TL;DR

- With mainstream platforms like Google, Meta, and X restricting crypto ads, specialized networks have become the go-to solution for Web3 marketing;

- Top networks—Cointraffic, Coinzilla, Bitmedia, Mintfunnel, and A-ADS—enable crypto payments, precise geo and wallet-based targeting, and implement robust anti-fraud safeguards;

- Entry costs vary: Cointraffic starts at €20, while larger-scale campaigns on Coinzilla require around $500. Available ad formats include banners, native content, video, and push notifications;

- Real-world campaigns show that splitting budgets across multiple networks and running A/B tests improves CPA and conversion rates;

- A well-balanced strategy allows crypto marketers to reach genuine audiences, scale campaigns confidently, and maintain ROI even in volatile markets.

The Evolution of Crypto Ad Industry: Beyond Traditional Barriers

The crypto advertising ecosystem for crypto project promotion has rapidly evolved out of necessity. As Google (often seen as a replacement for traditional Google Adsense or Google Ads), Meta, and social media platforms tightened their policies, often without clear guidelines or consistent enforcement, crypto project owners found themselves in a bind. This led to the emergence of ad network options that specialize in crypto ad, offering several key advantages for crypto advertisers:

- Compliance & Stability: these crypto ad networks understand the regulatory landscape for crypto ad, providing a more stable environment for your marketing campaigns, reducing the risk of unexpected bans;

- Targeted Audience: they connect you directly with individuals who are already interested in or actively involved in the crypto space, ensuring higher relevance and engagement for your crypto ad. They excel at reaching relevant audiences;

- Crypto-Friendly Payments: most crypto ad networks accept payments in popular cryptocurrencies, simplifying transactions for blockchain-based businesses;

- Specific Ad Formats: they offer ad formats and placements tailored to the crypto ecosystem, including unique integrations within wallets and decentralized applications (DApps) and sometimes even mobile apps.

Methodology: How We Compared the Networks

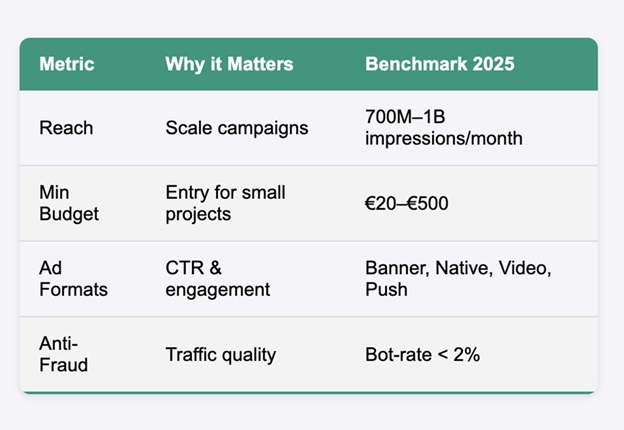

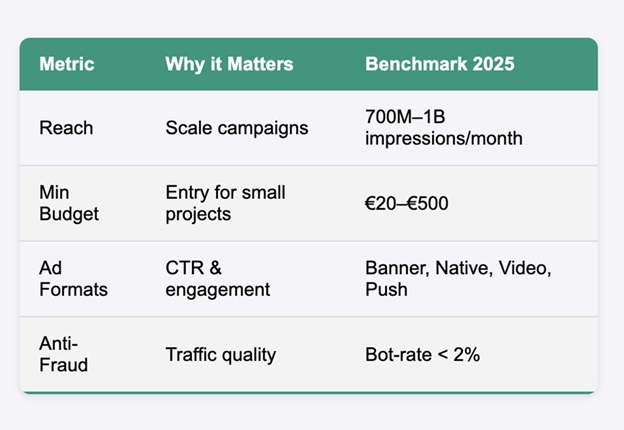

We evaluated networks based on 4 key metrics, using public sources and case studies:

- Reach: Total monthly impressions and audience relevance;

- Minimum Budget: Entry cost for small projects;

- Ad Formats: Banner, native, video, push notifications, and PR;

- Anti-Fraud Measures: Bot detection, manual vetting, AI or on-chain verification

