No one can say the founders of Agritech companies have their passion and skills translated to businesses in a wrong country. They discovered lack of information, insufficient financial support to smallholder farmers, market access and transportation challenges as frictions that must be fixed for everyone to have food and for the manufacturing industry to have ram materials for production. Throughout the developing world, Agritech companies operate with the framework of connecting investors with the smallholder farmers in the rural areas. When investors subscribed to agricultural production and distribution package, the financial proceeds are remitted to the farmers for farming and distribution activities.

Usually, investors are assured of security of their money and return. According to various sources, return on investment could be as high as 35%. In our analysis of 20 companies using average and static approaches, 30.05% was found as ROI. This promise remains unrealistic when one considers economic recession, unstable macroeconomic and microeconomic policies, and how the COVID-19 pandemic is testing the promise. The pandemic has led to a number of uncertainties in many industries without the exemption of agriculture industry. Investors thought that the sector may save them from the harsh impacts of the recession and the pandemic. Despite the uncertainties, Onyeka Akumah, co-founder and CEO of Nigeria’s Farmcrowdy believes that the potential for sizeable returns for investors in Agri-tech startups are as big as the sector.

Since Nigeria is experiencing a number of economic downturns, which have been used by local and international bodies for classifying the country among low-growth economies, our analyst hypothesized the companies’ ROI in this regard. This was done with a view of finding linkages between real and nominal Gross Domestic Product contribution [using crop production, livestock and fishing categories being used by the National Bureau of Statistics for measuring agriculture industry contribution to overall GDP], and ROI [average and static approach] of some companies.

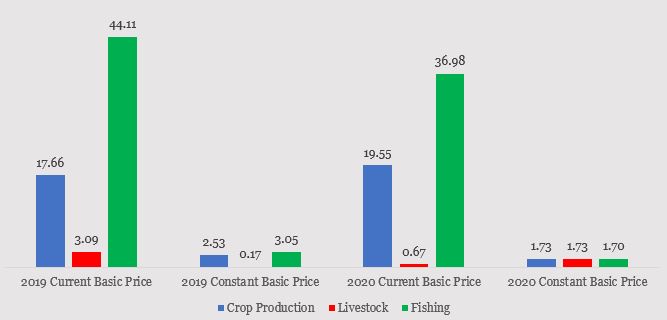

Groupfarma, Farmsponsor, Requid, Thrive Agric, Farmcrowdy, Farmpower, Farm Agric FarmKart, Goldvest, Foxygreen, Kenfarms & Agrovet, Shopagric, Farmnow, Farm4me, Farmkonnect, Abadini, Green fold, Farmtrove, DivaRice and Eatrich are analysed. Our analyst also analysed real and nominal GDP growth of crop production, livestock and fishing. These categories were used because select companies are providing solutions that resonate with the categories. While using the real and nominal GDP growth, attention was paid to the current and constant basic prices. Nominal GDP is the market value of goods and services produced in an economy, unadjusted for inflation. Real GDP is nominal GDP, adjusted for inflation to reflect changes in real output. Trends in the GDP deflator are similar to changes in the Consumer Price Index, which is a different way of measuring inflation.

From 2019 Q1-Q4 to 2020 Q1-Q3, analysis reveals N20.5 million as average of the current basic price of all categories [crop production, livestock and fishing], while it was N1.8 million for constant basic price. Analysis of the select 20 companies’ ROI shows that on average the brands promise 30.05% within the average of 8 months and 2 weeks farm cycle. While other brands seem to have normalised solutions [common solutions], FarmKonnect has a number of unique packages which could not be analysed with other 19 brands. Therefore, for the benefit of a strong inclusion in the average and static ROI approach, standard package of FarmKonnect was factored into the analysis.

