The performance of Nigeria’s labour market in 2024 offers both optimism and caution. Data from the first three quarters of the year, released by the National Bureau of Statistics, shows that nearly one million jobs were created, yet the economy also suffered significant job losses by the third quarter. Our analyst posits that understanding these dynamics is crucial for business leaders, policymakers, and investors who must navigate a labour market that reflects the wider challenges of the Nigerian economy.

A Promising Start to the Year

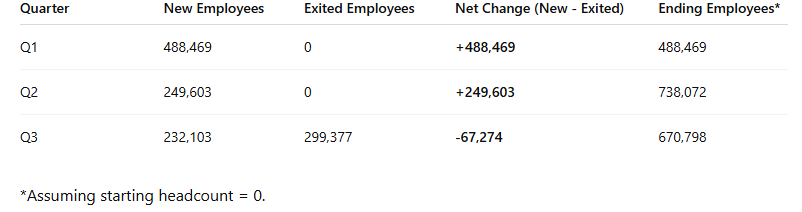

In the first quarter of 2024, Nigeria experienced a remarkable wave of job creation. Almost 490,000 new jobs were added, reflecting either government-led employment drives, seasonal agricultural demand, or private sector expansions. The second quarter sustained this trend, though at a slower pace, with about 250,000 additional jobs. Taken together, the first half of 2024 gave the impression of positive momentum, suggesting that the economy was beginning to absorb some of the millions of Nigerians entering the workforce every year.

This growth should not be understated. Nigeria faces one of the fastest-growing populations in the world, and each year over four million young people join the labour force. The creation of over 700,000 jobs in just six months was a significant achievement. It signalled resilience in sectors such as agriculture, services, and possibly parts of manufacturing, despite the macroeconomic challenges of inflation, foreign exchange volatility, and infrastructure gaps. For many, the data from the first two quarters provided a sense of cautious optimism that Nigeria could expand opportunities in the face of global and domestic pressures.

The Turning Point in the Third Quarter

By the third quarter, however, the picture shifted dramatically. Job creation fell further to about 232,000, while job losses surged to nearly 300,000. This resulted in a net decline of more than 67,000 jobs during the quarter. For the first time in 2024, the labour market contracted, reflecting deeper structural weaknesses in the economy.

Several factors likely contributed to this reversal. Inflation remained elevated, particularly food inflation. High costs of living reduce consumer demand and put pressure on businesses to cut costs. The depreciation of the naira also raised import costs and disrupted supply chains, particularly for manufacturers reliant on imported inputs. Rising energy prices added another layer of difficulty for small and medium enterprises, many of which operate with already thin margins. In more formal sectors such as banking, oil and gas, and technology, cost-cutting measures and retrenchments have also been reported.

This quarter’s outcome reveals how fragile the labour market gains have been. Without a steady macroeconomic foundation, job creation becomes highly vulnerable to shocks and policy inconsistencies.

The Broader Structural Challenge

While the net job gain across the first three quarters of 2024 stands at about 670,000, this falls short of what Nigeria needs to keep pace with its rapidly expanding workforce. Even in a year of relatively strong job creation, millions of Nigerians remain unemployed or underemployed. Many of the jobs created are concentrated in the informal sector or in seasonal agricultural activities, which often lack stability, social protections, and the ability to generate sustainable income.

This disconnect between headline job numbers and real livelihood improvements highlights a deeper structural problem. Nigeria’s economic growth has not consistently translated into quality employment opportunities. The mismatch between skills and available jobs, weak industrialisation, and underinvestment in sectors that drive productivity all limit the ability of the economy to create stable, high-paying jobs. Unless these issues are addressed, periodic spikes in job creation will not be enough to solve the underlying employment crisis.

Building a More Resilient Labour Market

To transform these patterns, Nigeria needs a deliberate strategy that links economic growth with sustainable job creation. Policymakers must focus on stabilising the macroeconomic environment by tackling inflation, improving foreign exchange liquidity, and reducing energy costs. Investment in infrastructure, particularly reliable electricity, would allow businesses to expand with more confidence.

Equally important is the need to strengthen the connection between education, training, and the evolving needs of the economy. As global industries shift toward technology and green energy, Nigeria must prepare its workforce with relevant skills to remain competitive. Supporting entrepreneurship and small businesses, which already account for a large share of employment, will also be critical.

For the private sector, the challenge is to identify opportunities in adversity. Companies that innovate around local sourcing, renewable energy, and digital services can create not only profit but also significant employment. Partnerships between government and businesses can accelerate this process, while international investors should see Nigeria’s young and energetic workforce as a long-term opportunity once structural reforms take root.