Femi Gbajabiamila: For demonstrating uncommon fairness towards a stronger Nigerian union when he declined to consider a flawed loan structured to exclude a region. By rejecting the loan, already passed by the Senate, despite concerns from the affected constituency, Speaker Gbajabiamila rose above his party and the current government, to serve his country with honor and decency. We celebrate him today, and quote his inspiring words – “Equity suggests that all zones must be carried along” – for all Nigerians, as we honour him as Tekedia Person of the Quarter, Q1 2020.

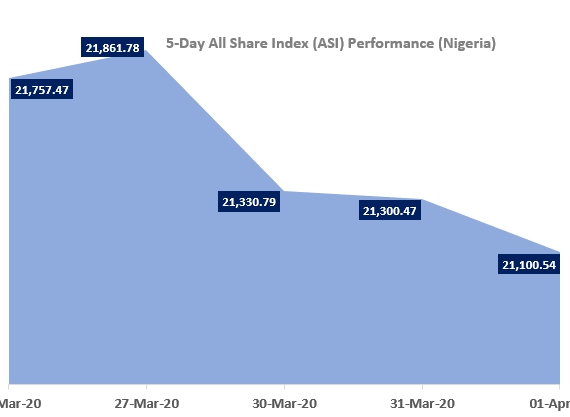

TrustBanc Daily Stock Market Scorecard, 1st April 2020

|

“I want every American to be prepared for the hard days that lie ahead…” Trump “The number of deaths, based on current projections, is between 100,000 and 200,000. On 15 April, for instance, 2,214 Americans are expected to die.” BBC The outbreak’s rapid spread and projected deaths put huge question marks over when economic life in the U.S. will return to normal. When economic life and activities will return to normal in the U.S. is the closest reality to projecting when it will globally, including Nigeria. |

Market Breadth: The breadth of the market was weak today as the bears overwhelmed the bulls with 26 declining stocks as against 6 rising stocks. See the list of top gainers or losers below:

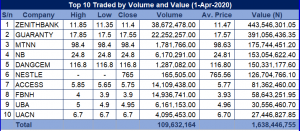

Market Turnover: Turnover declined by 63.38% in volume and appreciated by 2.52% in value. See top 10 traded stocks below:

Have a great evening.

Covid-19 And Nigeria’s Social Intervention Program

In a bid to alleviate the hardship emanating from the restrictions and lockdowns initiated by governments as measures to curtail the spread of coronavirus, the federal government said it has started doling out palliatives to poor households in the country.

Sadiya Farouk, the Minister of Humanitarian Affairs, Disaster Management and Social Development, said the Ministry has commenced disbursement of cash transfer to poorest households in Nigeria.

“In Mr. President’s speech, paragraph 54, he directed that the conditional cash transfer should be given in advance of two months. This we have also done. We have directed immediate cash transfer to the poorest and most vulnerable households in the country.

“Because of this COVID-19, the vulnerable groups have to be expanded because we are aware that there are people who live on daily wage. So we are also going to look at those groups of people to see how we can get this food relief intervention to them this period,” she said.

As part of efforts to reach the most vulnerable with relief supplies, Farouk said the National Emergency Management Agency (NEMA) has deployed trucks of relief materials to states affected by the coronavirus pandemic.

As at March 31, Nigeria has recorded 139 confirmed cases of coronavirus, scattered across 12 states of the country with Lagos having the highest number (82). Many states have embarked on restrictions and curfews in an attempt to quell the spread, resulting in deprivation of people’s means of income, especially those who depend on their daily income to earn a living.

President Buhari on Sunday, during his state broadcast promised to make provisions that will assuage the hardship stemming from the restrictions and lockdowns. Accordingly, the Ministry of Humanitarian Affairs has commenced cash remittance to the most affected people in the country.

According to Mrs. Farouk, over 11 million Nigerians have been identified so far as beneficiaries. She said on Tuesday during the press briefing of the Presidential Task Force on coronavirus that the government already has a social register with details of those considered as the vulnerable in the society.

She said the neediest in the society cut across 35 states of the federation in around 2.6 million households, among them, those in Internally Displaced Persons (IDP) camps, who have received two months rations of the relief supply already.

However, this development is not receiving its supposed applause because of how people see it. The question popping here and there are: “How did the government identify poorest Nigerians”? How does the government determine poorest households? Among the reasons many think the answers to the questions are relevant is that poorest Nigerians don’t even own bank accounts. But according Mrs. Farouk, the disbursement has been through bank accounts, and that has appeared fishy to many.

