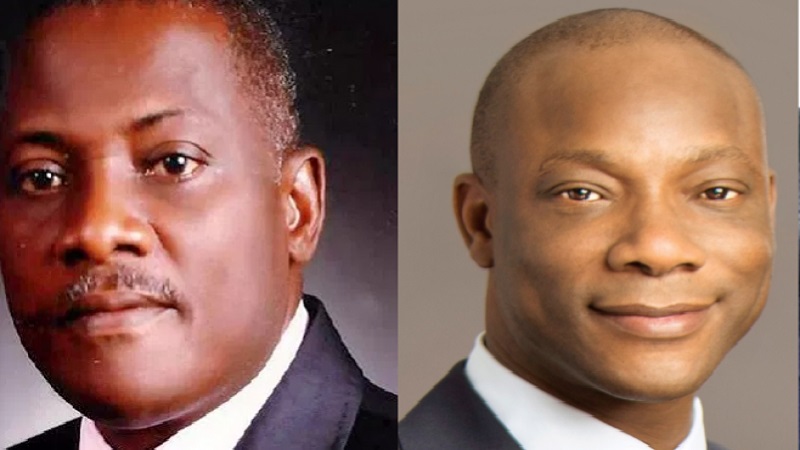

This will not just go away. As the CEO of GTBank, Segun Agbaje, completes his 10 years as the boss of a bank, reaching the regulatory limit, he has a plan of staying in charge. That plan would go via a holding company (holdco) which ensures he continues to run GTBank via proxy. For that to happen, GTBank Plc has to be de-registered to become a limited liability company while a new company, possibly “Guaranty Trust Holdings Plc” will evolve to become the new public liability company.

Then the boss man will become the CEO of the new public company with a new CEO of GTBank Limited reporting to him. It is a playbook in Nigeria which has been used after the CBN imposed the 10 year maximum limit for bank CEOs. Segun has done a good job and investors welcome this redesign.

But there is a problem: Innoson Motors has gone to court asking the court that GTBank cannot have this transmutation until it pays its alleged N32 billion judgement debt. It looks ugly from there, and using the snail pace of Nigeria’s legal system, Segun could be out of job before this new court case is sorted out.

Read the full document below..

Court To Restrain GTB From Deregistering Itself As A Limited Liability Company.

Press Release

29/11/2020

For Immediate Release.

..As Innoson seeks an order restraining GTB from transmuting to a Private and a Financial Holding Company until GTB pays it over N32Billion Judgement debt

The Supreme Court of Nigeria has struck out GTB’s motion filed to set aside its earlier decision/order made on 27th February 2019 dismissing GTB’s appeal against Court of Appeal judgement of 6th February 2014 in favor of Innoson Nigeria Ltd

Recall that The Federal High Court, Awka Division on March 27th, 2019, pursuant to Supreme Court dismissing GTB’s appeal, granted leave to Innoson Nigeria Ltd to enforce and execute the judgment and Garnishee Order Absolute made by the court coram Shakarho, J at the Ibadan Judicial Division on the 18th of May 2010 and the 29th of July 2011 respectively. This order was concurrently affirmed by the Court of Appeal in the judgment of 6th February 2014 and by the Supreme Court in its judgment of 27th February 2019.

As Innoson Nigeria Ltd commenced the tedious act of the execution, GTB rushed to the court vide its desperate motion on notice seeking orders staying or suspending the execution embarked by Innoson Nigeria Ltd and also seeking orders setting aside the exparte Orders made by the Court granting Innoson leave to enforce the judgment and to issue the processes of executing same.

Whilst resfusing GTB’s application and staying further proceedings the court further held that the order it made on March 27th, 2019 in favor of Innoson Nigeria Ltd granting it leave to enforce the judgment and issue processes of execution of the judgment are valid; also that all the steps taken to levy executions in pursuance of that order are still valid and are not vacated; whilst all the prayers by GTB in its motion of 1st April 2019 are not granted.

