In any country, agriculture is the father of all industries. From developed to developing countries, other industries and sectors including markets within the duo cannot survive without receiving inputs in forms of finished or semi-finished products from the agriculture industry. In spite of the significant place of agriculture in human and organisational survival, in developing countries such as Nigeria the industry is suffering due to a number of factors.

Poor spending on agriculture and citizens’ interest in the industry remain low despite the availability of arable lands for production and possible jobs. Between 2001 and 2005, less than 2% of total federal expenditure was allotted to agriculture. From 2006 to 2020, the spending on the industry by the federal and state governments is not quite different. The poor spending has raised many issues among the public analysts and investors who believe that agriculture requires more attention if truly the governments want to achieve economy diversification agenda, from oil dominated to multi-economy.

Since agriculture provides what people eat and industries use, Nigeria has continued to have a low human development index occasioned by the poor attention to the industry. Over the years, our checks reveal that the Nigerian government at state and federal levels have had varied policies towards the industry development. The outcomes remain mixed. It is not clear whether the country is making significant progress or not.

This, according to our analyst, is largely due to the failure of the governments to address insecurity, irregular inflation rate growth, drought, earthquake, floods and systemic corruption among the agencies saddled with the responsibility of delivering policy goals and objectives. In the North-Eastern Nigeria, the Boko Haram insurgency has led to heightened levels of displacement, leading to non-availability of food and restricting individuals’ ability to access it.

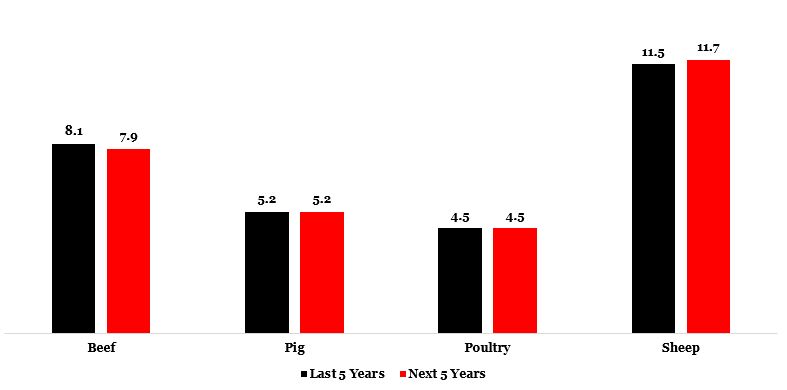

In the last five years (2016-2020), analysis shows that the level of consuming meat product of beef, pig, poultry and sheep had positive and negative connections. The more Nigerians [including industrial use] consumed beef meat the more they devoured pig meat. According to our analysis, one unit of beef meat consumption increased consumption of pig meat by 45%, while it reduced consumption of poultry and sheep by 88.3% and 90.4% respectively. In our analysis, we only found positive linkage between poultry and sheep consumption in the last 5 years. One unit of consuming poultry meat in metric tons led to more than 99% of consuming sheep meat. On average, over 1.6 million metric tons of beef, more than 1 million of metric tons of pig meat, over 912,000 metric tons of poultry meat and over 2.3 million metric tons of sheep meat were consumed during the period.

In the next 5 years, our analysis suggests that the consumption of one unit of beef meat would lead to 15.6% increase in consuming pig meat, while it would be a 45.1% increase in devouring poultry meat. However, the level of consuming sheep is expected to be reduced by 96.2%, while the consumption of sheep meat would be increased by the same percent. By 2025, our analysis indicates that pig and poultry meat consumption would connect negatively, signifying that the more people and industries consume pig meat, the less they would consume poultry meat [-70.7%].

The negativity would be less for sheep meat consumption. We found a 38.4% reduction in consuming sheep meat, while it was positive for pig meat consumption. Sheep meat consumption would also have the same outcome. One unit of consuming poultry meat would reduce consumption of sheep meat by 20.3%. On average, over 1.5 million metric tons of beef meat more than 1 million metric tons of pig meat, over 912,000 metric tons of poultry meat and over 2.3 million metric tons of sheep meat would be consumed by 2025.

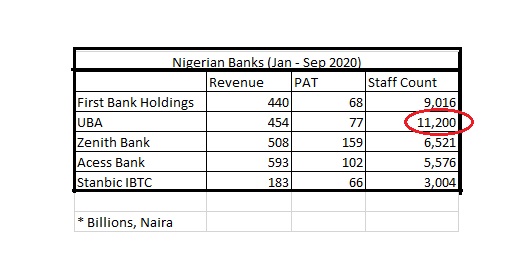

Exhibit 1: Meat Consumption in Million Metric Tons

What Do We Need?

Looking at our current analysis, insights and those in the public domain, it is clear that federal and state governments should do more to enhance agriculture industry, especially building sustainable security architecture for farmers and distributors. When farmers and distributors are at peace, final consumers would not be starved. When farmers and distributors are protected, inflation driven food prices and unemployment rates would be reduced. These have been discovered by academic and industrial researchers many years ago.