Notes We have launched Tekedia Mini-MBA LIVE which runs live sessions on Weekdays 11am-11.30am and Saturdays 11am-12 noon Lagos time. Click and learn more here. We have added a video to explain Business Canvas to help members understand the Challenge Assignments. The Career Week (not for jobs though!) which is designed to make us better […]

This Week in The Nigerian Capital Market: Devaluation, Inflation and The Stock Market

This Week in The Nigerian Capital Market is Back on Tekedia. Your weekly updates and insights on Government policies, capital market activities and how they affect your savings, investments, fundraising and wealth in general.

The COVID Effect

It took Africa 90 days to tick 100,000 infections and only 19 days to hit 200,000. Nigeria recorded 10,000 cases in 94 days and crossed 20,000 cases in only 21 days. In the last 7 days alone, over 4,000 new cases have been recorded in Nigeria, an indication that the Virus is now in its community transmission stage in most locations across the country, especially Lagos.

Beyond the health implications, the negative economic impact is scary. The novel coronavirus pandemic locked down countries and wiped off more than US$3.4 trillion from the world economy. In Nigeria, it’s currently paving the way for rising inflation and fueling the momentum for another round of devaluation.

Another round of devaluation is on the horizon, are your investments safe?

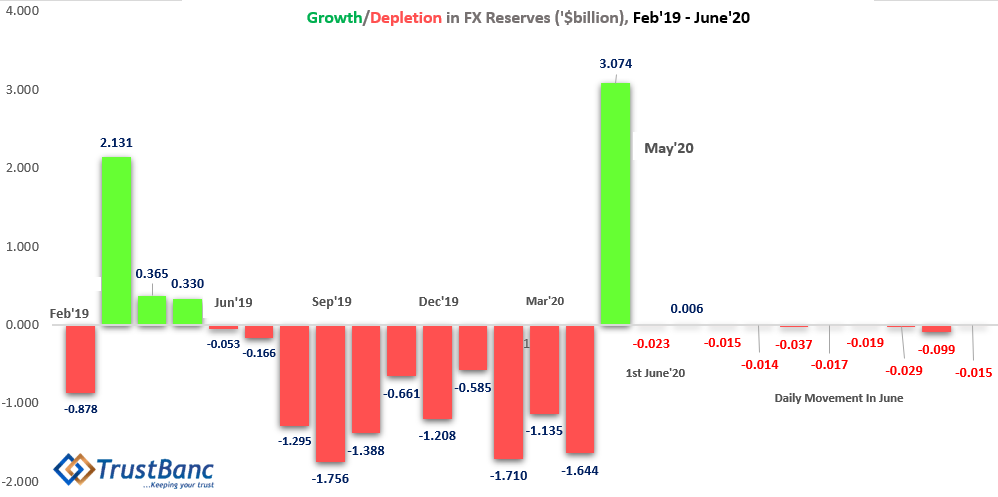

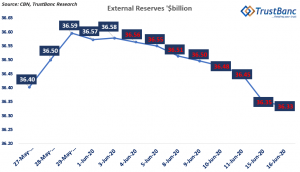

Last week, Nigeria’s external reserves declined by $132 million to close at $36.3 billion. As a Nigerian, you should monitor the price of crude oil and the balance in the reserves same way you monitor your bank balances and investments. At the current balance of $36.3 billion and the price of oil at $41.80, every decline in reserves reinforces the possibility of another round of devaluation of the Naira.

Business Day reported late last year that “At an investor meeting in London, Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), told foreign investors that the apex bank would meet all foreign exchange demands so long as the nation’s external reserves are above $30 billion and the international prices of crude oil do not go below $45 per barrel”

This year, the Naira was devalued by 15% on the 20th of March when Nigeria’s Bonny Light oil price was trading at $26.07 and external reserves stood at $35.89 billion.

Repeat the ‘red buzz’: $45 and $30 billion.

In the simplest terms, devaluation is when Naira depreciates in value over time when compared with another currency. That point when you need more naira to get a unit of another currency.

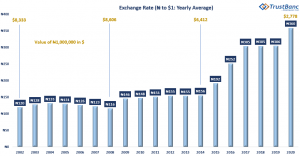

As shown in the graph, in 2002, you needed only N120 to get $1 but now you need N360 to get the exact same dollar, in that case, you can say Naira has been devalued or depreciated by over 66% since 2002.

