Thirteen years ago, I resigned from FirstBank after just three months at the bank as a Banking Assistant (or something of that sort). On the day of my resignation, I sent the letter below to Jacobs Ajekigbe (MD of FirstBank), Bernadine Okeke (Head of Human Capital Management) and Remi Babalola (a former Executive Director) who had just left to take a role as the Minister of State for Finance.

“Dear Sir/Ma,

We thought we had it bad last month when my colleagues and I were paid a sum of N46, 946.61 as our monthly salary. Not in our wildest dreams could we have imagined that that was just the tip of the ice-berg. Unfortunately, I waited too long to make the decision to leave hoping for the best. But finally, last week, I informed my BM of my decision and while some of my colleagues questioned my decision, this month’s salary of N43,946.61 (although only N41,133 made it into our accounts) blew away all contrary views.

It is therefore with both joy and regrets that I say ‘Adieu’. Joy that I’ve escaped FirstBank’s humiliating rat-trap and regret that an organization with such potential could be caught in this kind of situation. Especially painful and bewildering is the fact that management saw no reason to give any reason for the reversal (of our salaries from N89,000 to N56,000) and this even after our numerous mails of complaint. Instead we got a memo from Mrs. Bernadine (Head, HCM) informing us of the right way to exit the bank! Oh, what respect FirstBank has for its staff and what value it attaches to them!

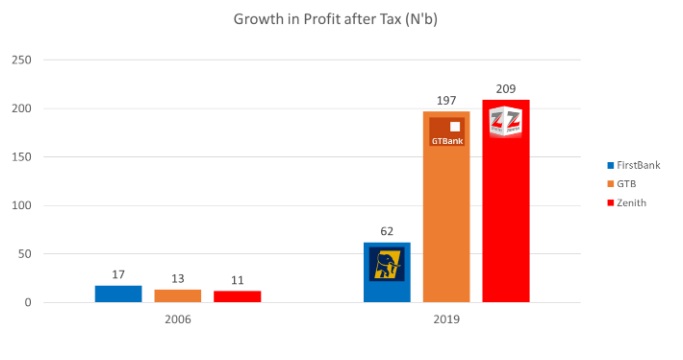

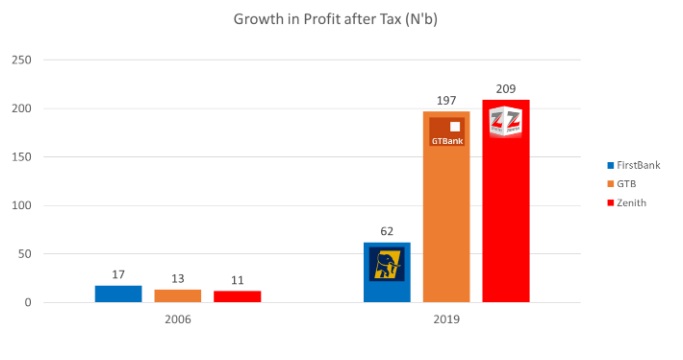

In this age and environment, it is immoral and socially irresponsible for any organization that can boast of an annual turnover in excess of N96billion and PAT of a whooping N20.4billion (the highest so far in the industry and a turnover-to-profit conversion ratio of 21.25%) to pay the same staff which made it possible such meager wages. But the fact remains that we could have done much better if only we had been a bit more motivated. Though not many seem to realize, in relative terms, FirstBank now lags seriously behind a number of its competitors. For our experience, staff strength, branch network, assets, brand name – although that is fast becoming a liability –, type of funds available etc, it is a disgrace to be slugging it out with the likes of Zenith Bank.

After all is said, the strength of an organization does not lie in its size (“Great men are not always wise”), age (“Neither do the aged understand wisdom”) or the amount of funds it can raise from the market. It lies in the quality of the people that make it up. And it goes without saying that the worth of an organisation’s staff can only be expressed first and foremost in their remuneration for services rendered. I refuse to believe that all I’m worth is only N41,000. I believe that I have a right to get an adequate explanation when my wages are being toyed with. I believe … but I guess it doesn’t matter anymore.

Of ‘cos I’m only one man out of a thousand, so my exit doesn’t really matter, right? Wrong! And anyone who believes that should be sacked. The success of any organization depends on everyone in that organization, from the lowliest doorkeeper who is courtly to customers to the Chairman who might not even be aware of where the bank’s profit comes from. And remember, a stitch in time really does save nine. A quote from Procter & Gamble:

“If you leave us our money, our buildings, and our brands, but take away our people, the company will fail. But if you take away our money, our buildings, and our brands, but leave us our people, we can rebuild the whole thing in a decade.” No wonder P&G is today the world’s second largest producer of consumer goods. The question: Can FirstBank also say the same?

In all, my experience in FirstBank was a pleasant one. It was with pride that I put on my lapel pin every morning and with the joy of a task accomplished that I put it down at night. The smile on a customer’s face and the sound of ‘Thank you’ always made my day. I hope that joy and pride will be enough to keep my colleagues that will be staying going on.

I do hope I haven’t ‘burnt any bridges’, as I would love to have the opportunity to come back much later to contribute my own quota in making FirstBank truly the first. Though I might not exactly patronize FirstBank after I leave, FirstBank will always be my bank… especially if I get the shares I applied for.

