This Week in The Nigerian Capital Market is Back on Tekedia. Your weekly updates and insights on Government policies, capital market activities and how they affect your savings, investments, fundraising and wealth in general.

The COVID Effect

It took Africa 90 days to tick 100,000 infections and only 19 days to hit 200,000. Nigeria recorded 10,000 cases in 94 days and crossed 20,000 cases in only 21 days. In the last 7 days alone, over 4,000 new cases have been recorded in Nigeria, an indication that the Virus is now in its community transmission stage in most locations across the country, especially Lagos.

Beyond the health implications, the negative economic impact is scary. The novel coronavirus pandemic locked down countries and wiped off more than US$3.4 trillion from the world economy. In Nigeria, it’s currently paving the way for rising inflation and fueling the momentum for another round of devaluation.

Another round of devaluation is on the horizon, are your investments safe?

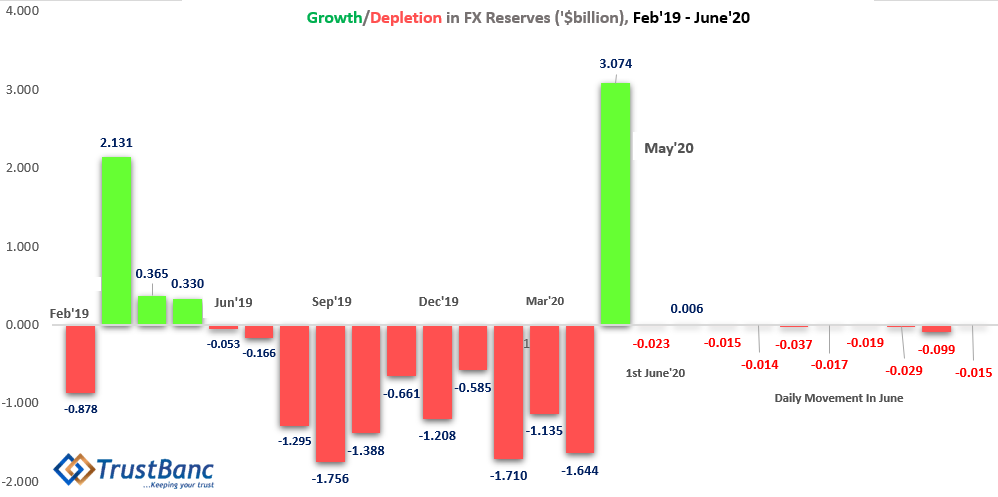

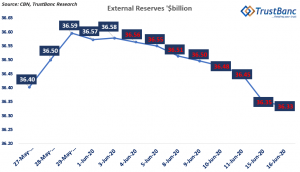

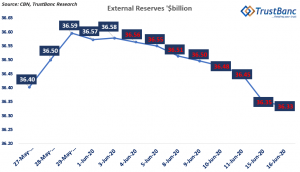

Last week, Nigeria’s external reserves declined by $132 million to close at $36.3 billion. As a Nigerian, you should monitor the price of crude oil and the balance in the reserves same way you monitor your bank balances and investments. At the current balance of $36.3 billion and the price of oil at $41.80, every decline in reserves reinforces the possibility of another round of devaluation of the Naira.

Business Day reported late last year that “At an investor meeting in London, Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), told foreign investors that the apex bank would meet all foreign exchange demands so long as the nation’s external reserves are above $30 billion and the international prices of crude oil do not go below $45 per barrel”

This year, the Naira was devalued by 15% on the 20th of March when Nigeria’s Bonny Light oil price was trading at $26.07 and external reserves stood at $35.89 billion.

Repeat the ‘red buzz’: $45 and $30 billion.

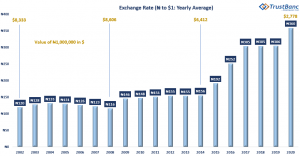

In the simplest terms, devaluation is when Naira depreciates in value over time when compared with another currency. That point when you need more naira to get a unit of another currency.

