Since the confirmation of the first case of Covid-19 in Nigeria on February 27, 2020, businesses, people and government officials have been working towards total containment of the disease. From the virtual sphere to the physical sphere, concerned stakeholders have expressed their views and still informing people on the need to follow recommended measures for possible contraction. During the first wave of the disease, our analyst spoke with Ukeme Peters, the Head of Planning, Enterprise and Management Systems of Alpha Mead Group, a total real estate solution company in Lagos.

He was asked to speak on the impact of the disease in the real estate industry and coping strategies being implemented by his company to ensure continued service delivery to the clients and what the future holds for the industry. In the current analysis, we leveraged his responses to understand how Alpha Mead Group’s strategic statements aligned with what he said. We also analysed his responses because we wanted to find out how the views of a strategic leader in a real estate company are beneficial to strategic discourse in the industry.

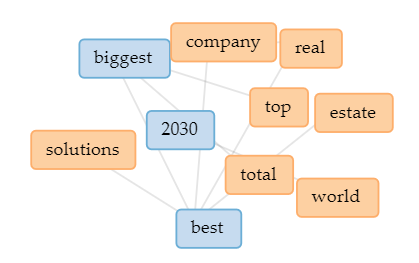

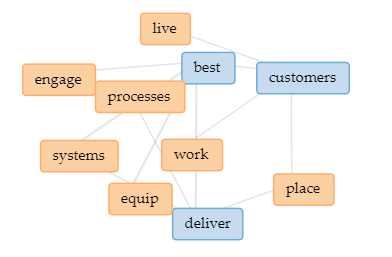

The vision of Alpha Mead Group is “to be among the Top 3 Biggest and the Best Total Real Estate Solutions Company in the World by the Year 2030”, while the mission is “to engage the Best People to equip them with the best Processes and systems to deliver the best Place for our customers to live, work and play.” Looking at the vision, it is clear that the company is positioning itself as leader and best in terms of products and service offering to the stakeholders. Mission statement has clearly shown that the company prioritises human resources, standardisation and value for the actualization of its vision statement. The points in the vision statement have a direct link with the points in the mission statement and stresses that being a leader and offering the best solutions cannot happen without people, processes and being committed to the stakeholders.

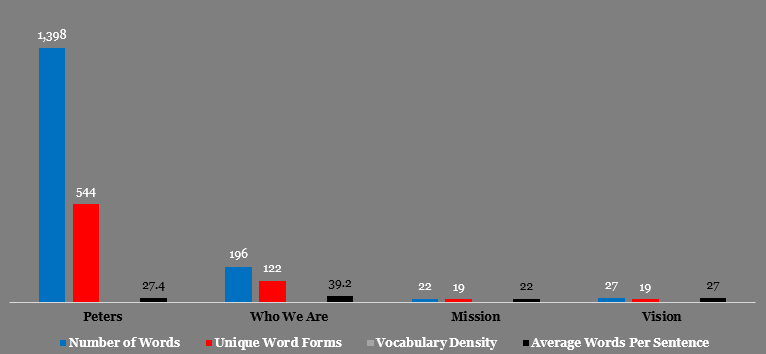

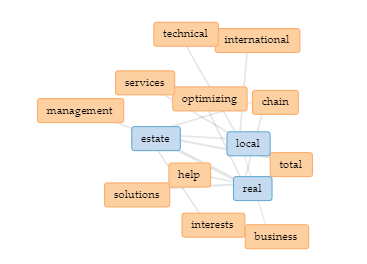

Analysis further establishes that Alpha Mead Group employed 196 words to construct its “Who We Are” to the public, especially potential clients and investors. We also discovered that 22 words are unique in the strategic positioning to the public. With 62.2% of the capacity to use vocabulary, our analysis suggests that it is possible that publics would not understand the message appropriately because the higher the complex word usage the lower the level of comprehending strategic statements. Analysis further shows that real (9 times), local (4 times), total (3 times) and business (2 times) are the most frequently used words in “Who We Are”.

Looking at the context of appropriating these words, our analysis reveals that Alpha Mead Group tends to establish its superiority within the total real estate solution. However, the dominance of ‘local’ suggests reason for doubting the strategic intent of being one of the best total real estate solution companies in the world by 2030. This position becomes clearer when one looks at absence of ‘world’ dominance in the vision and mission statements. Instead, best, biggest, company, estate, customers, deliver, engage and equip dominate the strategic intents space.

