Elon Musk’s fortune flight took to a new height this week by the surge in Tesla’s shares. The Tesla and SpaceX CEO briefly overtook Bill Gates to occupy the second position in the world’s richest index.

Tesla’s share price recorded an unprecedented surge this week and added $7.2 billion to Musk’s fortune, bringing his net worth to $127.9 billion. Musk has added $100.3 billion to his net worth this year, moving him from no. 35 where he was in the billionaires’ table in January, tied 2nd position with Gates, after Bloomberg index put the men on $128 billion each.

Musk 49, has seen his fortune skyrocket alongside Tesla’s that is now valued at almost $500 billion. Tesla’s stock has shot up almost 524%, increasing the entrepreneur’s wealth unprecedentedly. Tesla’s stock jumped 6.6% on Monday, closing at an all-time high of $521.9 per share.

Musk owns 20% of Tesla stock and has prudently reaped more than many other investors through his model of payment.

In 2018, Musk got Tesla’s shareholders to approve a pay package that does not involve salaries or cash bonuses. The deal means that Musk will be paid through 20.3 million stock options over the course of 10 years, in 12 equal blocks of 1.7 million options. His stock payment happens whenever Tesla achieves its operational and market value goals.

Last week, Musk toppled Facebook founder and CEO, Mark Zuckerberg to become the third richest person in the world. But that was just the beginning of a fortune-filled week for both Musk and Tesla that was inducted into the prestigious S&P 500.

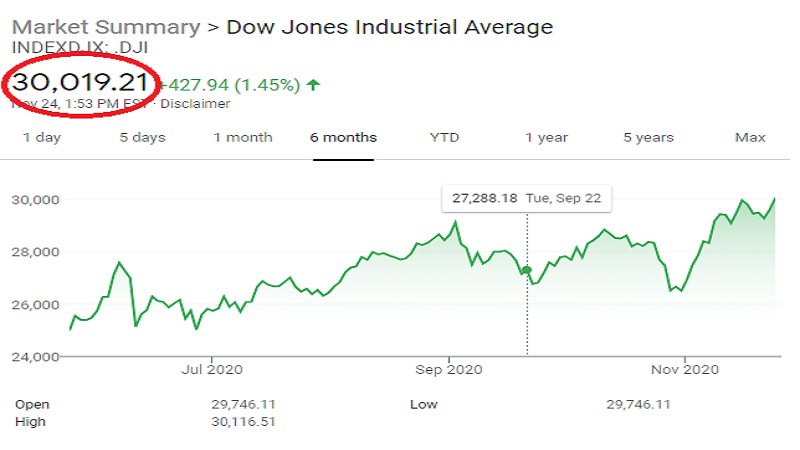

To be included in S&P 500, a company must post positive fully audited profits for four consecutive recent quarters. Tesla could only achieve that feat this year, making it eligible to join the S&P elites. The electric vehicle maker’s shares rose 8.2% last week Tuesday, following the news of its inclusion in the index.

The year of the pandemic has been kind to Bezos, Gates, Zuckerberg and Musk, who have seen their net worth increased in defiance to the global health crisis that has battered economies globally, and disproportionately created misfortune.

In August, Bezos became the first person ever to worth $200 billion, despite going through the most expensive divorce in history that took $30 billion from his net worth.

Each of the centibillionaires has kept his place in the top 5 of Bloomberg Billionaires index, a ranking of the world’s 500 richest people.

Gates would have moved further up in the second position but for his donations to charity foundations, including the Bill and Melinda Gates foundation that has gulped more than $27 billion from net worth.

Bloomberg index said its members have collectively gained 23% — or $1.3 billion since the beginning of the year, despite the strains of the pandemic. The index said those in the electric vehicle industry have been particular beneficiaries.

The combined fortune of Zeng Yuqun and Huang Shilin, Chairman and Vice Chairman of China’s biggest electric-vehicle battery maker, Contemporary Amperex Technology Co., has soared by $18.8 billion year-to-date, the index said.

Tesla will join the S&P 500 next month, and with the rising interest in electric vehicles, the automaker’s value is expected to jump again before the end of the year.

Outside Tesla, SpaceX, another of Musk’s companies is increasing its mission to space. The company has raised $1.9 billion in new funding due to emerging interest in SpaceX rockets, which has surged since the successful trip of the Dragon Crew to space, and the company now has oversubscription of nearly $2 billion.

The global space economy is expected to be worth at least $1.1 trillion in 2040, according to Forbes. SpaceX’s Starship will have the capacity to accommodate 100 passengers per trip at the cost of about $50 million per seat.

The imaginable progress in these top notch companies means Musk will only have Bezos to beat in the billionaire index.