How does devaluation affect your livelihood? How does it impact your money journey?

It affects the cost of living, reduces purchasing power and causes disproportionate suffering among high and low-income consumers. Devaluation erodes investments, capital and profitability.

This year alone, the Naira has depreciated in value by 15%. What does this mean and how does it affect your wealth and money journey? Let’s ponder on some lines from the money journey of Dangote to drive the negative impact of devaluation home.

According to Forbes, in 2014, Dangote ranked as the 23rd-richest person in the world with a net worth of US$25 billion. As of March 2019, he had declined to an estimated net worth of US$10.6 billion and ranked as the 100th-richest person in the world. Currently, he is the 162nd-richest person in the world with a net worth of US$8.0 billion. In the league of world billionaires, Dangote is getting poorer.

In a National context, in 2017, millions of Nigerians became poorer and we displaced India as the world’s poverty capital. Devaluation is a problem, and it affects the poor and the rich.

2014 to 2020, what changed?

Between 2014 and now, the naira has lost over 56%% of its value. In money terms, N1,000,000 could buy $6,412 in 2014 but it will only buy you $2,778 in 2020. Now imagine if $6,412 was your school fees in 2014, can you still go to school in 2020 with N1,000,000? Imagine if it was your working capital in 2014, can you still do business in 2020?

Devaluation downgrades your capital and compels you to get more. It erodes your savings, investments and returns. In fact, Saving is not enough now, you need to invest at rates that will grow your money in real terms.

Inflation Jumps to 12.40%: why you should be worried

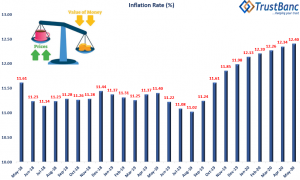

Last week, the National Bureau of Statistics (NBS) released inflation data for the month of May, 2020, inflation is now at 12.40%. As shown in the inflation graph above, it’s the highest in 24 months.

We hear of inflation going up or down every month, but we still can’t figure the real impact it has on our money, savings and investments. Simply put, inflation effectively shrinks the value of your money over time, clears the interest on your savings and erodes the returns on your investments.

Here is the implication, if inflation were to stay at 12.40% for the next 12 months and you invest N100,000.00 in a fixed deposit to earn 13% annually. After 12 months, your precious N100,000.00 will worth N100,534.00 in real terms.

Don’t get it mixed up, your bank or investment manager will credit you with N113,000.00 after 12 months, but in real terms, that 113,000.00 is actually worth N100,534.00. Inflation just robbed you off N12,466. Now, imagine if the return on your investment was not 13%, something around 6%, inflation will eat into your capital. This is why savings is not a good idea in times like this.

This erosive impact of inflation makes it particularly compulsory to find ways to potentially boost the returns on your long-term savings and investments in order to beat inflation with a reasonable premium and grow your wealth.

Stock Market

Last week was a turbulent one for Investors as they lost a total of N185 billion in a week that saw market capitalisation go below the N13 trillion mark for the first time since 21st May 2020.

On the last day of trading, 19th June, the Market closed in the negative zone for the fourth time in one week, this trend happened last in March 2020.

No worries. The sentiment in the market is still positive and we are bullish about the new week.

It’s a wrap.

Send all your money, savings, investment questions and worries to azeez.lawal@trustbancgroup.com. I will answer them for free and in a language you can easily relate with.

Digital Board Goes Live for Tekedia Mini-MBA

Good People, the Board is live for our 4-month Tekedia Mini-MBA journey. The first week will focus on Innovation and Growth. Yes, it has to be growth because that is what really matters now: companies are looking for ways to reignite and grow again. Three Faculty members will teach the session over the week:

- Growth and Innovation of Firms – Prof Ndubuisi Ekekwe

- Digital Transformation, Innovation & Strategy – Jude Ayoka

- Innovation Lessons: 5in5 (5 Firms in 5 Sectors) – Aderinola Oloruntoye

I will begin by looking at the elemental constructs of innovation systems. Then Jude Ayoka takes over for the best digital transformation & innovation lecture you would appreciate. It has the best visuals I have ever experienced! Then, dean Aderinola goes around the world with practical cases of innovation, from Swaziland through the U.S. to Pakistan. The link for Week 1 goes live at 12 noon Lagos time on June 22 here (click).