GTB however rushed back to the Supreme Court and applied for an order setting aside the Supreme Court’s judgement dismissing its appeal against the above judgement. However, the Supreme Court struck out the motion on Tuesday, November 3rd, 2020.

While Innoson Nig Ltd awaits GTB to come up with a payment plan for it’s over N32Billion Judgement debt, GTB resorted to a scheme of de-registering itself as a public limited liability company and re-registering itself as a private limited liability company and a financial holding company as well. Innoson Nig Ltd, as its creditor, has as a result sued GTB at the Federal High Court and therein seeks the following order of perpetual injunctions:

(a) restraining the 4th Defendant (Corporate Affairs Commission) from deregistering the 1st Defendant (GTB) as a public limited liability company and or re-registering the 1st Defendant (GTB) as a private limited liability until it-GTB- pays the outstanding judgment debt of N32, 875, 204, 984.38k arising from Suit Nos: FHC/L/CS/603/2006 and No. FHC/AWK/CS/139/2012 respectively affirmed by the appellate courts in appeal Nos. CA/1/258/2011, SC.694/2014 and CA /E/288/2013 to Innoson Nig Ltd;

b. an order of perpetual injunction restraining the 4th Defendant (Corporate Affairs Commission) from registering or re-registering the 1st Defendant (GTB) as a holding or financial holding company whether as a public or private limited liability company until it- the 1st Defendant(GTB) -pays Innoson Nigeria Ltd the outstanding total judgment debt of N32, 875, 204, 984.38k (Thirty two Billion, Eight Hundred and seventy Five Million, Two Hundred and four thousand, Nine Hundred and Eight Four Naira, Thirty Eight kobo) arising from suit Nos. FHC/L/CS/603/2006 and FHC/AWk/CS/139/2012 respectively affirmed by the appellate courts in Appeal Nos. CA/1/258/2011, SC.694/2014 and CA/E/288/2013:

c. An order cancelling the 1st Defendant’s (GTB’s) special resolution and or any other of its resolution that it should be deregistered as a public limited liability company and or be re-registered as a private limited liability company and or a holding company until it -the 1st Defendant (GTB)- pays Innoson Nig Ltd the total outstanding judgment debt of N32, 875, 204, 984.38k (Thirty two Billion, Eight Hundred and seventy Five Million, Two Hundred and four thousand, Nine Hundred and Eight Four Naira, Thirty Eight kobo) arising from suit Nos. FHC/L/CS/603/2006 and FHC/AWk/CS/139/2012 respectively affirmed by the appellate courts in Appeal Nos. CA/1/258/2011, SC.694/2014 and CA/E/288/2013:

d. an order setting aside the 3rd Defendant’s (Security and Exchange Commission) No -objection to 1st Defendant’s proposal to be re-registered as a private limited liability company and as a holding or a holding financial company:

e. an order setting aside the 2nd Defendant’s (Central Bank of Nigeria) approval -in- principal granted to the 1st Defendant (GTB) to operate as a holding or a holding financial company.

f. an order of perpetual injunction restraining the 2nd Defendant (Central Bank of Nigeria) from granting the 1st Defendant (GTB) a financial holding company license and or a final approval to operate or carry on business as a financial holding company whether in its present name or as a private limited liability company until it, the 1st Defendant(GTB )pays the Plaintiff(Innoson Nig Ltd) the total outstanding judgement debt of N32, 875, 204, 984. 38k (Thirty Two Billion, Eight Hundred and Seventy-Five Million, Two Hundred and Four Thousand, Nine Hundred and Eighty-Four Naira, Thirty-Eight Kobo) arising from suit Nos. FHC/L/CS/603/2006 and FHC/AWK/CS/139/2012 respectively affirmed by the appellate courts in Appeal Nos. CA/1/258/2011, SC.694/2014, and CA/E/288/2013.

Cornel Osigwe

Head of Corporate Communications and Affairs

IVM Innoson Group

Like this:

Like Loading...