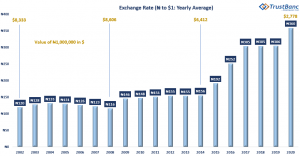

As shown in the graph, in 2002, you needed only N120 to get $1 but now you need N360 to get the exact same dollar, in that case, you can say Naira has been devalued or depreciated by over 66% since 2002.

How does devaluation affect your livelihood? How does it impact your money journey?

It affects the cost of living, reduces purchasing power and causes disproportionate suffering among high and low-income consumers. Devaluation erodes investments, capital and profitability.

This year alone, the Naira has depreciated in value by 15%. What does this mean and how does it affect your wealth and money journey? Let’s ponder on some lines from the money journey of Dangote to drive the negative impact of devaluation home.

According to Forbes, in 2014, Dangote ranked as the 23rd-richest person in the world with a net worth of US$25 billion. As of March 2019, he had declined to an estimated net worth of US$10.6 billion and ranked as the 100th-richest person in the world. Currently, he is the 162nd-richest person in the world with a net worth of US$8.0 billion. In the league of world billionaires, Dangote is getting poorer.

In a National context, in 2017, millions of Nigerians became poorer and we displaced India as the world’s poverty capital. Devaluation is a problem, and it affects the poor and the rich.

2014 to 2020, what changed?

Between 2014 and now, the naira has lost over 56%% of its value. In money terms, N1,000,000 could buy $6,412 in 2014 but it will only buy you $2,778 in 2020. Now imagine if $6,412 was your school fees in 2014, can you still go to school in 2020 with N1,000,000? Imagine if it was your working capital in 2014, can you still do business in 2020?

Devaluation downgrades your capital and compels you to get more. It erodes your savings, investments and returns. In fact, Saving is not enough now, you need to invest at rates that will grow your money in real terms.

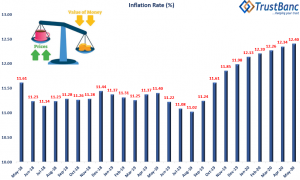

Inflation Jumps to 12.40%: why you should be worried

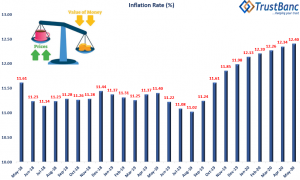

Last week, the National Bureau of Statistics (NBS) released inflation data for the month of May, 2020, inflation is now at 12.40%. As shown in the inflation graph above, it’s the highest in 24 months.

We hear of inflation going up or down every month, but we still can’t figure the real impact it has on our money, savings and investments. Simply put, inflation effectively shrinks the value of your money over time, clears the interest on your savings and erodes the returns on your investments.

Here is the implication, if inflation were to stay at 12.40% for the next 12 months and you invest N100,000.00 in a fixed deposit to earn 13% annually. After 12 months, your precious N100,000.00 will worth N100,534.00 in real terms.

Don’t get it mixed up, your bank or investment manager will credit you with N113,000.00 after 12 months, but in real terms, that 113,000.00 is actually worth N100,534.00. Inflation just robbed you off N12,466. Now, imagine if the return on your investment was not 13%, something around 6%, inflation will eat into your capital. This is why savings is not a good idea in times like this.

This erosive impact of inflation makes it particularly compulsory to find ways to potentially boost the returns on your long-term savings and investments in order to beat inflation with a reasonable premium and grow your wealth.

Stock Market

Last week was a turbulent one for Investors as they lost a total of N185 billion in a week that saw market capitalisation go below the N13 trillion mark for the first time since 21st May 2020.

On the last day of trading, 19th June, the Market closed in the negative zone for the fourth time in one week, this trend happened last in March 2020.

No worries. The sentiment in the market is still positive and we are bullish about the new week.

It’s a wrap.

Send all your money, savings, investment questions and worries to azeez.lawal@trustbancgroup.com. I will answer them for free and in a language you can easily relate with.

Like this:

Like Loading...