Vanilla gift cards are great for online shopping, subscriptions, and digital purchases, but sometimes cash is more useful. Many Nigerians find themselves stuck with unused cards, wondering where to exchange them safely without losing value.

The truth is, not every platform that claims to trade gift cards is trustworthy. Some offer poor rates, while others delay payments or fail to protect users.

That’s why choosing the right app matters if you want a smooth and secure experience. The good news is that there are reliable platforms where you can sell your Vanilla gift cards at fair rates and get your money fast.

In this article, we’ve put together the five best apps in Nigeria, trusted by thousands of users, so you know exactly where to trade your cards with confidence.

5 Best Platforms to Exchange Vanilla Gift Cards for Cash in Nigeria

Trading Vanilla Gift Cards for cash in Nigeria comes down to trust, good rates, and convenience. Below is a quick comparison of the five best platforms, such as Cardtonic, 1minutepay, SekiApp, FlipEx, and CardCash, based on their payout speed, exchange rates, ease of use, and Google Play Store reviews.

| S/N |

Platform |

Payout speed |

Rates |

Ease of use |

Google Play Store Review |

| 1 |

Cardtonic |

Very Fast |

Consistent |

Clean interface, smooth process |

4.3 ? (18.9K reviews) |

| 2 |

1minutepay |

Fast |

Fair |

Simple but limited features |

Not available |

| 3 |

SekiApp |

Moderate |

Varies by card |

User-friendly mobile app |

4.3 ? (302 reviews) |

| 4 |

FlipEx |

Fast |

Competitive |

Smooth interface |

4.3 ? (414 reviews) |

| 5 |

Cardcash |

Fast |

Decent |

Easy to navigate |

Not available |

1. Cardtonic:

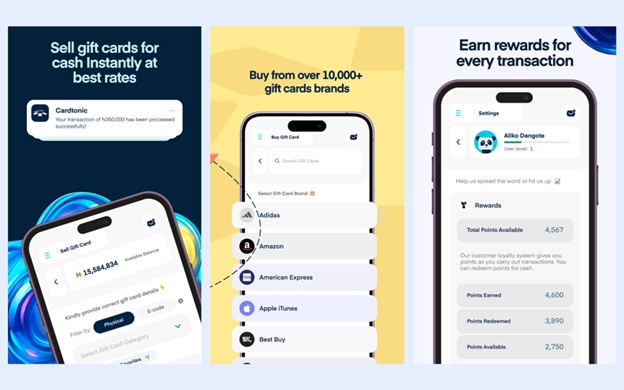

Cardtonic is one of the most trusted platforms in Nigeria for trading Vanilla gift cards. Its rates are fair and consistent, so you always know exactly what you’re getting without surprises.

Another big advantage is speed. Transactions are processed within minutes, so you don’t have to wait long to receive your cash. On top of that, every trade earns you reward points that can be redeemed later, giving you extra value beyond your payout.

Cardtonic also runs a referral program that pays for life. When someone signs up with your code and starts trading, you earn 10% of their transaction reward points on every single trade they do. As long as they keep trading, your reward points keep stacking, which you can later redeem as cash in your wallet.

Security is another reason Cardtonic stands out. The platform prioritises safe transactions, ensuring your gift cards and money are protected at all times.

Getting started is simple. Download the Cardtonic app from the App Store or Google Play, sign up and verify your account, then select “Vanilla Gift Card” under trade options. Enter the card details, upload, and confirm. The process is beginner-friendly and only takes a few minutes.

2. 1minutepay:

1minutepay is another reliable option for trading Vanilla gift cards in Nigeria. The platform is known for quick payouts, with most transactions processed in a short time.

Its rates are fair, though not always as competitive as some alternatives. The app itself is simple and easy to use but comes with limited features, which may not appeal to users who want more flexibility.

However, for those who value speed and straightforward trading without too many extras, 1minutepay remains a good choice. Its reputation for delivering on promises has made it a trusted option for many users.

3. SekiApp:

SekiApp offers a user-friendly mobile app that makes trading Vanilla gift cards easy, even for beginners. Its design is simple to navigate, which helps new users get comfortable quickly.

Payout speeds are moderate, so transactions may take a little longer compared to faster platforms. Rates also vary depending on the card type, which means you might not always get the same level of consistency.

Still, SekiApp strikes a balance between usability and reliability. For casual traders who want a smooth and straightforward experience, it’s a solid choice.

4. FlipEx:

FlipEx is a strong option for trading Vanilla gift cards in Nigeria, thanks to its competitive rates and quick payouts. Most trades are processed fast, giving users access to their cash without long delays.

One standout feature is flexibility. FlipEx offers both a mobile app and a website, so you can trade whichever way feels more convenient. The interface is smooth, and customer support is available if you need assistance during a transaction.

Although it’s not as widely known as some bigger platforms, FlipEx has built a solid reputation for reliability. For users looking for fair rates and speed, it’s a dependable alternative.

5. CardCash:

CardCash is another dependable platform for trading Vanilla gift cards in Nigeria. It is known for fast payouts, so users do not have to wait long to receive their money after a trade.

The rates are decent, although not always the highest compared to other apps. What makes CardCash appealing is its ease of use. The interface is simple to navigate, making it beginner-friendly for first-time traders.

With a smooth process and a strong reputation for reliability, CardCash is a solid option for anyone who wants quick and stress-free transactions.

Frequently Asked Questions About Trading Vanilla Gift Cards in Nigeria

- What is the Best App to Trade Vanilla Gift Cards for Cash in Nigeria?

The best app to trade Vanilla gift cards for cash in Nigeria is Cardtonic. The platform is fast, reliable, and secure, making it the top choice for anyone looking to trade gift cards in Nigeria.

- How Much is a $100 Vanilla Gift Card Worth in Nigeria?

The value of a $100 Vanilla gift card in Nigeria depends on the card type and the country of origin. On average, it ranges between ?8,000 and ?24,500. Physical cards usually sell higher than e-codes. For the most accurate value, check the Cardtonic rate calculator, which updates prices in real time.

- Is it Safe to Sell Vanilla Gift Cards Online in Nigeria?

Yes, it is safe to sell Vanilla gift cards online in Nigeria as long as you use a trusted and reliable platform. Always ensure you choose a service with good reviews, secure transactions, and prompt payments to protect yourself and enjoy a smooth experience.

- How Long Does it Take to Receive Cash After Trading a Vanilla Gift Card?

Payout time depends on the platform you use. Cardtonic is one of the fastest, with transactions completed in minutes. 1minutepay also pays quickly, while SekiApp and FlipEx may take slightly longer.

- Can I Trade Both Physical and E-code Vanilla Gift Cards in Nigeria?

Yes, you can trade both physical and e-code Vanilla gift cards in Nigeria. Both types are accepted, and the value you get will depend on the card category and the overall exchange rate at the time of trade.

Conclusion

Trading Vanilla gift cards in Nigeria is simple once you know the right platforms to use. Apps like Cardtonic, 1minutepay, SekiApp, FlipEx, and CardCash give you fast payouts, fair rates, and safe transactions, making the process stress-free.

Each platform has its strengths, but if you want consistent value, top security, and extra benefits like reward points and lifetime referral earnings, Cardtonic is the best place to start.

Like this:

Like Loading...