This would be fearful. Yes, the idea that one would need a passport, before air travel, that is linked, and which authenticates that the owner has taken a Covid-19 vaccine should be a concern. But you may ask: if some countries already require yellow fever vaccination documentation, for entry, why not Covid-19 vaccination documentation?

Vaccination records aren’t new, but there will be new ways to use them: There’s nothing revolutionary about needing to prove you’ve had a vaccine. Some countries require evidence of a yellow fever shot before you can clear customs, and many schools will not let you enroll your children in school unless they’re up to date on mandatory immunizations. Official tracking of who gets what vaccine is old news too. National and local governments around the world run registries where doctors send their vaccination records.

This is going to become the new reality and I just think that it will happen, not in some big nations, but in those mid-tier nations which like to throw everything on people. The problem, though, is that instead of asking Americans and British to show they have been vaccinated, poor countries in Africa which currently are not under the most severe direct health-burden of coronavirus would be the target. So, there would be waivers for British and Americans, but Gambians, Nigerians and the typical must show vaccine-ready passports.

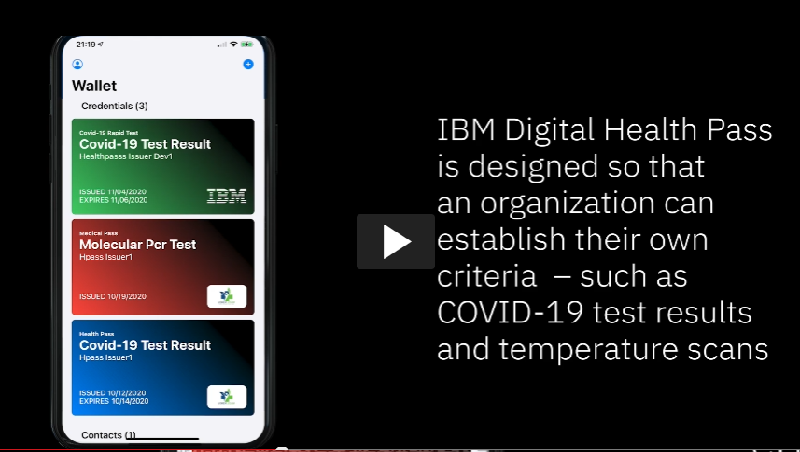

While coronavirus vaccines are distributed around the world, a Geneva-based nonprofit is teaming up with airlines and The World Economic Forum to create a “vaccine passport” app to ease air travel during the pandemic. They say the digital credentials can also be used at stadiums, movie theaters and offices. According to developers, users will receive a private QR code once test results or proof of vaccination are uploaded. IBM has developed a similar app, Digital Health Pass, that lets companies and venues customize what they require for entry to a physical location.

IBM has a product – Digital Health Pass – ready for customization for countries: the product is “ designed to provide organizations with a smart way to bring people back to a physical location, such as a workplace, school, stadium or airline flight. Built on IBM Blockchain technology, the solution is designed to enable organizations to verify health credentials for employees, customers and visitors entering their site based on criteria specified by the organization. Privacy is central to the solution, and the digital wallet can allow individuals to maintain control of their personal health information and share it in a way that is secured, verifiable, and trusted. Individuals can share their health pass to return to the activities and things they love, without requiring exposure of the underlying personal data used to generate the credential.”

ANNOUNCING: IBM Digital Health Pass will integrate with @salesforce Work. com to help businesses, schools and governments verify vaccine and health status in the wake of the COVID-19 pandemic.

Learn more: https://t.co/tNW8zM767y. pic.twitter.com/yCMBHiZczu

— Merative (@Merative) December 18, 2020