When I started my banking career many years ago in Nigeria, I opened a savings account with Union Bank. I left a standing instruction to run on perpetuity on an instrument therein. But with the new playbook that Nigeria is looking for dormant bank account balances and unclaimed dividends to fund our mindless bureaucracy, I have just informed Union Bank that “I dey here kampe”. Indeed, in Nigeria’s playbook, if you have a bank account and you have not done anything on it for 6 years, you have possibly forgotten it! Why is that a government’s problem?

If they are worried that some deceased people’s wealth is lost to banks, then, they need to make laws, mandating banks to contact the person or the next of kin before getting the government involved. In the US, it is automatic, once the owner is deceased, the bank moves the value to the next of kin. And if that next of kin does not exist, it goes to the next of kin’s track.

“Any unclaimed dividend of a public limited liability company quoted on the Nigerian Stock Exchange and any unutilised amounts in a dormant bank account maintained in or by a deposit money bank which has remained unclaimed or unutilised for a period of not less than six years from the date of declaring the dividend or domiciling the funds in a bank account shall be transferred immediately to the trust fund,” the act read.

The act exempts official bank accounts owned by the federal government, state government or local governments or any of their ministries, departments or agencies.

Also, those useless stocks we all bought ten years ago, during the boom, have been earning dividends. Now is the time to write to the companies that “you dey” in case you are like me who have not cared about those 10k per share dividends; one insurance company declared 2k per share!

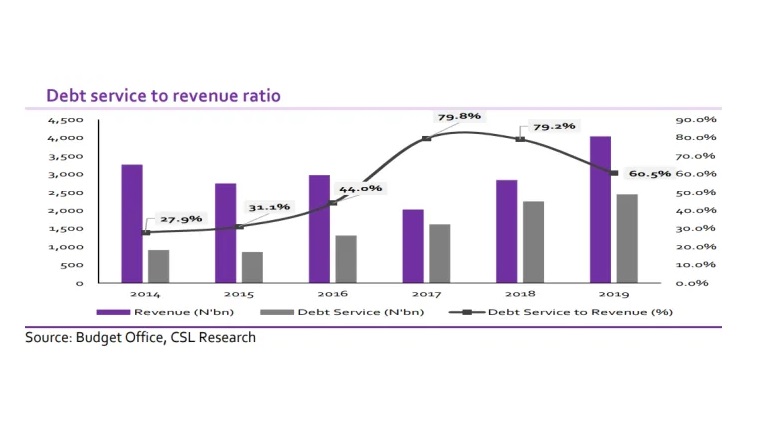

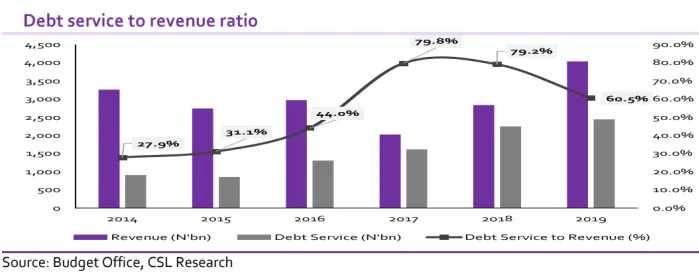

If you waste time and Aso Rock gets hold of the funds, they are gone forever. Nigeria uses 60% of its revenue to service debts. There is no business in the world that can survive with that model. I mean, I am not an accountant, but I passed ICAN’s Intermediate exam before I left banking. If your cost of capital is that high, you have no future.

Do not allow Nigeria to get hold of your money; talk to your bank or stock broker NOW.

Follow these steps to claim your Dividend

Unclaimed dividends increased from N109.1 billion in December 2016 to N130 billion in December 219

Search if you or your loved ones have unclaimed dividends using Security and Exchange Commission Portal and claim your dividends with these steps.

Step 1: Input your first name and last name into this link http://sec.gov.ng/non-mandated/ to get a list of your shares from SEC. This will give you a screenshot of all the companies you have shares in, and the registrars in charge.

Note: if you have changed your name due to marriage or other reasons, search with your previous name and also try different format of name e.g those with prefixes e.g ‘Olu’, ‘Oluwa’ etc

Step 2: Take note of your registrar’s name. A registrar, is the company that keeps the shareholder’s details for other companies. So, your shares could have data with different registrars.

Step 3: Download and fill your registrar’s form which is beside the company’s name on the website.

Step 4: Submit your form. Some companies require you to go to your bank and get a bankers confirmation, so they can initiate the e-dividend form for you.

Once this is done, your account will be credited automatically with the e-dividend going forward.