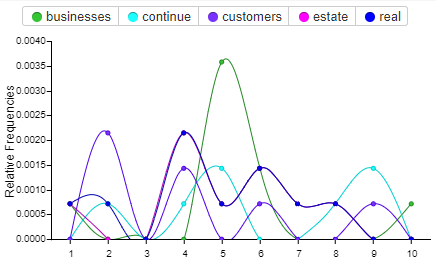

Meanwhile, it appears that what publics cannot get from the company’s strategic statements absolutely has been catered for by the responses of Ukeme Peters. In his responses to the questions asked by our analyst, Ukeme Peters employed 1,398 words. A total of 544 unique words was found. On like the mission and vision statements that have higher percent for vocabulary density, 38.9% achieved by Ukeme Peters indicates that his responses are most likely to be understood easily by the readers.

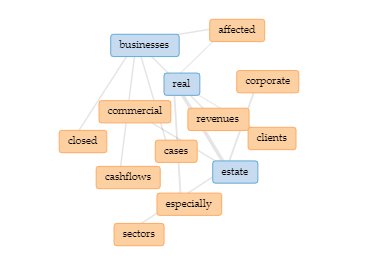

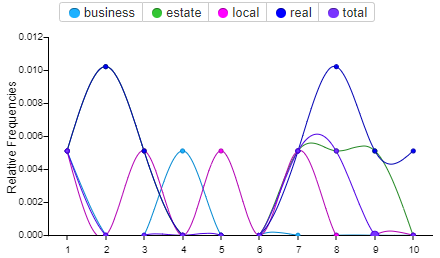

With this, our analyst notes that Ukeme Peters has strategically sold his company to the public by demystifying the issues and needs brought by the disease into the industry life. Analysis shows that Ukeme Peters adopted real (10 times), businesses (9 times), estate (9 times), continue (7 times) and customers (7 times) to frame his company’s competencies in a challenging time and what stakeholders and players can do to overcome storms.

Exhibit 1: Alpha Mead’s Strategic Statements

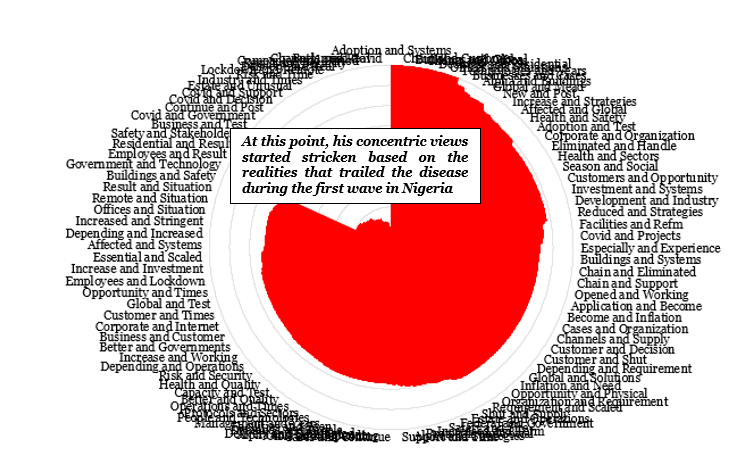

Exhibit 2: Dominant Words in His Response

Exhibit 3: Dominant Words in Who We Are

Exhibit 4: Link among the keywords in His Response

Exhibit 5: Link among the Keywords in Who We Are

Exhibit 6: Link among the Keywords in Vision Statement

Exhibit 7: Link among the Keywords in Mission Statement

Exhibit 8: Trending of Keywords in His Response

Exhibit 9: Trending of Keywords in Who We Are

His Positives and Negatives: Emerging Strategy

Corpus analysis of words employed by Ukeme Peters indicates he is truly a strategist, who understands the art of choosing words to explain complex issues and needs in a challenging time. Connection analysis of words shows that 161 terms were negative while 737 were positive. The connection ranges from 0 to 100 percent. The use of technological processes and equipping employees with knowledge of emerging technologies were found within the perfect positive use of word category [PPUSW].

Within the perfect negative use of word category [PNUS], we discovered corporate and period. These categories were used in different contexts. When PPUSW category was found, we discovered Ukeme Peters want technological processes and technology adoption to be strengthened as the crisis continues. Where we discovered PNUS, Ukeme Peters actually wants business owners, employees at corporate, business and functional levels to understand the challenging time and develop new ways of operating.

Exhibit 10: Link among His Positive and Positive Words about the Crisis