Enterprise systems planning looks at the entire business to decide what information system the enterprise requires to satisfy its objectives. For large businesses, this can be a costly procedure involving specialists and consultants, but smaller businesses can usually carry out analysis and planning in-house. Fundamentals for effective enterprise systems planning are the survival of a […]

The Prevalence of Half-hearted Digital Banking Practice Among Nigerian Banks: A Look at Access Bank and FCMB

Despite recent reforms in the Nigerian banking industry to make them more robust in securing the money of their depositors, customers and other stakeholders, there are clear indications that the sector needs a closer look in terms of its customer relationship management. The banking industry, as a service sector, is generally characterised by three of the five recognised features of service. These include intangibility, inseparability and heterogeneity. While intangibility refers to the non-physical nature of services, inseparability means that the rendering and consumption of services are done at the same time. This makes a bank-customer relationship an emotional/customer experience driven process where the quality of service is measured by how the customer is treated in the course of interacting with the bank.

Heterogeneity, which is the last of the three features, identified the role of human beings involved in the consumer service process. This feature sees service as an act of performance that cannot be repeated the same way when performed by the people involved in attending to consumers. Even in sectors, such as the banking industry, where there are standardized procedures of attending to clients, yet, human interaction makes service rendering a heterogeneous venture. From the analysis, it is argued that the management of Nigerian banks should understand the context of their operations especially for those commercial banks.

It is equally important to have a clear understanding of the process of the customer experience while patronising a bank. There is pre-service stage, service stage and post-service stage. The pre service stage is the point where customers are looking for a banking firm to bank with. Here, they have the alternatives to select from. The actual service encounter is the point at which customers relate with the banks in order to meet their financial needs. In short, it covers service requests, interaction with the personnel of the service provider and service delivery. The post service stage is the stage where the consumers review their experience with the service encounter. It is the point where the consumer’s expectation is reflected against the quality of the service outcome. The consumer evaluates the service experience against the perceived expectations. At this stage, future intentions to purchase are also determined.

A satisfied consumer whose perceived expectations are met by the quality of service may not only return to make a repurchase of the service but also tell others about their experiences and vice versa. This shows that banks, as a service sector operator, must have an efficient, seamless customer relationship management. But, the question is – is this the experience? The answer to this question is in the negative drawing from personal experience and complaints from some bank customers.

The first complaint is that of Mutiu Iyanda. He is an account holder with Access Bank who has not been able to resolve a 3-month complaint of a blacklist of his account. According to the angry and dejected customer of the bank, he has not been able to meet his financial responsibilities which has affected him badly. He detailed his attempts to get the issue resolved and the stumbling blocks he has continued to meet both at the branch where his account is domiciled and even from the head office of the Herbert Wigwe-led bank. How could the resolution of a compliant could still be pending three month after it was lodged? Why should a digital problem require an analogue situation? These are questions for Access Bank, Nigerian Deposit Insurance Corporation and the Central Bank of Nigeria who are the regulators of the banking sector.

Picture:

