What if the next financial juggernaut doesn’t emerge from Silicon Valley or Wall Street but from the internet’s wildest memes? The last cycle proved that cultural tokens can topple traditional investments. Dogecoin, born from a Shiba Inu joke, soared past the market caps of major corporations. Shiba Inu turned pocket change into fortune. Even Pepe transformed memes into multi-billion–dollar liquidity pools overnight.

This new cycle promises something even bigger, louder, and sharper. A lineup of fresh meme titans is emerging: BullZilla ($BZIL), Official Trump (TRUMP), Fartcoin (FARTCOIN), Apecoin (APE), and Popcat (POPCAT). Each carries a unique story, politics, absurd humor, NFT empires, and viral culture. Yet one towers above all.

That beast is BullZilla ($BZIL). Forged in Ethereum’s fire, it’s engineered with tokenomics that roar louder than any meme coin before it. Starting at $0.00000575, its presale spans 24 stages, with prices rising every $100,000 raised or every 48 hours. The path to 1000x gains isn’t wishful thinking, it’s coded in its DNA. The presale is now live, and those who join early will secure the maximum perks. BullZilla is already redefining what it means to be among the best coins to invest in now.

The $BZIL presale opened with a bang, 3 billion tokens gone and $20,000 raised almost instantly, marking BullZilla’s explosive debut.

1. The Roarblood Vault: BullZilla ($BZIL)

BullZilla is more than a token, it’s a living, breathing saga wrapped in smart contracts. Its Roarblood Vault ensures that community growth is baked into its mechanics. For every purchase above $50, buyers receive a 10% bonus, while referrers also earn 10%. This dual reward structure transforms word-of-mouth into a powerful growth engine. And unlike presale gimmicks, these rewards don’t vanish post-launch, they continue fueling adoption long after the presale closes.

But the Vault is only one part of BullZilla’s engineered dominance. Its presale mutation engine ensures prices rise with time and demand. Those who hesitate face higher costs; those who act early reap exponential rewards. The Roar Burn Mechanism adds another layer, burning tokens at milestone chapters, reducing supply and tightening scarcity. Meanwhile, the HODL Furnace offers up to 70% APY, turning conviction into profit.

Tokenomics—what BullZilla calls its Zilla DNA, are built for balance and scarcity. Half of the supply (80 billion) fuels the presale. Another 20% supports staking. The ecosystem treasury claims 20% to fund growth. A 5% burn pool powers the Roar Burn, while 5% is reserved for the team, locked for two years. This structure ensures that short-term traders, long-term holders, and the community all win together.

Consider the math. A $4,000 investment at stage one secures 695 million tokens. If BullZilla hits its projected launch price of $0.00527141, that stake exceeds $3.66 million. Even at half the projection, it surpasses $1.83 million. These numbers illustrate why BullZilla is the next 1000x meme coin and a leader among the best crypto to buy today.

Why BullZilla made this list: Its Roarblood Vault, mutation engine, and engineered scarcity make it not just a meme, but a presale powerhouse designed for exponential returns.