Lukman Olamilekan, a concerned Nigerian said the most vulnerable people in the face of coronavirus live in the most affected cities where the lockdown is currently active. And that means, the government has got all wrong going to all 35 states at the same time.

“The poorest households, which I believe are the people in the remote areas and hamlets. I don’t think COVID-19 presently affects these people, those affected are the people in the city who survive on daily earnings. They need this money far more than the villagers,” he said.

The World Poverty Clock puts the number of poor Nigerians at about 100 million people who are living below moderate poverty line ($2 and above daily), which means a staggering number of people in Nigeria live below $1.9 daily.

The Minister of Humanitarian Affairs said that the government has identified 11 million people out of about 100 million Nigerians who are living in abject poverty to be beneficiaries of the relief program.

Though some Nigerians have been sharing screenshots of their bank’s credit notification online as evidence that the government is living up to its promise, it only confirms the fear of many. It is believed that the poorest ones among Nigerians don’t even have what it takes to be on the internet, which puts a question mark on the government’s selection method of those deserving the social intervention program.

It is believed that it is “business as usual,” that nepotism must have played a big role in the selection of those who receive the cash and material support from the government, if at all it’s something anyone would believe.

Economy, Finance & Business News Headlines: 1st April 2020

In the midst of the fear and uncertainty, each day seems to bring news that’s worse than the day before. Yesterday, the number of deaths recorded in the U.S grew by 23% to 3,073, it has now moved again by 27% to 3,909.

The good news is that most people with COVID-19 recover. “Estimates now suggest that 99% of people infected with the virus that causes COVID-19 will recover. Some people have no symptoms at all. Children seem to be infected less often and have milder disease” Harvard Health please read more…

However, based on estimates and record of infections, this pandemic is still going to rage on for some time, don’t lose your guard, hold your investments in ‘near cash’. At this crucial, unpredictable and unprecedented times, cash is king. Don’t invest in risky assets, if you must, make sure it’s calculated else hold your investments in ‘near cash’ assets.

In the midst of the uncertainty, we launched a money market fund to help you grow your cash, the fund was successful and approved by regulators. Our first valuation is out and the yield is awesome, over 11.50%, it’s one of the best in the industry if not the best at the moment. Our fund was built during this pandemic, modelled around a product that will remain good even as the pandemic wears on.

As you are aware, we are a digital bank and working from home has worked best for us. Our customer care team are online, active and friendly, you can subscribe and make redemptions from your fund within 24 hours.

Same operation model applies across all our subsidiaries and products, feel free to reach out anytime, we are here.

In Nigeria, the pump price of petrol has gone down again, now N123.5. A mix of good and bad news.

Today, 1st of April is significant for oil prices from the supply cut angle, not that a reduction in supply will stop the current trend of daily decline in price but if an agreement is reached to sustain the current quota or cut it further, it may reduce the degree of fall in prices.

As of now, Traders are scrambling to offload their stock of crude at heavily unprecedented discounted prices. We are in a glut and it’s growing daily, if an agreement isn’t reached between OPEC members, Saudi and Russia, prices will continue to Tank.

Locally, the pump price of oil will also reduce so also will reserves. Devaluation again?

|

Headlines:

Lagos, Ogun, FCT may lose N1.6tn to lockdown – Investigation

FG reduces petrol price to N123.5 per litre

The Federal Government on Tuesday night reduced the price of petrol from N125/litre to N123.5/litre. Current petrol price indicates a reduction of N1.5 on every litre of petrol purchased nationwide. It announced the reduction through the Petroleum Products Pricing Regulatory Agency, after a whole day meeting with stakeholders in the oil and gas sector in Abuja. Read more

Internet traffic surges as lockdown begins in Lagos

The Chief Executive Officer, Internet Exchange Point of Nigeria, Muhammed Rudman, said a surge in Internet traffic was noticed on Tuesday when the lockdown took effect in selected states, especially in Lagos. According to him, Internet traffic has increased by 10 per cent in the past one week as many companies had introduced work-from-home policy a week before the government-imposed lockdown. Read more

DPR enforces petrol sale at filling stations

In a related development, the DPR on Tuesday began the enforcement of sales and distribution of petroleum products at filling stations, particularly in states where the Federal Government declared a two-week lockdown. It was gathered that the oil sector regulator dispatched more enforcement teams to filling stations in Abuja, Lagos and Ogun states and the teams would enforce compliance during the two-week period. Read more

