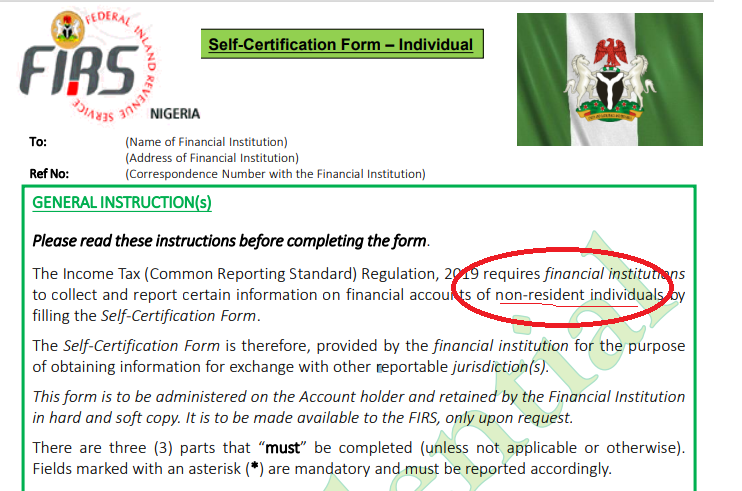

On Thursday, Nigerian government, through its social media pages, ordered Nigerians to obtain and fill Self-Certification forms in their respective financial institutions.

The order said the forms are required by relevant financial institutions to carry out income tax regulations.

“This is to notify the general public that all account holders in Financial Institutions (Banks, Insurance Companies, etc) are required to obtain, complete and submit Self-Certification Forms to their respective Financial Institutions.

“Persons holding accounts in different financial institutions are required to complete & submit the form to each one of the institutions. The forms are required by the relevant financial institutions to carry out due diligence procedures in line with the Income Tax Regulations 2019.

“The self-certification form is 3 categories: -Form for Entity, for Controlling Person (Individuals having controlling interest in a legal person, trustee, etc) –Form for Individual.

“Failure to comply with the requirement to administer or execute this form attracts sanctions which may include monetary penalty or inability to operate the account. For more enquiries visit website (firs.gov.ng) for more details,” the order said.

As it has been the case with several other decisions announced by the government recently, backlash followed the order. Nigerians were obviously angered for two reasons: 1. the government seems determined to tax Nigerians to death in the midst of a pandemic that has brought businesses to their knees. 2. Nigerians have had enough of registrations and data collections; from international passport to driver’s license to national ID to BVN.

“BVN. Driver’s license. National ID card. INEC registration. International passport. Biometrics were taken in all these places. So, what is the meaning of this?” Olusegun Adeniyi asked.

In 2014, the Central Bank of Nigeria (CBN) introduced Bank Verification Number; it was a Know Your Customer policy aimed at unifying different accounts of individual bank customers and curtailing fraud. The framework was executed through biometric identification, and bank accounts that did not enroll before the deadline were closed.

Subsequently, the BVN became a requirement for bank account opening and is expected to suffice in every banking and financial matter relating to data. So, the government’s demand from Nigerians to fill a form for further data collection means the previous exercise doesn’t count. And in the age of technology, Nigerians believe the government should have solved the data collection problem digitally.

“Forward-thinking nations are building digital solutions to solve various problems. But in 2020, our own government still wants us to go queue under the sun to fill and submit “self a certification” forms despite National ID, Voters Card etc suffer no dey taya you?” Wale Adetona wrote on Twitter.

While there have been so many attempts by the government to develop a national database, events now and then show how futile they have been. Part of the criteria for applying for an international passport is national ID number, which means the government has been harmonizing people’s personal information from various agencies. Therefore, with the number of Nigerians who have gone through the tedious process of each registration, it is disappointing that the government is yet to implement a unified data system that will save them from repeating the registration at every given time.

On the other hand, the Nigerian government appears to have no way out of the economic strains emanating from the crude oil plunge and COVID-19 pandemic, as it has totally depended on taxes and borrowing for its recurrent expenditures.

Thus, the order to submit Self-Certification Forms at various financial institutions appears to be targeted at the implementation of the newly introduced Stamp Duty tax. Nevertheless, Nigerians are concerned that new taxes may be on their way, and it may involve financial transactions, and the government is working to make sure that every account holder pays.

Like this:

Like Loading...