Winning in Business This week, we have a special session: Winning in Business. The session is all videos, and is designed to help with the reviews of some of our previous weeks on innovation & growth – the core theme of this program. There is no reading material. Also, there is no challenge assignment. […]

Central Bank of Nigeria (CBN) Suspends And Voids All Lay-offs in Nigerian Banks

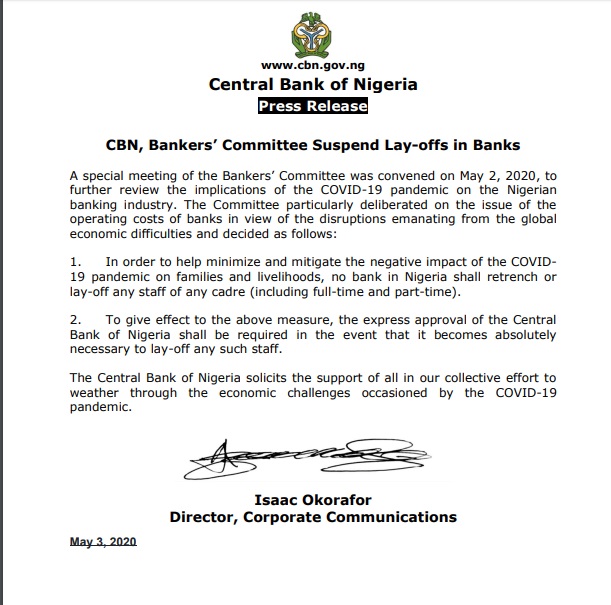

The Central Bank of Nigeria (CBN) has made lay-offs in the banking sector illegal: “no bank in Nigeria shall retrench or lay-off any staff of any cadre (including full-time and part-time…the express approval of the Central Bank of Nigeria shall be required in the event that it becomes absolutely necessary to lay-off any such staff.” Access Bank which plans to fire within 75% of its workforce will now need to open a new playbook now.

The full statement below

“A special meeting of the Bankers’ Committee was convened on May 2, 2020, to further review the implications of the COVID-19 pandemic on the Nigerian banking industry. The Committee particularly deliberated on the issue of the operating costs of banks in view of the disruptions emanating from the global economic difficulties and decided as follows:

“1. In order to help minimize and mitigate the negative impact of the COVID- 19 pandemic on families and livelihoods, no bank in Nigeria shall retrench or lay-off any staff of any cadre (including full-time and part-time).

“2. To give effect to the above measure, the express approval of the Central Bank of Nigeria shall be required in the event that it becomes absolutely necessary to lay-off any such staff.

“The Central Bank of Nigeria solicits the support of all in our collective effort to weather through the economic challenges occasioned by the COVID-19 pandemic.”

Ndubuisi Ekekwe Speech to Pan-African IT Forum – Business Innovation & Growth In Post Covid-19 World [Video]

Last night, I spoke before eminent professionals of the Pan African Information Technology Forum with headquarters in Houston, Texas. People all over the continent connected. The topic was Business Innovation & Growth In Post Covid-19 World. The presentation and Q/As below.

*We deleted the video in an old account and has re-posted in our current YouTube account

FUTO Notable Alumni: Believe in the Promise of Tomorrow

There are honours which are special. My mother built a trophy case for me since I was in secondary school. But this one is so special because it is coming from my seniors and my professors: listed on Federal University of Technology Owerri (FUTO) website as one of the 4 notable alumni. FUTO has tens of thousands of graduates around the world. To be in the Notable Four is a moment.

FUTO was the most challenging university I attended because of the culture shock. When I arrived from the village (Ovim, Abia state) to the university in Owerri (first time in the city), I was lost with living in a dorm, eating buka food, etc. But waking up at 4am to get a seating position for a class starting at 9am, in the old Lake Nwaebere campus, was normal as in the village I used to go to the village stream to fetch water before school.

Late last year when I visited to deliver the University Convocation Lecture, the Vice Chancellor hosted me in the VC wing. We spent 45 minutes discussing our university. As I walked out, students gathered for autographs, I became emotional.

My message today is this: Believe in the Promise of Tomorrow. Our world is good and be optimistic about it. Yes, anything is possible with life. That is my name: Ndubuisi – “life is first”. #Believe

The Explanation of the “extremely necessary for Nigeria”

My note: “Then praise him [President Buhari] for really good moves like closing the latest loan (extremely necessary for Nigeria)…” I had noted that it was “extremely necessary” for Nigeria to have taken the recent IMF emergency loan despite the concerns to the previous unbalanced and thoughtless one, pre Covid-19.

This is why that loan is very important:

- NNPC was not making money due to the Covid-19 pandemic. Whenever that happens, Nigeria has a real problem. Experiencing that during a period of national health emergency compounds the models.

- VAT & broad tax revenue was not coming because offices were shut down. Government was not having receivables because offices that were to process them were hibernating.

- Local & international capital markets were frozen. Not many private lenders would have been open to support Nigeria with capital due to the stochastic state of the world due to Covid-19. Our poor credit rating would not have helped. Only the IMF could have offered a way out, and it did.

So that triple whammy requires Nigeria borrowing since we do not have money for the rainy day to fight the virus and take care of the necessary urgent bills. That loan is for a health emergency and I do think it was a very necessary loan. Sure, while we all push against some of these loans, the recent $3.4 billion is a commendable one. My fear was that not many people would lend to Nigeria. But magically, the IMF, due to the virus, reversed its position and did the right thing.