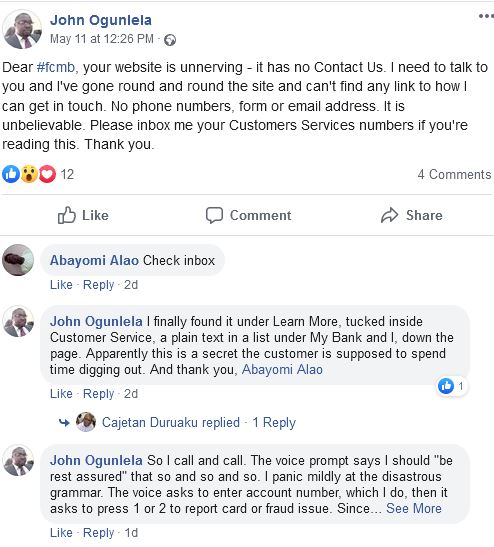

The second complaint comes from a colleague, John Ogunlela. He holds an account with First City Monument Bank. He had some issues to be urgently resolved, he found it difficult reaching the customer service. He quickly came to his Facebook page to call out the bank. He queried, “Dear #fcmb, your website is unnerving – it has no Contact Us. I need to talk to you and I’ve gone round and round the site and can’t find any link to how I can get in touch. No phone numbers, form or email address. It is unbelievable. Please inbox me your Customers Services numbers if you’re reading this. Thank you.” Upon help from a Facebook friend, who sent a Direct Message to him on how he could locate the buttons to get across to his bank on its own website, he still had a terrible experience. He narrated : “I finally found it under Learn More, tucked inside Customer Service, a plain text in a list under My Bank and I, down the page. Apparently this is a secret the customer is supposed to spend time digging out. And thank you, Abayomi Alao.”

It did not end there. He recounted his experience further: “So, I call and call. The voice prompt says I should “be rest assured” that so and so. I panic mildly at the disastrous grammar. The voice asks to enter account number, which I do, then it asks to press 1 or 2 to report card or fraud issue. Since I am not reporting fraud or a card issue, I disregard the statement. Pronto the call terminates. Then, I try the Whatsapp contact option. The faint double tick shows the message is diverted to the device. Seven hours later I am still waiting for a reply. The email I sent is also seven hours old. FCMB customer service desk used to be one of the best and it was midnight here. They kept on top of it and called me ceaselessly until I was okay. I am sad for them this is how they now operate. I will have to start all this tomorrow because I just won’t brave those Covid queues and crowds in the banking hall.”

It is easy to punch this argument based on the small number of the dissatisfied customers cited. However, the seriousness of the situations for the two banks would be better appreciated when the efficacy of the words of mouth especially in this digital era is taken into consideration. John Ogunlela has not less than 4,458 followers on Facebook where he shared his predicament. Mutiu Iyanda too has access huge following on an international blog that he writes for and where he has written an open letter to the Access Bank’s CEO, Herbert Wigwe. He has as well lodged a complaint with the Federal Competition and Consumers’ Protection Commission.

Again, considering the environment of the banking service, it is critical that banks ensure memorable experience for their customers. Whether on digital platforms or in the banking hall. The two complaints are representative of the issues an average bank customer deals with in Nigeria. Discomforting and hurtful experiences of the customers, such as the ones narrated above, has the tendency to affect financial inclusion drive of the Central Bank of Nigeria.

Insights drawn from a study reveal that despite the fact that Nigerian commercial banks have digitalized their operations, their customers still face a great deal of issues as they process their daily banking transactions. The customers still have to fill forms, queue within the banking halls waiting to be attended to. This is against the 2017 cashless policy of the Central Bank of Nigeria. That Nigerian commercial banks are claiming digital prowess but operating on an analogue mode is counter-productive to the financial inclusion drive of the apex bank. In a 2017 Global Findex Database, 40% of Nigerian adults have an account with a bank or a mobile money provider. The report further revealed that Nigeria and six other countries contribute nearly half of the globe’s unbanked population of 1.7 billion.

In conclusion, it is important to continue to ask questions on the digital banking practices in the Nigerian banking industry. How would a bank whose processes have been digitalized find it difficult to enable a seamless digital consumer service contact? In the same vein, how could Access Bank not able to resolve a complaints for three months? Where is the intelligent bank as claimed by the bank’s Chief Executive Officer? The complaints of the two customers are different in scope but are tilted towards the same direction- the digital platforms should ensure issues are resolved with customers’ minimal or no contact with the banking halls.