Criteria Table 2025

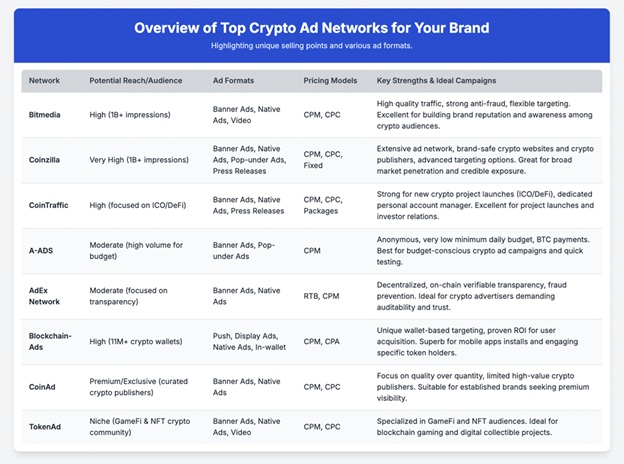

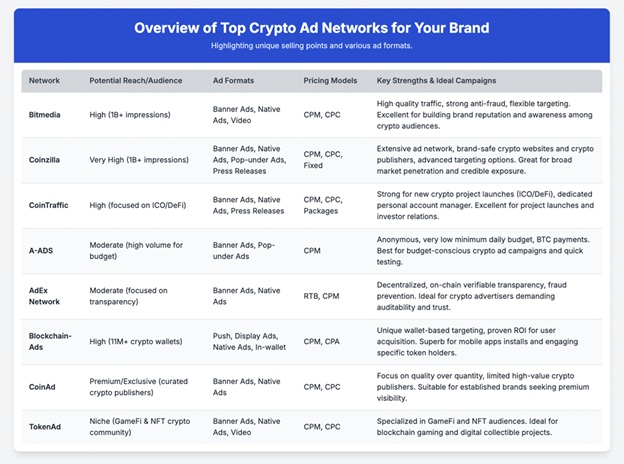

Overview of Top Crypto Ad Networks for Your Brand

Here’s a look at some of the best crypto ad network options available, highlighting their unique selling points and various ad formats:

A Closer Look at Prominent Crypto Advertising Networks

Bitmedia

Bitmedia has earned its reputation as a leading crypto ad network due to its commitment to providing high quality traffic from a vast network of reputable crypto websites. It offers advanced targeting options, allowing advertisers to precisely reach their desired target audience based on geo targeting, device targeting, and specific interests within the crypto space.

With strong anti-fraud measures in place, Bitmedia ensures that your crypto ad spend translates into genuine impressions and clicks. It supports various ad formats, including banner ads, native ads, and video, making it a versatile choice for building brand awareness and driving qualified high quality traffic.

Coinzilla

Coinzilla stands out for its massive reach and robust platform, connecting crypto advertisers with a broad vast network of brand-safe crypto websites and crypto publishers. It provides a comprehensive suite of ad formats, including display advertising (like banner ads), native ads, pop-under ads, and options for press releases distribution.

Coinzilla is highly regarded for its robust anti-fraud measures and sophisticated targeting capabilities, ensuring crypto advertisers connect with a relevant audience and that campaign performance is strong. Its diverse pricing models (CPM, CPC, and fixed packages) offer flexibility for marketing campaigns of various sizes and objectives, making it a go-to choice for extensive brand exposure and market penetration within the ad industry.

Cointraffic

Cointraffic has earned its reputation as a top crypto advertising network, particularly well-suited for ICO and DeFi projects looking to make a significant impact during their launch campaign phases. The ad network offers personalized service, including a dedicated personal account manager who provides guidance and support throughout the crypto ad campaign.

Cointraffic rigorously vets its crypto publishers inventory, guaranteeing high quality traffic and placements on legitimate crypto websites. With support for banner ads, native ads, and press releases, Cointraffic is an excellent option for new crypto project ventures aiming to build early momentum and foster a strong crypto community.

A-ADS (Anonymous Ads)

For crypto advertisers whose priority is a low entry barrier, anonymity, and cost-effectiveness, A-ADS is an ideal choice. A-ADS campaigns can be launched with minimal personal information and a very minimum daily budget (some starting as low as $1), primarily paid in Bitcoin. A-ADS operates on a CPM model, focusing on delivering high volumes of impressions quickly, making it excellent for budget-friendly marketing campaigns or initial testing.

While A-ADS might not offer the deep targeting capabilities of more premium ad network options, its simplicity and accessibility make it perfect for rapid testing, niche campaigns, or extending crypto ad reach without a significant financial commitment.