Our analysis indicates that these companies had less than 50% capacity to pay the average ROI [30.05%] when the current and constant basic prices were considered. With the current basic price of the chosen measurement categories of the agriculture industry, the companies 15.02% capacity of paying the return and capital. It was over 48% for constant basic price. Analysis further reveals that the 48% capacity threshold was lower than the return on investment promised by Farm4me [73%], Requid [60%], Kenfarms & Agrovet [55.66%], and higher than what Farmtrove [38.25%], Abadini [30.83%], Shopagric [26.08%], Farmcrowdy [25.5%], Groupfarma [24%] Goldvest [20.04%] and Farmkonnect [30%] proposed to investors.

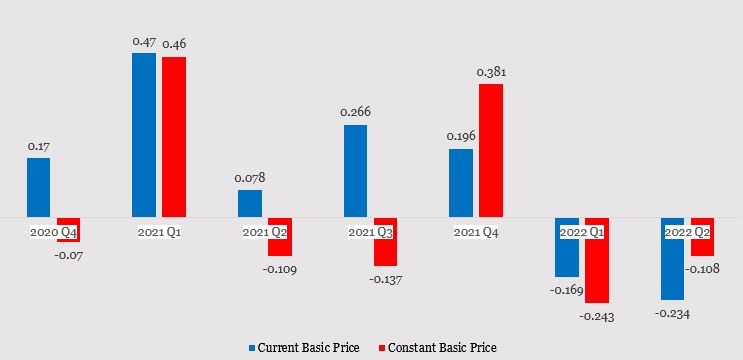

The impact of the two basic prices in the future is presented on Exhibit 2. Examination of the payment capacity within the context of the farm cycle period shows that one month of farming activities increases likelihood of paying the return by 13.4%. However, out of 140 months and 3 weeks of farming cycle, analysis shows that these companies only had a capacity of paying in 21 months. This result indicates that Nigerian Agritech companies have been defaulting in paying ROI to investors since July, 2019. This is further justified with our check which reveals that the public had significant interest in return on investment along with Thrive Agric and Farmcrowdy more than others.

Exhibit 1: Average Nominal and Real GDP in Million [2019-2020]

Exhibit 2: Real and Nominal GDP versus Return on Investment Projected Linkage

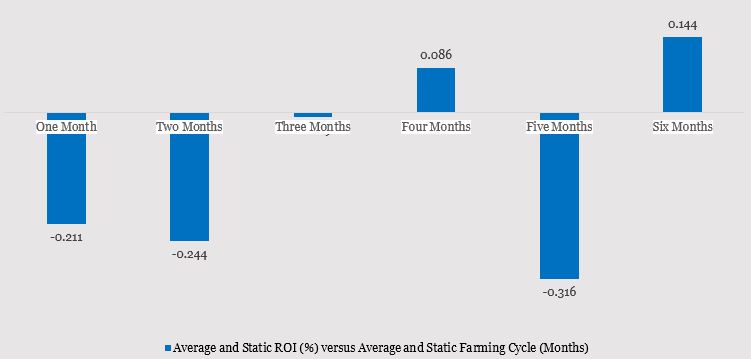

Exhibit 3: Return on Investment and Farming Cycle in the Future

With the current farming cycle months [use for payment in month] and consideration of the ROI of the selected companies, investors would not have their capital and returns in January, February and March, 2021. During these months, our analysis suggests that the players will have some challenges due to the ongoing pandemic and economic recession. However, in April 2021, analysis indicates less issues with the payment. If policies and measures being formulated and implemented by the government at state and federal levels fail to yield positive results for the agriculture industry, analysed companies would not be able to fulfill their promise in May, 2021. But, in June 2021, our analysis suggests a positive situation for the players.

The Implications and the Need for Regulation

The emerging insights have many implications for the sector, especially promise ROI of companies. It has emerged that players need to factor the two basic prices into their ROI percent formulation framework. This is more imperative for the players that provide solutions that resonate with crop production, livestock and fishing. It is obvious that the current economic uncertainties being driven by the recession and the pandemic are having significant impacts in the sector. Therefore, the current ROI should be adjusted to fix the reality of the business environment. Before the sector is turned to the Ponzi Scheme sector, the government needs to devise means of regulating activities of the players and investors. The Securities and Exchange Commission, and the Corporate Affairs Commission are needed for sustainable investor protection.