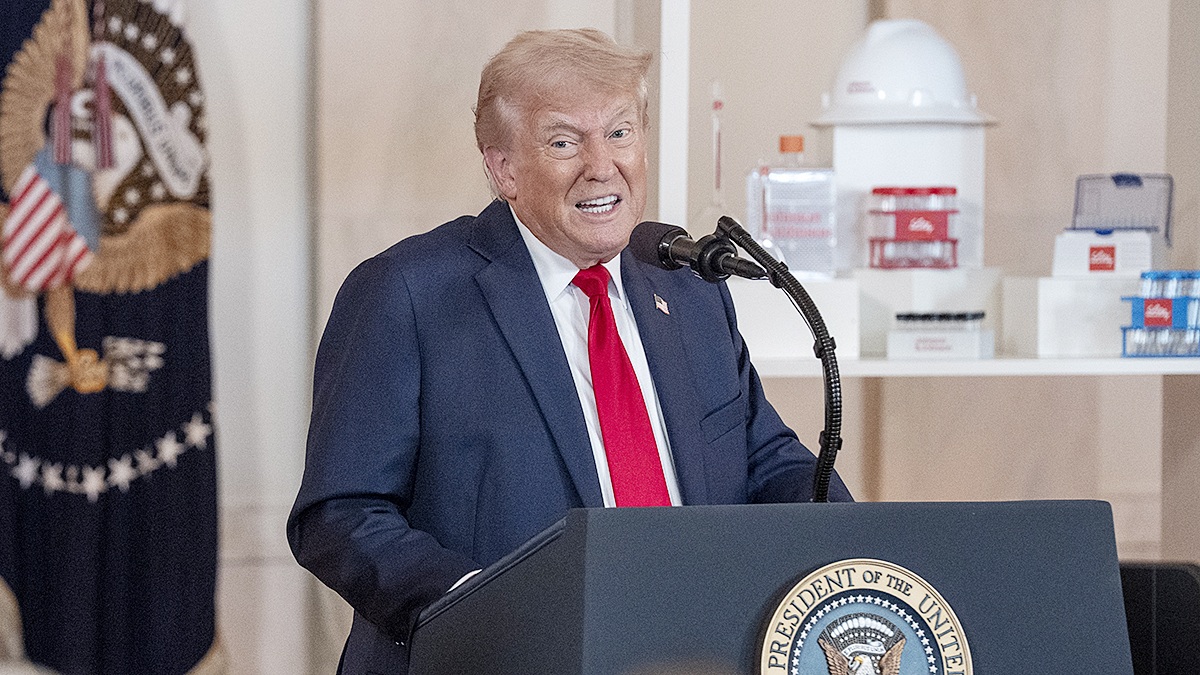

2. Politics on the Blockchain: Official Trump (TRUMP)

Crypto has always thrived on controversy, and no figure generates more of it than Donald Trump. The Official Trump token (TRUMP) merges politics and blockchain, creating a speculative playground tied directly to global headlines. Each campaign rally, press conference, or controversy injects fresh volatility into the token’s price.

The strength of TRUMP tokens lies in attention economics. Memes thrive on visibility, and few names are more visible worldwide than Trump. This ensures constant conversation, constant speculation, and constant trading. Investors know that whenever the political spotlight intensifies, TRUMP tokens often ride the wave.

Beyond speculation, TRUMP tokens symbolize the fusion of real-world influence with digital finance. Political supporters treat it as a badge of loyalty, while traders exploit its volatility. This dual dynamic creates both cultural stickiness and financial opportunity.

Critics may scoff, but meme history shows that cultural resonance is often more powerful than technical utility. Dogecoin wasn’t built on complex mechanics, it was built on recognition and relatability. TRUMP tokens operate the same way, thriving on notoriety and magnetism.

Why TRUMP made this list: Its direct link to political spectacle makes it one of the top crypto picks 2025, offering high-risk, high-reward opportunities tied to global headlines.

3. Absurdity Unleashed: Fartcoin (FARTCOIN)

In crypto, absurdity often beats logic. Fartcoin (FARTCOIN) proves this rule. What sounds laughable on paper transforms into a viral magnet once unleashed. The humor in its name alone guarantees conversation, memes, and curiosity.

But Fartcoin isn’t just about jokes, it’s about the psychology of investing. Humor lowers barriers to entry. Newcomers who might hesitate at technical jargon are far more likely to throw $50 into something as silly as Fartcoin. Once invested, they become part of the community, amplifying its memes, and fueling liquidity.

The project thrives on social shareability. Twitter posts, TikTok clips, Discord memes, Fartcoin spreads everywhere without marketing budgets. This organic virality has already sparked speculation waves, and as 2025 approaches, its potential only grows.

Consider Dogecoin. It started as a joke, yet it became the face of meme investing. Fartcoin channels the same energy. Its absurdity is its strength, turning humor into hype and hype into liquidity.

Why Fartcoin made this list: It shows how humor-driven absurdity can evolve into serious financial gains, securing its spot as one of the best coins to invest in now.

4. From NFTs to Currency: Apecoin (APE)

When NFTs became cultural juggernauts, the Bored Ape Yacht Club (BAYC) stood at the top. From that empire came Apecoin (APE), a governance and utility token designed to fuel the Ape ecosystem. Its launch was monumental, with tokens airdropped to BAYC holders, instantly gaining global attention.

What sets APE apart is its hybrid identity: both a meme and a utility token. On one hand, it thrives on the cultural relevance of BAYC. On the other, it powers real use cases across games, NFT marketplaces, and metaverse projects. This dual function ensures it appeals to both degen speculators and long-term builders.