So again, with both joy and regrets, I say ‘Adieu!’

Beecroft, John O.

SN021211, Class Governor (May Induction Set)”

Unlike the first letter I sent (you can read that here), my resignation letter became instantly famous; it found its way around the bank and then outside. I got swamped with calls from people who wanted to know the young graduate who had the audacity to send the MD such a letter – some from FirstBank wanted to thank me for standing up, some counselled me to go apologise for my ‘destiny-destroying’ mistake, and some just wanted gossip.

I sent the letter in the morning and that same day, the MD of FirstBank, Jacob Ajekigbe, sent for me. Of course, I was worried as I was ushered into his office. He stormed and raged for the first 15mins or so while I sat there very timid. He even had a member of his staff on hand to provide evidence showing what the bank had done for people. But after the initial storming, he listened to me and we spent the next hour and a half talking cordially. The funny part was that he did admire my writing skills and offered me a job in the Head Office, with access to him. I respectfully declined; the bridge had to be burnt.

His main grouse though was that he felt deeply offended that I thought it okay to insult the bank because I had gotten a better paying job. Probably to scare me, he picked his phone and said he was going to ask Fola (GTB) and Jim (Zenith) if I had gotten a job with them. But I didn’t have another job, neither was I expecting one at that time. And of course, after just three months into my first job, I didn’t have any savings built up. Luckily for me though, I had a place to lay my head in my parents’ house and there I stayed for the next 4 months while searching for the next thing.

Those were tough months and my pride took some permanent damage. It was humiliating spending the whole day doing house chores as a man, while others went to work. It was embarrassing going out with my girlfriend and then pretending to be busy when it was time to pay so others wouldn’t see I had no money. I sent out the usual solicited and unsolicited job-seeking applications, and when I got no reply, sent new ones offering to work for free! And so went the months, until job offers came from Nigeria LNG and Mobil.

Joining NLNG that December didn’t end my problems though. I remember we were given $500 to buy warm clothing in preparation for our trip to the UK for training in January. But I couldn’t just up and leave with the debts I was owing. I paid off my friends with the money, and left for the cruel British winter with the normal clothes I had. Lordy lordy lord… I’ve never been so miserable in my entire life! The cold came for me like it was something personal. And I still haven’t forgotten the laughter and insults from some of my colleagues as I literarily froze – they had concluded I was just being stingy.

Despite all that, I realise that leaving FirstBank was probably the best decision I ever made. Though made quickly, the decision was not hasty. It came from a place of anger (at being cheated) and conviction (of my self-worth). I had joined FirstBank as a detour on my entrepreneurship journey, but the training school did too good a job – somehow, they convinced us that we were the next set of gamechangers in the industry. Yet after all the hype, the series of actions FirstBank took that period was evidence that it had lost its way. I wasn’t going to lose mine.

I was angry at being cheated, but more importantly, I realised that not taking action would permanently damage my sense of self-worth – because to a large extent, your salary is actually a reflection of what the organization thinks you are worth. Accepting that salary without doing anything to change it means you accept the valuation. And a job that does damage to your confidence is a job you shouldn’t have. To put things in perspective, I would have felt happier working as a waiter for half that amount at that time, knowing I had something better to look ahead to. But FirstBank was supposed to be my ‘ahead’ then and the actions they took gave me absolutely no hope to look forward to, so I quit.

What do I say to others? Should you quit that job that pays you peanuts? Should you close down that business? There are no easy answers here, especially when the person involved is not as fortunate as I was to have somewhere to sleep without bothering about rent. The truth is that we all know if/when it’s time to leave, but knowing and having the liver are two different things already. It’s a personal thing; the answers have to come from deep within, from a place of deep conviction. Yes, the cost would be high and there are absolutely no guarantees of success. But whoever heard of great gain without equal sacrifice?

Anyway, that was the end of my first journey. Looking back now, I remain pretty proud of the decision I made that day. It has enabled me take many more tough decisions over the years especially in my many business ventures – a failed mutual fund started during the 2008 stock market boom, a failed supermarket venture that almost made me hypertensive before my 30th birthday, an ill-advised dabble into a bureau de change, a fast-food restaurant that never saw the light of day, a struggling water & juice production factory, a real estate development company (Tetramanor) and… Writing that letter, burning that FirstBank bridge, gave me the courage to keep moving forward all these years without fear. Staying back at the bank with spirit crushed would have condemned me to a life of fear and hesitation.

I know many out there would find it way more difficult than I did to take the same steps. There is really no guarantee that things would turn out right, but there is every guarantee that the road would be hard. So why do it? Why venture into the unknown? That is for you to answer. But if you’re like me and the answer is positively clear in your mind, then know this: You’ll never ever find true satisfaction in that day job, no matter how comfortable. The world is yours to conquer!

In my typical way, I have gambled a whole lot on Tetramanor and I struggle daily, utilizing the lessons of the past, to make it work. Still, if it does not turn out to be the great success I want it to be, it would just be the end of another journey. I will keep walking.

John O. Beecroft

Like this:

Like Loading...