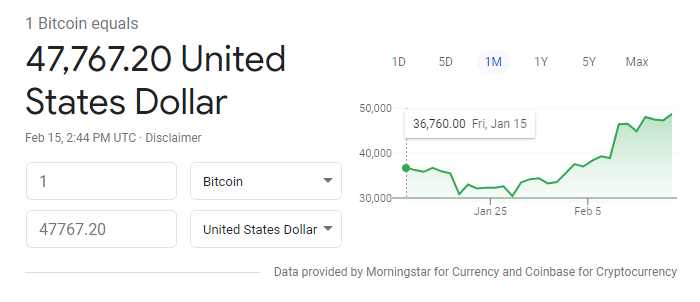

Bitcoin is nearing a $50 000 record, maintaining its rally from late last year, following growing acceptance by Wall Street and Main Street moguls.

On Sunday morning, the cryptocurrency rose up more than 3% to $48,700, after trading as high as $49,714 earlier in the day.

Bitcoin is up 70% year to date following increasing mainstream acceptance. Big corporations and traditional financial firms that previously shunned the cryptocurrency are now embracing it.

More companies have shown interest in bitcoin after Elon Musk’s Tesla revealed last week it has invested $1.5 billion and would accept the coin as a form of payment.

BNY Mellon said last week it has formed a new unit to help clients hold, transfer and issue digital assets. Canada’s Ontario Securities Commission, on Friday, approved the launch of Purpose Bitcoin ETF, according to Toronto-based asset management company Purpose Investment Inc. The approval makes it the first North American Bitcoin ETF.

“Bitcoin has been one of the best performing asset classes on a 1-year, 3-year, 5-year and 10-year basis, both absolute and risk-adjusted. Given Bitcoin’s historical track record and future potential, along with its portfolio diversification properties, we are looking forward to offering investors exposure to the asset class in an easy-to-use, low-cost ETF,” Accelerated Financial Technologies CEO Julian Klymochko said.

The firm said the fund will offer units denominated in both United States and Canadian dollars with a 0.7% management fee, and it had applied to list ABTC units on the Toronto Stock Exchange.

In the US, it’s a race to get involved by both companies and authorities. Miami Mayor Francis Suarez said on Friday the city is looking to adopt bitcoin in transactions in hope that it will attract tech companies. BlackRock Inc., world’s largest asset manager had in January added bitcoin as an eligible investment to two funds.

MasterCard said it will allow customer-to-merchant payments in cryptocurrency this year, without the need to settle in fiat.

“Our change to supporting digital assets directly will allow many more merchants to accept crypto – an ability that’s currently limited by proprietary methods unique to each digital asset. This change will also cut out inefficiencies, letting both consumers and merchants avoid having to convert back and forth between crypto and traditional to make purchases,” the payment platform said in a statement.

Although MasterCard already works in partnership with crypto payment firms such as BitPay and Wirex on cryptocurrency debit cards, the move underscores a shift to enable cryptocurrencies, particularly bitcoin, to be used directly for transactions through its network.

CEO of Uber, Dara Khosrowshahi told CNBC on Thursday the ridesharing giant is considering accepting cryptocurrencies including bitcoin as form of payment.

Twitter CEO Jack Dorsey has announced he is teaming up with rapper Jayz to create “Trust”, a blind bitcoin development trust. Dorsey had earlier invested in bitcoin using his payment company Square. The Trust is worth 500 BTC ($23.7m) and will focus on India and Africa for a start.

Dorsey said they are looking for three people to make up the board members. The application form for board members said the goal is to “make bitcoin the internet’s currency.”

However, the Trust is facing a big speed bump as India is reportedly working to completely ban cryptocurrency. Sources told Bloomberg that the Asian giant is giving users a 3-6 month grace period to liquidate their holdings. In Nigeria, the central bank last week directed all regulated financial institutions to close accounts used for crypto transactions.

India and Nigeria are huge crypto markets. Nigeria was the second largest crypto market last year, after the US, and India has a growing large population of crypto enthusiasts. The move by their respective authorities to stop the asset investment will undermine plans such as Dorsey’s.

Notwithstanding, these interests indicate the growing mainstream acceptance of bitcoin, suggesting that Nigeria will lose a large share of the more than $1 trillion market if it doesn’t change its stance on cryptocurrency now.