Madagascan Covid-Organics: A Challenge to Nigerian Herbalists

The controversy surrounding Madagascan COVID-19 cure is throwing Nigerians and other Africans into a frenzy. Some stood against it while some are die-hard fans of the medicinal drink. Those that have their reservations are viciously attacked by its fans. Medical practitioners and scientists have called attention to the fact that Madagascar has not published any clinical trial data on the drug. They also revealed that the drug has not passed through any peer review and third party verification and approval. However, their observations are discredited by many Africans, who claimed that these medical practitioners and scientists only wanted to save their jobs. The advocates of this drug also claimed that the medical practitioners and scientists condemn it because it is made in Africa. They refused to listen to reason.

The drama surrounding this cure started when the Madagascan President, Andry Rajoelina, claimed that WHO’s hesitation to declare the drug, branded COVID-Organics, as a potent cure for COVID-19 is because Madagascar is an African country and the 60th in world poverty ranking. He claimed that 55 Madagascan COVID-19 patients were treated with the herbal drink and they have all been cured. He also explained that COVID-Organics was developed by a research institute known as Malagasy Institute of Applied Research, but he failed to answer the questions surrounding clinical trials and tests.

The accusations by the Madagascan president is unfounded because WHO has not approved any reported newly developed drugs for COVID-19 and should, therefore, not jump in to approve those whose contents, indications, contra-indications, effects and adverse effects are not known. But this accusation played both political and economic role for the country. By playing the victim, the country has turned the world’s attention towards her and has used the campaign to offer to the world that which it craved for – cure and prevention of COVID-19. Many African countries have purchased the medicine for the treatment of their COVID-19 patients. Even Nigeria has joined the bandwagon of buyers though Lauretta Onoochie, the Personal Assistant to President Muhammadu Buhari on Social Media, revealed in her Twitter page that the consignment Nigeria is flying to Madagascar to pick is “a gift” from the generous country.

As we wait for verification, approval and confirmation from the countries that purchased this Madagascan COVID-19 cure (which should be out within the next ten days according to Rajoelina), let us turn to our numerous agbo sellers, agbo makers and herbal drug mixers and ask them, “HOW FAR?”

There is no market in this country that doesn’t have megaphones mounted in strategic places for herbal drug sellers. These people continue to remind us that we have everything it takes to heal diseases embedded in plants and that we should stop patronising “chemical drugs”. They also discourage people from going to hospitals because doctors make sickness worse, or that they treat symptoms without treating the sickness. Don’t get me wrong, I know that herbal drugs work, at least I used Dogonyaro to treat malaria during my service year in Zamfara because I noticed that most of the drugs sold in Kaura Namoda were uncertified by NAFDAC. My point here is that these people need to come out to prove their worth.

When COVID-19 started its ravage in the country, some herbal healers came out to claim that they have the cure for the disease and invited the people and the government to send patients to them. Even some religious “healers” made their own claims too. The herbalists’ claims were not tested as the government did not send patients to them nor take them to patients. Of course, even if they healed any private individual, they wouldn’t come out to say so because they may be arrested. But with the discovery and the release of COVID-Organics, the herbalists have their opportunities to show their skills.

Concerning Nigerian herbalists being given the opportunity to also show their skills, BBC Pidgin reported that the DG of NAFDAC, Prof. Mojisola Adeyeye, invited interested traditional medical practitioners on Wednesday, 13 May 2020 to submit their applications and drugs for clinical trials. She said that Nigerian traditional medical practitioners and academics only claim the potency of their drugs on social media and other media outlets without approaching NAFDAC for testing and approval. She revealed that of all the people claiming expertise on treating COVID-19 only one person has submitted an application. She, however, noted that the individual that submitted the application wishes to treat the symptoms of COVID-19 and not to cure the disease.

So here is an open door, and window, for all the owners of the megaphones blaring away in our markets. They need to hear about this opportunity and make use of it. All they need to do is conduct research, which they have obviously been doing before, and then bring up a cure just like Madagascar did. Nigeria too has herbs and roots that can cure everything.

