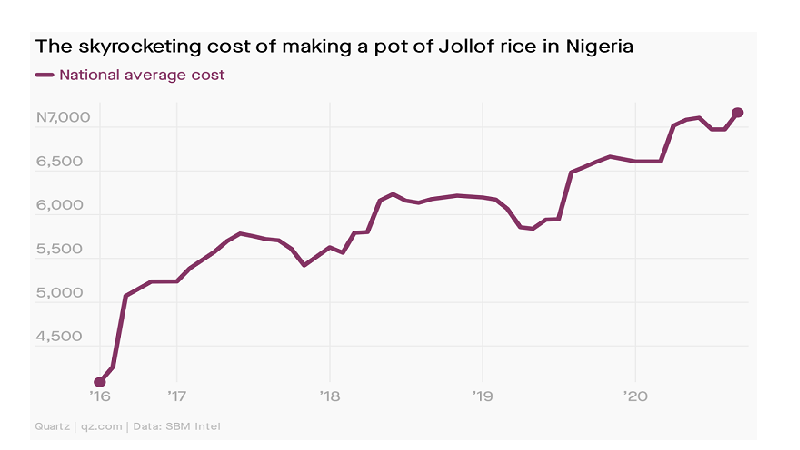

The Jollof Rice Index shows that food prices have risen in Nigeria. With the main ingredient, rice, becoming a luxury product, I do think this is the time to consider if we can do something at the supply side. Basic economics tells us that price will rise if supply is frozen even as demand rises. Covid-19 was an xfactor for most subsistence Nigerian farmers, and because growing rice is not like a factory process where you can add shifts to meet new demand, the recalibration cannot be instantaneous.

Yes, for rice, you have to wait for months for the farming gestation cycle to happen. If that is the case, can Nigeria open a 2-month window to equilibrate price by increasing supply, via imports, temporarily, and once the farmers have normalized production, close the imports?

There is no reason for us to allow the suffering even though we want to do import substitution. I do think our policy must be nuanced with flexibility to accommodate moving variables. Our main challenge today is that supply is out of phase with demand, due to many perturbations from the coronavirus pandemic, and I do think that Nigeria needs to account for that in our policy playbooks.

This is the reason I am calling the government and the central bank to open the ports, and support importers with forex (strictly for food) to import food since, technically, we did not plant enough to generate the necessary supply to handle the huge demand in the nation. Without that import, prices of food items will continue to rise since demand has well outstripped by supply.

Without addressing the supply via short-window food imports, prices will continue to go high as farmers cannot magically produce and grow the crops overnight. A 60-day import window, starting immediately, will go a long way to normalize food prices before the peak of the Christmas season.

I vote for the Central Bank of Nigeria to make it easier for rice to be brought into the nation now, and later, as we move towards harvest season, freeze the policy. This will ensure families do not suffer more on this staple food in Naija. Yes, the impact could be more than a tax waiver for minimum wage earners.

Nigeria Needs To Reconsider Its Food Import Restrictions on Forex

Like this:

Like Loading...