The community behind APE is massive, including celebrities, athletes, and tech leaders. This network effect keeps APE relevant, even during bear markets. As the NFT market prepares for another cycle, APE is positioned to lead the charge. Its liquidity, recognition, and integration across Web3 platforms give it resilience that many meme coins lack.

Apecoin’s trajectory mirrors the idea that memes plus utility equal exponential growth. While others rely solely on viral momentum, APE is anchored by one of the strongest IP brands in digital history.

Why Apecoin made this list: Its role as the BAYC ecosystem token and hybrid meme/utility structure solidify it as a best crypto investment 2025.

5. Viral Culture Engine: Popcat (POPCAT)

Few memes have captured the internet’s humor as effectively as Popcat (POPCAT). Inspired by a viral cat image with its mouth wide open mid-pop, the meme spread globally. That same energy powered Popcat’s transformation into a token.

POPCAT thrives on simplicity. Its meme is universal, funny, and instantly recognizable. Unlike niche projects, Popcat appeals across cultures and languages, giving it global virality. This universality has translated into active trading communities, meme floods across social platforms, and traction on exchanges.

The power of Popcat lies in its raw cultural engine. Meme coins don’t need complex roadmaps if the meme itself is strong enough. Popcat proves that. While some tokens build ecosystems, Popcat builds laughs, and those laughs turn into liquidity.

Yet it would be wrong to dismiss it as shallow. Memes are identity markers in digital culture, and Popcat taps into that perfectly. Its potential for sudden viral surges is unmatched, making it a speculative powerhouse heading into 2025.

Why Popcat made this list: Its universal virality and cultural staying power make it one of the top crypto picks 2025 for explosive returns.

Conclusion: The Titans of 2025

Based on the latest research, BullZilla, TRUMP, Fartcoin, Apecoin, and Popcat represent the best coins to invest in now as 2025 approaches. Each carries unique strengths—politics, absurdity, NFTs, or cultural virality. Yet one roars louder than the rest: BullZilla.

With its presale live and surging, BullZilla offers early adopters maximum perks. Its Roarblood Vault rewards loyalty and referrals. Its presale mutation engine punishes hesitation and rewards conviction. Its Roar Burn mechanism ensures scarcity deepens with every chapter. BullZilla isn’t just another meme, it’s a cinematic event engineered for exponential growth.

Presales are the ultimate chance to secure wealth before mainstream attention floods in. As nations add Bitcoin to reserves and crypto adoption accelerates, the meme coin titans of 2025 are already rising. This isn’t just a launch. It’s a mutation. And the roar belongs to Bull Zilla.

For More Information:

Follow BZIL on X (Formerly Twitter)

Frequently Asked Questions for BullZilla Presale

What is BullZilla’s presale price?

$0.00000575.

How does the Roarblood Vault work?

10% bonus for buyers above $50 and 10% for referrers.

Why are presales important?

They allow investors to buy before mainstream demand.

What makes TRUMP tokens unique?

They thrive on global political attention and headlines.

Why is Fartcoin popular?

Its absurd humor makes it highly viral and shareable.

What is Apecoin used for?

It fuels governance, gaming, and NFT marketplace integrations.

Why is Popcat a contender?

Its universal meme appeal ensures global virality.

Glossary

- Progressive Presale: Prices rise with time or funding milestones.

- Roar Burn: BullZilla’s live supply-burning mechanism.

- HODL Furnace: Staking rewards of up to 70% APY.

- ERC-20: Ethereum’s token standard.

- Referral System: Incentives for buyers and referrers.

- Roarblood Vault: BullZilla’s referral and loyalty mechanism.

- Staking APY: Yield from staking tokens.

- Supply Scarcity: Reduction of tokens to increase demand.

- Community Vesting: Lock-ups that encourage long-term holding.

- Ethereum Smart Contracts: Programs enforcing token rules.

Disclaimer

This article examines five of the best coins to invest in now for 2025: BullZilla ($BZIL), Official Trump (TRUMP), Fartcoin (FARTCOIN), Apecoin (APE), and Popcat (POPCAT). BullZilla is positioned as the standout, with its Roarblood Vault referral system, mutation engine presale model (prices rise every $100K or 48 hours), and Roar Burn scarcity mechanics. TRUMP thrives on political attention, Fartcoin on humor-driven absurdity, Apecoin on its NFT empire, and Popcat on cultural virality. The conclusion highlights presales as powerful wealth multipliers and frames BullZilla as the most compelling crypto investment heading into 2025.