Your Jobsearch Backpack – A Succinct Guide For Recent Graduates/Jobseekers

According to popular LinkedIn Job Search Specialist Kirsty Bonner, a young graduate’s first “volunteer 9-5 job” is SEARCHING for a job”.

There is nothing strange in being the guy who is so busy searching for a job. It is a phase in Life. Along the line in reaching for success, comes a time of transition and that is where you have just arrived. You could be a creative, an ordinary recent graduate or a person who is in search of a different career opportunity, the jobsearch adventure just provides that period of transition to a job of your dreams and a life of fulfilment. So it is all just perfectly normal to set out on a very good day in search of any job of interest which will in turn put food on your table.

This article is intended to introduce a jobseeker to the necessary papers, documents and approaches needed to excel in a typical job search scenario. These points were carefully made for modern day job search most of which are electronic. Although not exhaustive, these bullet points will be very much handy for recent graduates and NYSC members whose next target will be landing a job and becoming self-reliant or at least something similar. Modern day jobsearch is mostly Electronic and in some cases manual except in a typical documentation process where most of the processes are basically manual. There are certain practices and documents which a jobseeker must be conversant with in order to excel in the quest of jobsearch.

This writeup depicts job search as a process similar to hiking. In a typical hiking adventure, a ‘hiker’ will most likely carry a backpack. This backpack will contain all he needs to succeed in his quest. So as a jobseeker, what should be contained in your backpack?

Here we go, “The jobseekers backpack.

CV/Resumé

Your CV(curriculum vitae) is your ticket to reach a company. It is your “image” portrayed in your absence. A record of who you are, what you can do, what you’ve done and what you’ve achieved. These might be arranged in no particular order but most safely arranged as follows:

- 1. Name, contact details

- 2. Personal Information(optional)

- 3. Personal Statement

- 4. Experience

- 5. Educational Background/Achievements

- 6. Hobbies

- 7. References

Although, these could be rearranged depending on the level of employment or achievement but for “Entry Level” jobs, the arrangement above is the basic.

Your CV should be well organised and in multiple according to your career interests. Take care of ATS (Applicant Tracking System) concerns by eliminating unnecessary lines and including major keywords.

NYSC Discharge/Exemption certificate

Every HND/BSC entry level job requires an NYSC certificate either during the job registration process or during the interview. Other jobs like those in the public sector will always require the tendering of an NYSC discharge/exemption certificate so this is a very important document that must never miss a jobseekers backpack at least for those in Nigeria.

An Editable Sample of a Cover Letter

There is usually a conflict amongst recent graduates and jobseekers as to the difference between a ‘Cover Letter’ and an ‘Application Letter’. A cover letter is basically an application letter. It is a formal letter just like every other formal letter. A cover letter is accompanied by a CV. It is intended to introduce a prospective employer to your CV. The cover letter in its closing paragraph should draw the attention of your prospective employer to any other document that is part of your application with a statement that could the form below:

“Attached within, are copies of my CV, BSc Certificate, NYSC certificate…”

In simple words a cover letter is intended for you to “sell yourself to the company. Give them a reason to employ you”

With an Editable Cover letter sample handy, one can quickly make adjustments in applying for multiple jobs.

Recent Passport Photograph

Your passport photo is also a part of your jobsearch backpack. Red or white background is mostly the acceptable format that is generally acceptable.

No one wants to see your primary school passport. Your passport should most probably portray your current facial look.

Certificate/Statement of Result

A very important document which shows that you have been to the four walls of a higher institution or any qualification to be presented. Your certificate should be guided with pride as it is your foremost qualification.

Clear Bag/Office flat file

A clear bag is very much needed and should not be discarded. Never fold any document!

Normally, your documents are fitted into an office flat file and inserted into a clear bag. The clear bag is waterproof and it ensures that water does not get into your papers during movement from one interview center to another.

