amazing speakers. The first to come to the stage is the Nigerian Professor of History at the Western Carolina University in the United States, Saheed Aderinto. He spoke directly to the theme of the webinar focusing on The Role of Mentors and Networks in Building Academic Community in Africa. In the opening paragraphs of the now widely-circulated speech, Aderinto paid homage to Prof. Pius Adesanmi who he stated was committed to mentoring up-and-coming scholars using his academic contacts in North America and Africa. He then made suggestions on new and diversified ways of mentoring young scholars as he identified the shortcomings of the traditional academic mentorship tips and prescribed new ones. Aderinto said “my speech will insert suggestions on what should be the role of mentors and academic networks and communities into the structural problems that militate against quality knowledge production in Africa. The common manual for building academic networks prescribes attending seminars and conferences, contacting scholars, and publishing in areas of specialization. But, research has shown that many factors, including but not limited to gender, race, location, funding, and even ethnicity and religion make it difficult for up-and-coming scholars to build their own network all by themselves.” He concluded that “effective networking is also about personality, which varies from individual to individual. We always expect scholars to network, but we rarely reflect on the difficulty they encounter in doing so. Networking, like everything else, is not a level playing field.”

The erudite historian acknowledged the roles of senior scholars in enabling a seamless network and mentorship scheme for young scholars on the continent. He prescribed that “an ideal network must provide a conducive environment for early career scholars to learn from senior scholars without feeling intimidated or entrapped. A space where senior scholars could give back and invest intellectually in budding scholars, without feeling entitled to anything from them. A serious academic community building must correct the imbalance in the distribution of opportunities for professional development. It must work to close achievement gaps between scholars.” Aderinto also charged senior scholars not to “invest in themselves or activities that directly enhance their status alone, but in academic networks that improve the professional development of the larger community.” He sermonized that “institutions are stronger when their ideals go beyond the personal, the individual, self-legacy building.”

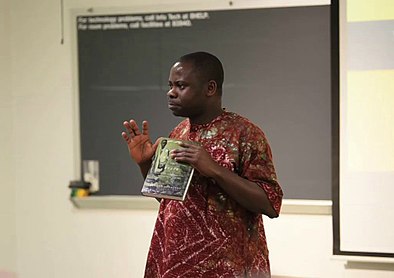

In her own presentation titled Building Your Academic Community: the Roles of Networks, Prof. Akosua Adomako Ampofo of the Institute of African Studies, University of Ghana, spoke on the nitty gritty of academic networking. The charming former Director of the IAS of Ghana’s number one university navigated the issues around building academic networks using her own personal experiences. She advised young scholars in Africa to first identify their own personality and what they intended to draw from different networks before they venture into building one. She highlighted why scholars need networks, the responsibilities of people within any network, where network building happens and how such networks could be sustained.

The programme came to an end with a dialogue session between the two speakers and the members of the audience where further questions were provided answers to. For me, kudos should be given to the five-member committee chaired by Dr. Caroline Agboola (University of South Africa) for a webinar well-coordinated and successfully hosted. Other members of the committee included Helen Fontebo-Linonge (University of Buea, Cameroon);Angelita Kithatu-Kiwekete (University of Witwatersrand, South Africa); Johannes Mampane (University of South Africa); Mshai Mwangola (Independent Scholar) and James Yeku (University of Kansas, United States).

As I look forward to more editions in the monthly series, it is my hope that relevant, diversified issues affecting the academia in Africa would be engaged drawing from the list of established scholars that populate the African Doctoral Lounge and that are spread on and beyond the continent. It is then that the dreams of late Pius Adesanmi would be sustained and the memories of his struggle to see African academics rise beyond the horizon of the continent and match their contemporaries across the world in lifting the banner of quality knowledge dissemination, knowledge production and knowledge application embossed in gold.