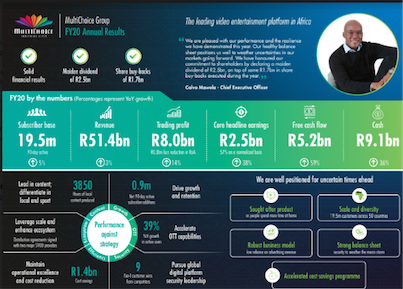

When you are a category-king, you become the castle and control all axes of the moats. As we discuss the struggle of TStv and its failure on challenging the dominance of DStv, we are learning that DStv is putting its best video entertainment yet: “Africa’s leading video entertainment company, MultiChoice Group delivered solid financial results for the year ended 31 March 2020. Highlights include 38% growth in core headline earnings…with consolidated free cash flow increasing by 59% …, driven mainly by an improvement in the trading results from the Rest of Africa (RoA), a focus on cost containment and a reduction in working capital.” That Rest of Africa is Nigeria, the African land of opportunities which many Nigerians do not appreciate.

Looking at the report, MultiChoice reduced cost, grew revenue, added more subscribers, and checked all positives at the same time. Then, it left the usual line: “MCG continues to position itself as Africa’s leading video entertainment platform, both now and into the future”.

People, this is what it is called: Accumulation of Capabilities. When you attain that level, you exert asymmetric impacts in markets, crippling newbies and making any frontal assault to backfire. Yes, send it back to the sender because when the competitor thinks you will bleed, you open the playbook, with ferocious frontal and flank assaults, and just like that, the competitor is gone: HiTv, TStv, etc.

To challenge DSTV & cousins, you need to set a new basis of competition. Trying to beat this company on its game is hopeless! It is really great!

The report….

Africa’s leading video entertainment company, MultiChoice Group (MCG, or the Group) delivered solid financial results for the year ended 31 March 2020 (FY20). Highlights include 38% growth in core headline earnings to R2.5bn, with consolidated free cash flow increasing by 59% to R5.2bn, driven mainly by an improvement in the trading results from the Rest of Africa (RoA), a focus on cost containment and a reduction in working capital.

“We are certainly facing unprecedented times but are pleased with our performance and the resilience we have demonstrated this year,” says Calvo Mawela, Chief Executive Officer. “Our healthy balance sheet positions us well to weather the uncertainties in our markets going forward. We have also honoured our commitment to shareholders by declaring a maiden dividend of R2.5bn, on top of some R1.7bn in share buy-backs executed during the year.”

Despite global and country-specific macro-economic challenges, the Group added 0.9m 90- day active subscribers, representing 5% growth year-on-year (YoY). This took the overall subscriber base to 19.5m households, split between 8.4m households in South Africa (SA) and 11.1m households in the RoA.

Revenue was up 3% to R51.4bn and included R42.8bn in subscription revenue which increased 4% YoY. Top line momentum was affected by modest subscriber growth due to rising consumer pressure, a decision not to increase prices of its Premium package in South Africa, and the fact that last year’s growth benefitted from specific once-off events. Nonetheless, a strong focus on cost containment underpinned a 14% increase in trading profit to R8.0bn (29% organic), with some R1.4bn in cost savings generated during the year and a R800m (R1.8bn organic) reduction in losses in RoA.

The like-for-like core headline earnings increase, which excludes the impact of the additional 5% allocated to the Phuthuma Nathi (PN) shareholders in March 2019, was 57%. The Group reported R9.1bn in cash and cash equivalents, which combined with R5bn in undrawn facilities provides R14.1bn in financial flexibility.

MCG continues to position itself as Africa’s leading video entertainment platform, both now and into the future. Local content remains a strategic differentiator, with a sizeable 3 850 hours produced this year to bring the Group’s total local content library to nearly 57 000 hours. This focus on local content and innovative production models is yielding results, with MCG’s first local co-production Trackers becoming M-Net’s top performing series for the year, outperforming established global shows such as Game of Thrones.

In addition to compelling local stories, MCG continues to broadcast the best of sport and international content and will now be integrating third party streaming services onto its DStv platform. The recently signed distribution agreements with two major international Subscription Video on Demand (SVOD) providers will ensure that customers have access to a wider variety of content, all in a single place.

“We have long been a content aggregator, and this is proof of our aggregator model at work – providing simplicity, choice and convenience for our customers,” Mawela explains. “As our industry evolves, we believe that we are well positioned to benefit from both worlds – a large, growing pay-TV market in Africa, as well as an emerging over-the-top (OTT) opportunity, where our own OTT services and aggregation capabilities can drive success.”

The Group also has an exciting product line-up that will launch during the year, including the much-anticipated DStv streaming product.

FINANCIAL REVIEW

The Group achieved its target of generating positive operating leverage by keeping revenue growth ahead of growth in costs. Organic revenue growth of 2% compared to a 3% reduction in operating costs on an organic basis resulted in improved operating leverage of 5%. A focus on tight cost controls and the early implementation of cost cutting initiatives underpinned an expansion in the Group’s trading margin from 14% to 16%. Cost savings included a reduction in variable costs such as decoder subsidies due to supply chain consolidation and lower unit costs, as well as close to R1bn in fixed costs savings through a broad range of initiatives across multiple areas of the business.

Capital expenditure (capex) of R0.8bn was slightly down on the prior year and included a R0.2bn investment as part of a multi-year programme to futureproof the Group’s customer service, billing and data capabilities. As one of the largest taxpayers in Africa, MCG paid direct cash taxes of R4.0bn, slightly higher than the prior year driven by higher Group profitability.