National ID or equivalent

This is necessary for you to identify yourself anywhere you go. A typical “government” ID ensures that you are a citizen or that you have a local identification that ensures you are captured as a person within the country and perhaps permitted to work in Nigeria.

Scan all relevant documents and save in your Email/Google drive

All the documents mentioned above except the ones that are already in electronic form should be scanned and sent to your personal email. God forbid if your documents go missing but if it does, it will not stop you from having access to them in case of any job opening that you wish to apply for.

There is no need running to a “cyber cafe” every time there is a job opening, just open your email and export the documents into your application as required.

Worthy of note is the fact that a lot of our people do not understand that their mobile smart phone is a mini computer. With a smartphone, you can scan, upload and save any document provided the phone has a good camera resolution.

Subscribe to an Online job vacancy newsletter for regular vacancy updates

There are tens of job websites out on the internet for your easy navigation. Jobberman.com, hotnigerianjobs.com etc.

Create a LinkedIn profile

Unfortunately, there is not much publicity about LinkedIn in our clime. People will rather log in to facebook, twitter and Instagram, neglecting LinkedIn. LinkedIn presents job seekers and teeming career driven minds with the opportunity to mix with industry like minds. Connect with #recruiters from around the world, be active and learn from them.

Last but not least, kindly Keep all of your Social media accounts free of “weird” posts because as we all know, “the internet never forgets”

You will succeed!

Digitization in Nigeria’s Microfinance Banks

Many IT professionals were idle, while some were overwhelmed with so many activities during the lockdown due to Covid-19 pandemic.

I feel reluctant to write this, but it is a path to opening up digital growth for Microfinance Banks (MFBs).

A digital Microfinance bank in this context is a bank that is reasonably equipped technologically with necessary gadgets and IT infrastructures directly or indirectly to function fully and discharge its products and services to its target customers through E-channels at all times with minimal or no limitations.

I have reviewed several fantastic and creative Core Banking Solutions suitable for Microfinance activities but some of them never had the opportunity to become noticed.

There is one major problem regarding digitization that had slowed down the growth in the Microfinance sub-sector in more than a decade. The problem was self-inflicted by MFBs unknowingly while choosing Core Banking Solution as everyone wants to connect to a popular platform.

The emergence of several innovations through Fintechs has opened our eyes to see more possibilities.

I do not support a unified IT platform for MFBs from the onset, but the enforcement of reporting templates among Solution Providers for uniformity will be preferred.

To help microfinance banks grow digitally, CBN should limit the numbers of Mfbs that should subscribe to each Core Banking Solution Provider for effectiveness and promptness of creative innovations.

Many Core-banking Solutions Providers are overwhelmed; professionalism in responding to complaints that could evoke innovative solutions is usually sacrificed at this point.

When the focus begins to shift from excellent Customer Service to “they don’t have a choice because the decision to change Core Banking Solutions cannot be hurriedly taken”. It shows there is a huge problem ahead.

Many Mfbs (most especially Unit-licensed) are dying in silence. Their Core Banking Solutions are fast-tracking their funerals. I have once used a Solution that gives conflicting reports on the same query at different times. Many Mfbs may still be facing such a problem. Even those MFBs that invested heavily in IT infrastructure are not yet getting the expected returns on their investments due to unresolved high failure rates in the activities on e-channels that could be traced to their Core Banking Solutions.

Dear MFB, behold yourself now, are you sure you do not need help to grow digitally?

I am sure you do. But you are handicapped because you cannot run faster than the rope while being dragged.

Review the activities of your IT Solution Providers.

When was the last time they innovated and implemented a new or better approach to your operations’ processes digitally?

It is not a capability issue in most cases, but many of them are overwhelmed by the number of clients they serve.

It does not necessarily mean migrating to another better Solution that is willing and authorized to grow the client base should cost you more; it all depends on negotiation.

The first bold step into the journey of achieving improved digitization in the activities of MFBs is to have the numbers of subscribers to each Core Banking Solution regulated.