Registration continues – N50k or 140. Payment options are on this link.

The Cost of Writing

Some weeks ago, a neighbour told me that she has observed I’m always in front of my laptop. She asked if I teach online classes. Well, I told her that I write, read and conduct research through the internet. Further questioning revealed to her that writing can actually be a source of income. But, like many people out there, my neighbour believed that being a writer comes with no price. To her, writing is a profession in which somebody can sit down in her house and make easy money. My neighbour actually said, “So you sit down in your house and make cool money without stress and without spending money?” Well, like I told her, only writers will understand how “easy” it is to write.

Like the Igbos say, “The snake seen by one person is always a python”. This saying is used to refer to the fact that only the person that wears the shoes knows where it pinches. Many people believe that writing is an easy thing to do. They thought it is just a matter of putting something down and pushing it out for people to read, after all they did composition in schools. With this ideology, this set of people easily condemn another person’s writing without critically analysing it or putting into consideration what it took the writer to come up with the piece. But when you ask them to draft their own “composition” they will find that hard to do.

This piece isn’t about complaining of those that don’t appreciate people’s hard work. The focus of this article is to expose to prospective writers some of the prices they will have to pay when they join the writer’s club. It is actually not meant to scare them away, but to get them prepared for the future.

For those aspiring to become writers, here are the prices you’re expected to pay in the profession.

- Sleepless Nights

There are several reasons why most writers hardly sleep at night. Some find night times as the best time to concentrate and write. Some face insomnia because they have ideas twirling around their minds and they’re trying to give it a solid form. Then there are writers that use night times to pursue writing gigs (especially when targeting foreign clients). Writers also experience sleepless nights because of anxiety caused by approaching deadlines or readers’ judgement. Actually, the reasons why writers experience sleepless nights are innumerable. But just remember when you find it hard to sleep at night that you’re not alone.

- Researching

You might have an idea that you want to put down, but you need to carry out further research to make it concrete and relatable. Conducting research is challenging because you may find it hard to get what you’re looking for. Those of us that are mostly into academic writing and research may be frustrated to notice that no recent research has been conducted on the concept you’re writing on. This is more frustrating when a peer reviewed article you managed to find demands that you pay an amount that is ten times more than what the writing will fetch you. Or it could be that the respondents you approached decide to be difficult. Anyway, just bear it in mind that you must conduct research for almost everything you are writing about, irrespective of its genre. That it is difficult to obtain data is not anybody’s concern but yours.

- Concretising Ideas

Like I mentioned earlier, some sleepless nights come as a result of inability to concretise an idea. Sometimes you have a good theme to write on but you find it hard to even build an outline for it. You might finally develop its outline but still be unable to add flesh to the skeleton. This can be frustrating. However, the easiest way out of this is to put the idea down, do some mind mapping, and, if it still won’t take a solid form, keep it and come back to it another time. You actually don’t force an abstract idea into a piece of writing; if it’s not working, then leave it.

- Emotional Turmoil

Anxiety is the bane of every writer. If you must have noticed that most of these famous great writers from different parts of the world have suffered from depression at a certain time in their lives. The causes of these are numerous: it ranges from the fear of writer’s block to anxiety over critics’ unmerciful pens. Writers even suffer from the fear of missing deadlines and that of inviting public condemnation. To be a writer, you have to pay the price of unstable emotion – you laugh at one time, and cry at the next.

- Low Income

Writers are not rich people. I’m always blunt about this when people ask me how much I earn from writing. I don’t waste time telling them that my lecturing job pays my major bills. I know some people have been able to find their ways to the peak so that whatever they push out yields lots of income for them. But not every writer is that lucky. As a writer, you should be ready to wear yourself out in order to pay your bills. This is one of the costs of writing.

There are so many other prices writers pay. Like every other profession, it comes with its own occupational hazards. However, developing and improving on your writing skills can teach you how best to go about the job. But, you have to cut your niche if you truly want to be a successful writer. That way, the cost will not be too high.

Trans-Atlantic Trade War Looms As The US Backs Out of Negotiation With The EU on Digital Tax

The quest to tax online tech companies in Europe suffered setback as the US President Donald Trump withdrew from the international negotiations on the best way to effect the taxation.

There has been years of long talks on how to tax multinational corporations such as Amazon, Google and Facebook in countries outside North America. Members of the European Union have been leading the talks, hoping it would materialize to a consensus until the Trump administration abruptly left the negotiation table.