The Group’s strong balance sheet has supported the repurchase of 15.6m ordinary shares over the course of the year, to the value of R1.7bn. R1bn was executed as part of a general share buy-back programme between September 2019 and March 2020 at an average price of R96. These shares are currently held as treasury shares. The remaining R0.7bn related to the funding of the Group’s restricted share plan.

The Group remains fully dedicated to broad-based black economic empowerment (B-BBEE) and transformation. In line with prior commitment, the Group’s offer to PN shareholders to exchange up to 20% of their PN shares for MCG shares was finalised on 28 October 2019 and resulted in 3.7m shares being issued to PN shareholders, while MCG acquired 3.8m shares in PN in return. Following the conclusion of this share swap, the Group’s overall interest in MultiChoice South Africa increased from 75.0% to 76.4%, with PN owning the rest.

SEGMENTAL REVIEW

South Africa The SA business held up well in a tough consumer climate, delivering subscriber growth of 6% YoY or 0.5m subscribers on a 90-day active basis. The impact of the coronavirus (COVID19) pandemic in South Africa and associated lockdown saw an uplift in subscribers towards the end of March. Revenue growth of 1% to R34.2bn was muted as healthy subscriber growth in the mass market was negated by the strategic decision not to increase prices on the Premium bouquet. Trading profit increased only 1% YoY to R10.3bn due to modest revenue growth and the cost impact of broadcasting three major sport events in the reporting period, but the trading margin remained stable at 30%.

The business continues to focus on growth, retention, strategic upselling of bouquets and operational efficiencies to support margins. Digital platforms saw strong uptake during the year, with self-service channels now handling 66% of all customer interactions. This follows the restructuring of the customer care division during the first half of the year.

The year saw strong, ongoing growth in Connected Video users on both the DStv Now and Showmax platforms as online consumption increases. Showmax, the Group’s standalone OTT service, gained solid traction this year following the launch of a mobile-only offering, improved marketing and further enhancements to the user interface and the content slate. The platform now boasts more than 50% local content.

Rest of Africa

The RoA business grew its 90-day active subscriber base by 4% YoY or 0.4m subscribers, to reach in excess of 11m subscribers for the first time. Growth was affected by non-recurring sport events in the prior year and some country-specific challenges. In Zimbabwe, the current hyperinflationary economic environment and lack of US dollar liquidity caused significant pressure on consumers, while severe drought-related electricity shortages of up to 18 hours per day in countries like Zambia impacted demand for services like pay-TV. Similar to SA, a slight increase in subscriber numbers was seen in March 2020 as lockdowns were initiated in various markets across the continent.

Revenue was up 4% (3% organic) to R15.5bn, with subscription revenue growing at a similar rate and contributing R14.3bn. While material currency depreciation in the Angolan kwanza (47%) and the Zambian kwacha (25%) affected the segment’s financial results, the business continues to make progress towards its medium-term breakeven target. Trading losses narrowed 22% (47% organic) or by R0.8bn (R1.8bn organic) to R2.9bn, representing a 7% improvement in trading margin.

Despite challenging conditions, the RoA business still enjoyed several operational successes. Across many markets the Festive Season campaigns achieved higher growth than in any of the preceding 8 years, and the popular #DStvStepUp campaign served well to win back customers and increase engagement. The roll out of digital products to enhance customer service is now complete in all major markets, with the MyDStv and MyGOtv apps servicing 1.3m monthly users.

Technology segment

The Technology segment, Irdeto, delivered positive results, despite being the business segment most affected by the COVID-19 pandemic in the last quarter of FY20. It contributed R1.8bn in revenues, an increase of 12% YoY (4% organic). This momentum combined with cost efficiencies, resulted in a 25% (40% organic) increase in trading profit to R0.7bn.

Irdeto continues to gain market share in its media security segment, while also investing in connected industries as part of its strategy to diversify its reliance on traditional broadcasting revenues. New services such as security solutions for online video, online gaming and the Internet of Things (especially connected vehicles) are gaining traction. In the current year, the first vehicles incorporating Irdeto security technology were manufactured and a second long-term customer win with one of the world’s largest automotive groups was secured.

COVID-19 AND FUTURE PROSPECTS

The COVID-19 pandemic has had a significant impact across the world, adversely affecting the lives of the Group’s customers and its employees.

“Our absolute priority has been the health and safety of our employees and moving swiftly to implement business continuity plans well ahead of the forced lockdowns. Content line ups were adjusted, including making news channels more widely available across the continent, as well as adding more kids’ shows, movies and curated sports content,” Mawela explains.

The aftermath of the virus and low oil price, although uncertain in quantum, will likely have a negative impact on the economies of many of the Group’s markets, with weaker currencies and higher levels of unemployment expected. The impact of this on the Group’s performance is not yet known.

“While macro-economic implications are largely uncontrollable, we are taking steps wherever we can to counter potential future headwinds. These include implementing further cost savings initiatives across the organization and continuing to do what we do best – provide our customers with great entertainment,” says Mawela.

Going forward, subject to a stable regulatory environment and the unknown impact of COVID-19 pandemic, the Group will be looking to continue scaling its video entertainment services across the continent, focusing on the mass- market for pay-TV services, as well as on OTT. In addition, it plans to further increase its investment in local content and adjust its cost base to deliver acceptable returns.

“We remain well positioned with a sought-after product offering, significant scale, a diversified footprint across the African continent and a robust business model with a low reliance on advertising revenue. Importantly, we have hedging programmes in place to offset some of the currency pressures we’re exposed to and a healthy balance sheet, which includes R9.1 billion in cash. These organisational strengths provide us with confidence that we can withstand the impending macro-challenges and demands and continue to enrich lives through our video entertainment services,” Mawela concludes.