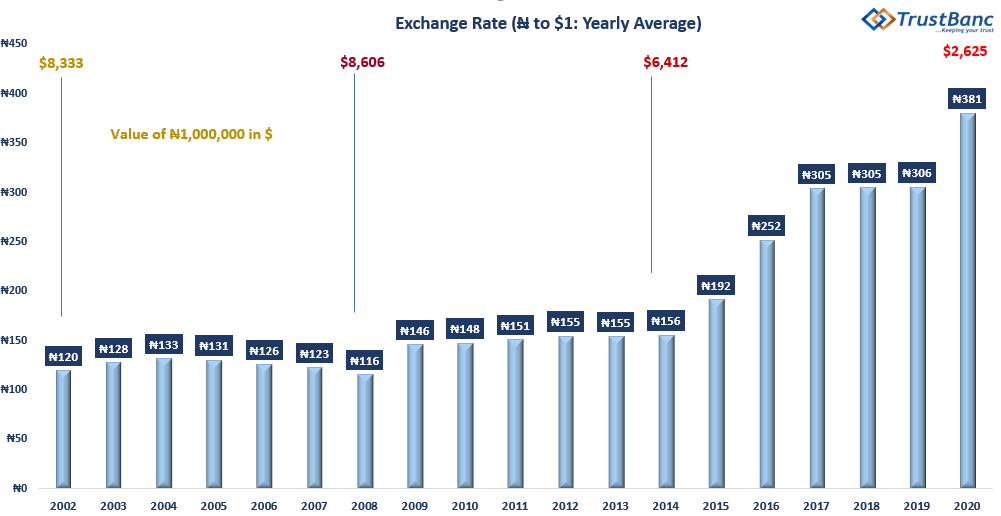

It crawled from 12.13% in January to 12.26% in March, jumped from 12.34% in April to 12.56% in June, inflation is gaining momentum, beware. Four months into the first wave of Covid-19 storm and the Naira has already lost 19.71% of its value.

Earning in Naira is a daily hustle, preserving your earnings in Naira is a day and night struggle. Welcome to This Week in The Capital Market.

Over time, inflation and devaluation reduce the value of your savings, this isn’t the time to save, you need investments with decent returns and a financial adviser to weather through this Covid-19 economic storm.

Earnings season is here: brace-up for heavy bites from Covid-19

Earnings season is the period of time during which the majority of publicly-traded companies listed on the Nigerian Stock Exchange (NSE) release their quarterly earnings reports. Typically, earnings season begins one or two weeks after the last month of each quarter.

This season is particularly important as companies’ financial data will provide insights on the impact of coronavirus on the economy. Earnings reports do not just tell stories about the performance of companies, they can also be used to measure the economic pulse of the country, sector by sector.

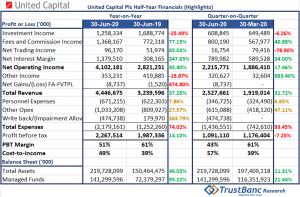

This week, we saw the first major earnings release – the half-year financial performance of United Capital Plc. It gave us a first glimpse of what the earnings season will look like for Banks and other Non-Bank Financial Institutions.

The Story: a decline in profitability as a result of huge impairments from Non-performing Loans (NPLs). NPLs from companies that have been heavily battered by the prolonged total economic shutdown.

Impairment allowance grew by over 373% in three months. N474 million impairment allowance is about 19% of the company’s total revenue. This pushed down profit before tax by 7.25% and PBT margin declined by 18% percentage points quarter on quarter.

However, the year to date performance of the company was strong enough to grow PBT by 14.10% despite the impairment allowance. This is a decent performance

We expect huge impairment from the financials of Banks too but the profitability of majority of these Banks are resilient enough to absorb this first wave of impairments.

The likes of GTB are well capitalised and enjoy good profitability, which combined, provide a decent buffer to withstand expected asset quality deterioration and looming impairments. In addition, these banks maintain a cheap deposit-based funding profile.

The strengths mentioned above are balanced against Nigeria’s uncommon operating environment which is worsened by depressed oil prices, depleting reserves and the coronavirus pandemic.

The financial result of Airtel will be out on 24th July, if you believe they are one of the biggest beneficiaries of this pandemic, get their shares before the result is out.

Global Standing Instruction (GSI): the days of serial and habitual debtors are numbered

On 13th July 2020, the Central Bank of Nigeria (CBN) issued the Global Standing Instruction (GSI) for various eligible individual accounts such as savings, current and domiciliary accounts. The GSI will also cover joint accounts, investment/deposit accounts and electronic wallets.

The GSI will serve as a last resort by a creditor bank, without recourse to the borrower, to recover past-due obligations from a defaulting Borrower through a direct set-off from deposits/investments held in the Borrower’s qualifying bank accounts with participating financial institutions.

The GSI is expected to:

1. Facilitate an improved credit repayment culture;

2. Reduce Non-Performing Loans (NPLs) in the banking industry; and

3. Watch-listing consistent loan defaulters

This is a significant move by the apex bank, our concern is the impact of GSI on NPL portfolios since it will only apply to individual accounts – these accounts constitute only about 10% of the loan portfolios of the banking industry.

Regardless, any guideline that will improve the access of decent Borrowers to loans and reduce NPLs in the banking industry is a positive step in the right direction and we are all for it.

Have a great week ahead.

This week in the capital market provides a cocktail of information, education and insights on how you can take advantage of investment and funding opportunities to grow your wealth.

Leave your questions and comments below. If you need private financial advisory, send your enquiries to azeez.lawal@trustbancgroup.com or call 08028379367. Advisory is free.