It came with a promise to take down DStv and GOtv. But it seems TStv, a satellite TV provider in Nigeria, cannot take care of itself. Premium Times reports that the company could not pay its rent, and has been kicked out! Going against the richest company in continental Africa by market cap, Naspers, and a single company that could buy all the stocks in the Nigerian Stock Exchange with just then-30% of its value in the Johannesburg Stock Exchange was boldness.

The West African Business Platform Ltd., a law firm, has taken possession of the Abuja Headquarters office of Telcom Satellite Ltd. Television (TSTV) due to its inability to pay its rent.

The Abuja Headquarters office of the television company is situated at Plot 1191, Jahi District, off Gilmore Construction Company, FCT.

The property was taken over on Tuesday following the judgment entered in favour of the plaintiff by Justice Yusuf Halilu of the FCT High Court in Nov. 2019.

Officers from the Execution Unit of the FCT High Court, including four police officers, were stationed in the premises during the takeover.

The law firm through its principal, Raphael Adakole, had filed the suit in 2018 with No. CV/2739/18 against the television company and its Abuja Managing Director, Bright Echefu

TStv had no chance, but do not blame it for trying. Yes, many of us were worried as Naspers, the then-direct custodian of MultiChoice brands like DStv and Gotv, could outbid even Facebook or Google on things dear to it. It is that liquid with electronic money, not liquid water from my village. With truckloads of cash, DStv was going to win European Football rights bidding provided C. Ronaldo and Lionel Messi continue to earn the budget of Abia State for kicking a round leather around.

The elders will remind you NEVER to fight against your god – and some wiser people will say “choose your fights wisely”. TStv was stubborn and it has paid for it.

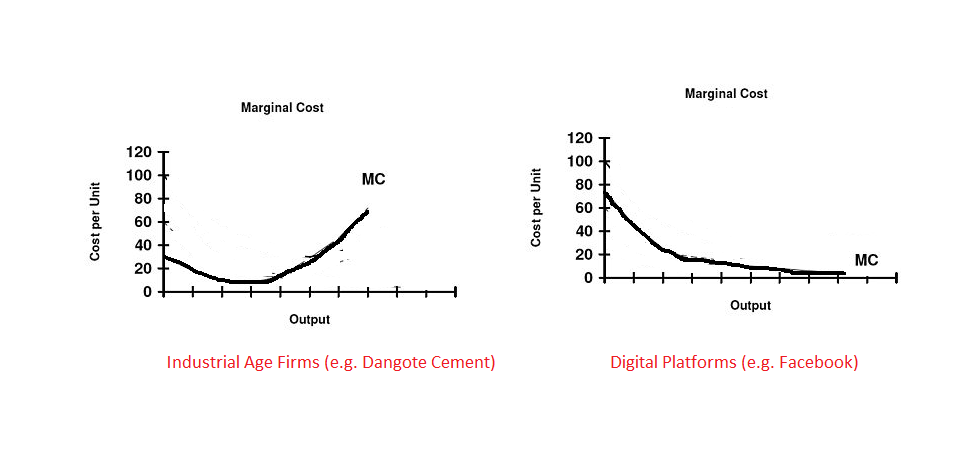

Sure, this is not to say one cannot dream big. But you need to be strategic when dreaming. This is what I do suggest when it comes to dealing with these ICT utilities with unlimited piles of cash – read here in Harvard Business Review.

I titled an article when TStv launched, “TStv’s Goliath Challenge of DStv“. I did note that “it has to plan very well as it takes on the Goliath of pay TV in Africa. Sure, Goliath has been beaten in the past and that should be encouraging for TStv.” Unfortunately, TStv does not have “David” as a second name.

TStv, a new pay TV company, is beginning a journey to challenge the largest company in Africa by market valuation. Naspers which owns MultiChoice operates the DStv brand across sub-Saharan Africa. DStv is a digital satellite TV service which leads its category in the region. It is well funded by South Africa’s Naspers which has a valuation of $100 billion.