By December 1, 2020, a professor would be in charge of affairs of the University of Ibadan as the new Vice Chancellor. The expiration of the tenure of the current Vice Chancellor, Professor Abel Idowu Olayinka would necessitate this development. Professor Olayinka’s tenure will officially come to an end on the 1st of November, 2020. Since the seat of Vice Chancellor has been announced by the Registrar of the University, a number of professors in Nigeria’s oldest University, have indicated their interest through applications.

Our checks revealed that some of them have engaged with the University community at different fora, informing staff most especially what they have for the school’s advancement. However, this piece is not about x-raying what they wanted to do in terms of welfare and better environment provision for sustainable teaching and learning. Instead, the piece focuses on demographics and psychographics of seven contenders.

Our analyst believes that this is imperative for the public to understand what and how any of the contenders would advance the vision and mission of the University nationally and globally. Our analyst specifically focuses on Professor Oyebode Adebowale of the Department of Chemistry, Faculty of Science; Professor Remi Raji-Oyelade of the Department of English, Faculty of Arts; Professor Adeyinka Abideen Aderinto of the Department of Sociology; Professor Oluyemisi Adefunke Bamgbose, SAN of the Department of Law, Faculty of Law; Professor Emiola Oluwabunmi Olapade-Olaopa of the College of Medicine; Professor Temitope Alonge of the University College Hospital (UCH) and Professor George Olusegun Ademowo of the Department of Pharmacology and Therapeutic, Faculty of Basic Medical Science.

Scholarship and the Seat

According to the vacancy message released by the Registrar, the candidate is required to possess a good university education in addition to being a highly distinguished scholar of the rank of Professor, with a minimum of ten (10) years’ experience. These are sufficient in terms of qualifications and academic prowess. In addition to these, the person must have the ability and capability of commanding the respect of the national and international academic communities through his/her track record. Our analyst examined these and discovered the select contenders possess the requirements at varying degree. They all have significant number of publications and more than 10 years of experience required. However, our checks showed that two of the contenders’ presence on the known academic database [Google Scholar] is low. In spite of using deep search and data mining tools, publications of Professors Remi-Raji Oyelade and Oluyemisi Adefunke Bamgbose were not found when our analyst used 2015 to 2020 as search period. Further research, however, indicates that Professor Remi-Raji Oyelade has some of his publications on personal website, while this cannot be said of Professor Bamgbose.

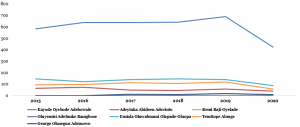

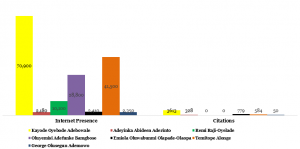

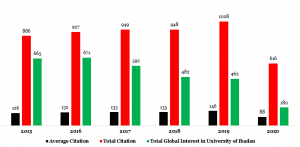

Beyond knowing the publication frequency during the period, we analysed the number of citations each of the contenders has. Averagely, Professor Kayode Oyebode Adebowale has been cited 1,032 times. He is being followed by Professor Emiola Oluwabunmi Olapade-Olaopa, who has been cited by 222 times. Professor Temitope Alonge is in third position with 166 citations. We further developed more interest in understanding how the publications and citations helped the University in terms of being searched by people throughout the world. Here, our focus is to find out the extent to which people had interest in the University through the contenders’ publications or citations from January 1, 2015 to July 26, 2020.

Using 5 of the contenders [those with presence on Google Scholars and Semantic Scholars], analysis indicates 49.4% of the Collective Total Citations variation in global interest in the University. When we analysed the citations using Collective Average Citations, the percent increased by 1% (49.5%). These results imply that during the five years, the 5 contenders can only account for less than 50% of people interest in the University, signifying a low interest in knowing the University through their publications or voices on national and international issues. This position becomes more useful when analysis of their presence on the Internet only accounts for 4.3% of public interest in the University. Meanwhile, disaggregated analysis reveals that Collective Total Citations is better at directing public attention to the University. From the total of 158, 240 Internet presence results for the 5 contenders, 116,306 results facilitated public interest in the University.

Exhibit 1: Candidates’ Citation Trends from 2015 to 2020

Exhibit 2: Internet Presence Versus Citations

Exhibit 3: Candidates’ Scholarship Network and Global Interest in the University

Management and the Seat

In line with the Registrar’s release, candidate should be a proven, successful manager of human and material resources; be a person of proven integrity; demonstrate ability to provide academic and administrative leadership for such a well-established institution strengthen the bridges between staff, students and other members of the University community; be a person with a clear vision for the development of the University and attract the much-needed funds into the University.

Tracking and analysis of Professor Oyelade’s views on national and international issues reveal that he believes in changing his immediate environment using his writing skills and leadership experience. “Writers need to come together more often to deal with real national issues, rather than personal and local issues. We seem to be too afraid to be accused of being vocal without being active,” he said during a recent interview. While addressing a number of people in the University Community, Professor Adeyinka Abideen Aderinto also said the University needs a Vice Chancellor that will re-engineer and re-invigorate its greatness nationally and internationally.

Demographic and Geographic, and the Seat

Like what we have in the Nigerian larger society, as the race gets hot up, people have been expressing their views on who emerges and from which town or state. Our analyst themed this as socio-political mentions and listening in which people and associations from Ibadan have started seeing the seat as what should come to the city considering that none of the city’s professors [working in the University] has been Vice Chancellor of the University.

Examining the contenders using a geographical lens, analysis shows Professors Emiola Oluwabunmi Olapade-Olaopa and Remi Raji-Oyelade and Kayode Oyebode Adebowale are from Oyo state, while Professor Oluyemisi Adefunke Bamgbose, SAN is from Ogun state. Professor Adeyinka Abideen Aderinto and Professor Temitope Alonge are from Osun and Ondo respectively.

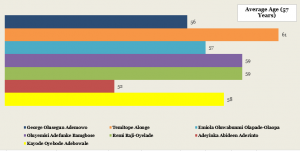

Following the Registrar’s release, our analyst also picked the age limit requirement for analysis. The release states that candidate must not be more than 65 years old as at the date of possible assumption of duty on 01 December, 2020. Analysis shows that the average age of the select 7 contenders is 57 years [see exhibit 4].

Exhibit 4: Age of Contenders

Source: University of Ibadan’s Staff Profile, 2020; Others, 2020; Infoprations Analysis, 2020