AdEx Network

AdEx is a pioneer in decentralized crypto advertising network solutions, built on blockchain industry technology to ensure unparalleled transparency and combat bot traffic and ad fraud at its core.

Every crypto ad impression and click is recorded on-chain, providing verifiable proof and eliminating the need for intermediaries. This focus on trust and auditability makes AdEx highly appealing to crypto advertisers that prioritize transparency in their crypto ad spend. It supports banner ads and native ads and uses a Real-Time Bidding (RTB) model, allowing advertisers for efficient and fair crypto ad placements. AdEx is an excellent option for those who value verifiable results and a strong stance against fraudulent activities.

Blockchain-Ads

Blockchain-Ads offers a cutting-edge approach with its wallet-based and on-chain activity targeting, allowing advertisers to reach crypto users based on their actual crypto holdings and interactions. This innovative targeting method ensures hyper-relevance and highly engaged crypto audiences.

The ad network provides diverse ad formats, including highly effective push notifications, display ads, native ads, and unique in-wallet ad formats. Blockchain-Ads has demonstrated strong ROI, particularly for user acquisition and mobile apps installations, making it a powerful platform for crypto project initiatives focused on measurable campaign performance. It often receives praise for its exceptional service.

Anti-Fraud & Compliance

- Manual vetting (Cointraffic);

- AI-powered fraud shield (Coinzilla, 2024);

- On-chain verification & wallet checks (Mintfunnel, Blockchain-Ads);

- KYC for publishers, MiCA/FinCEN compliance for EU/US projects.

Crypto Marketing Strategic Considerations for Your Crypto Ad Campaign

To ensure your marketing campaigns are successful, keep these practical tips in mind:

- Align with Your Goals: Before selecting a crypto advertising network, clearly define your crypto ad campaign objectives. Are you focused on brand recognition (CPM), driving website traffic (CPC), or achieving conversions (CPA) like sign-ups or token purchases?

- Start with a Test Budget: Don’t commit a large sum initially. Allocate a small test budget (e.g., $500 – $2,000) to experiment with different crypto ad networks, ad formats, and targeting strategies. Analyze the data to see what performs the best crypto ad network.

- Monitor and Optimize: Regularly review your campaign performance analytics, which provide detailed insights. Pay attention to click-through rates (CTR), conversion rates, and the quality of high quality traffic. A/B test your crypto ad creatives, landing pages, and calls to action to continually improve campaign performance.

- Combat Fraud: Always prioritize ad network options with strong anti-fraud measures. Bot traffic can drain your budget without delivering any real value. Look for transparency in fraud detection to protect advertisers.

- Consider Niche Networks: If your crypto project targets a very specific segment (e.g., GameFi, NFTs), specialized crypto ad networks like TokenAd might offer more concentrated access to your desired target audience. You might also explore influencer marketing to complement these efforts.

- Leverage Case Studies: Look for leading crypto ad network providers that provide real-world success stories or case studies, as these can offer valuable detailed insights into their effectiveness for crypto project promotions similar to yours.

Step-by-Step Launch Guide

- Create an account on selected network(s);

- Upload creatives (HTML5 ?120 KB);

- Set geo, device, and interest targeting;

- Start with test CPM: €0.20–0.60 (Cointraffic avg);

- After 48h, pause sites with CTR <0.2%;

- Monitor KPIs: CTR, CPA, D7 retention;

- Run A/B tests to optimize creatives & targeting

Common Mistakes

- Overpaying for above-the-fold banners on low-traffic sites;

- Ignoring frequency capping – banner blindness;

- Buying only CPM without UTM tags – impossible to calculate CPA;

- Launching one network instead of testing multiple.

Key recommendations:

- Small test budgets: Cointraffic or A-ADS;

- Large reach/brand awareness: Coinzilla;

- Wallet-based/on-chain targeting: Mintfunnel or Blockchain-Ads;

- Launch two networks with different strengths, monitor CTR, CPA, and D7 retention

Conclusion: Empowering Your Crypto Brand’s Growth

Specialized crypto ad networks empower Web3 projects to reach highly relevant, crypto-native audiences. By leveraging networks with AI anti-fraud, wallet-based targeting, and diverse ad formats, advertisers can maximize ROI, manage risk, and scale campaigns effectively. Testing multiple networks with different strengths ensures optimized campaigns, better CPA, CTR, and retention.

Like this:

Like Loading...