The push to get the tech giants to pay taxes for their online services in countries outside the US was intensified by the outbreak of coronavirus pandemic. As many businesses were forced to close in a bid to contain the spread of the virus, many countries, especially in Europe turned attention to big tech companies whose businesses are online.

But the US government made a sudden turnaround from the negotiations. Treasury Secretary Steve Mnuchin wrote a letter to the finance ministers of France, the UK, Italy, and Spain, saying that negotiations were at “impasse,” threatening to retaliate “with appropriate commensurate measures” against any country that attempts to unilaterally Impose digital services taxes on US-based tech companies.

“The United States remains opposed to digital services taxes and similar unilateral measures.” Mnuchin wrote in his letter. “As we have repeatedly said, if countries choose to collect or adopt such taxes, the United States will respond with appropriate commensurate measures.”

EU leaders have expressed their disappointment at the sudden turn of events, and many fear it could lead to trans-Atlantic trade war. French finance minister Bruno Le Maire said the US backed down when they were close to sealing a deal on digital taxation on only companies that offer hope in the midst global health crisis.

“We were inches away from an agreement on digital taxation at a time when the digital giants are the only ones in the world to have benefited immensely from the coronavirus crisis,” he said.

European capitals, Paris, Madrid, London and Rome led the campaign to tax the tech companies. They said that US-based tech companies are making enormous gain from the European markets while making little contribution to the public coffers.

But Mnuchin, in his letter said that move is premature, and “a distraction” considering the health crisis that every country around the world is battling right now.

“Attempting to rush such difficult negotiations is a distraction from far more important matters. This is a time when governments around the world should focus their attention on dealing with economic issues resulting from COVID-19,” he said.

The US said they would resume the talk later in the year, but European countries seem eager to move on with the taxation plan. The UK Treasury said on Wednesday that British law empowers them to do so. The tax proposal will take effect in 2021.

The Financial Times reported on Thursday that the Organization for Economic Co-operation and Development (OECD) had proposed a compromise with two pillars. The first suggested countries would be allowed for the first time to have some rights to tax profits made on the basis of sales in their jurisdiction. This means that the US will have equal right of taxation on European tech companies operating in the US soil.

The second pillar was that there would be a global minimum corporate tax rate to prevent countries from lowering corporate tax rates in an attempt to shift company headquarters to their jurisdictions.

Mnuchin said negotiations based on the second pillar are still on the table, but the US would want more time as the focus is on COVID-19 for now. But it appears that the US is buying time to conduct an investigation on digital tax plans of European countries to ascertain the measure its retaliatory response will be if they go ahead to impose it on US-based tech companies.

Le Maire said on Thursday that the US decision to back out of negotiation is a “provocation” for European countries negotiating in good faith. He added that France will go ahead to reimpose its suspended 3% tax on digital services if OECD nations fail to reach a deal at the end of the year.

“So it is a provocation… to all the citizens of the world who say that it is still legitimate for all the digital giants to pay their taxes. It is also a provocation to the US allies. What is this way of treating US allies- the British, Spanish, Italians, French by threatening us with sanctions?” he said.

The New York Times reported on Wednesday that many European countries are already rolling out plans to impose an unfriendly tax regime on the US tech companies.

The report said: “Several European countries, led by France, have been rolling out digital taxes, which would fall heavily on American internet companies. Italy, Spain, Austria, and Britain have all announced plans to levy digital taxes, which impose duties on the online activity that takes place in those countries, regardless of whether the company has a physical presence.”

But Spanish government spokesperson, Maria Jesus Montero said the intent of the tax plan is not to damage the interest of other countries.

“We are not legislating to damage the interest of other countries. We are legislating so that our tax system is orderly, fair, and adapted to current circumstances,” he said.

The idea has been to make tech giants pay taxes everywhere their products are consumed. That would amount to billions of dollars in revenue. If the EU succeeds in implementing the digital tax, many other countries will follow suit.

Nigerian Finance Minister, Zainab Ahmed said earlier in the month that the federal government has plans to introduce digital tax targeting social media and ecommerce companies offering products and services in Nigeria.

If the EU countries defy the US’ threat and impose the tax, it will trigger a new global digital tax regime that will slash the earnings of tech giants who have had it free for years.