NERC suspends electricity tariff increase

The Nigerian Electricity Regulatory Commission has suspended the proposed increase in electricity tariffs initially slated for Wednesday (today). The regulator said on Tuesday that public hearings were held at different locations within the franchise areas of the Discos from February 25 and March 9 to consider the applications. It said the wide metering gap in the Nigerian electricity supply industry, currently at about 60 per cent, “is a major impediment to both an immediate tariff review and revenue protection for Discos.” Read more

Fed Govt distributes preventive items

The Federal Ministry of Humanitarian Affairs, Disaster Management, and Social Development has donated preventive items to the People Living with Disabilities (PLWDs), at the Karmajiji disabled community in Abuja. The ministry explained that the donation is in line with the efforts of President Muhammadu Buhari’s administration towards the prevention and further spread of COVID 19 in the country. Items donated include hand sanitizers, face masks, soaps, bleach and plastic buckets. Read more Nigeria’s COVID-19 cases rise to 139

Asian shares hold on to gains but virus keeps markets on edge

Asian stocks clung to gains on Wednesday, helped by a bounce in Australian shares, but risks for equities remain large as the coronavirus pandemic rattles the underpinnings of the global economy. E-Mini futures for the S&P 500 traded 1.39% lower in Asian trade, highlighting the cautious mood. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.23%. Australian shares jumped by 2.87%, reversing a 2% decline on Tuesday, as a slowdown in new coronavirus cases and rising iron ore prices lifted the market. Read more

European stock index futures slide as coronavirus damage grows

European stock index futures fell more than 3% on Wednesday as dismal economic data from Asia underlined the damage to the economy from the coronavirus pandemic and fanned fears of a deep global recession. Read more

Oil prices fall as U.S. inventory build-up heightens oversupply concerns

Global crude oil prices slid further on Wednesday, following their biggest-ever quarterly and monthly losses, as a bigger-than-expected rise in U.S. inventories and a widening rift within OPEC heightened oversupply fears. As of 0345 GMT, Brent crude was down by 47 cents, or 1.8%, at $25.88 a barrel. U.S. West Texas Intermediate crude was up 12 cents, or 0.6%, at $20.6 a barrel, an uptick analyst said was driven by position building at the start of a the new quarter. Read more

Dollar firms as investors brace for global downturn

The dollar was a touch firmer on Wednesday, buoyed by its safe-haven status with the world staring at what is likely to be one of the worst economic contractions for decades as it locks down to fight the coronavirus pandemic. It advanced against the Australian and New Zealand dollars, the euro, yen, Swiss franc and pound in Asian trade – but not much – as appetite for the safety of cash dollars was offset by aggressive liquidity measures from the U.S. Federal Reserve. Read more Gold Prices Down as Russia Halts Bullion Purchases Gold prices were down in Asia on Wednesday morning, extending yesterday’s losses amid speculations that Russia might move from big buyer to possible seller of bullion. Gold futures were down 0.13% to $1,594.45 by 09:40 PM ET (2:40 AM GMT), but the losses were limited as investors remained cautious amid turbulent economic times. Read more

China reports 36 new coronavirus cases

China reported on Wednesday a fall in new confirmed coronavirus cases, with almost all cases imported from overseas. China had 36 new cases on Tuesday, the National Health Commission said on Wednesday, down from 48 a day earlier. Read more Devaluation and your wealth Continue reading …

|

What Happens To My Business Now?

There are 41,543,028 micro, small and medium scale enterprises in Nigeria according to data from the National Bureau of Statistics and the small business agency, SMEDAN. My educated guess is that nearly every Nigerian adult has at least one small business contributing in one way or another to the economy. Unfortunately, for a segment this huge, little is reported of its impact.

With the current outbreak of the corona virus and its crippling effects, there is no doubt that many businesses precisely the micro, small and medium scale enterprises will be gravely affected to the point of death since many of them have fewer cash reserves and a smaller margin of error for managing sudden downturns.

While many business owners are desperately looking towards the Nigerian government for some form of succour, there are few important things you should reconsider as an entrepreneur to save your business from dying with the corona virus scourge.

1) Reconsider your finances: one key area in your business that will call for concern in this period is your finance but what exactly should you reconsider about your business finance? (i) burn rate and (ii) runway. In the simplest form, a burn rate is how much cash your company spends on a monthly basis while your company’s runway is the amount of time you have until your business runs out of money, assuming your current income and expenses stay constant.

These two indexes are great sustainability tests that will guide you in what financial decisions to make, what expenses to cut or what moves to make to keep your business from flaming out till the pandemic is over.

2) Reconsider Your Business Model: here is a truth, every business by default has a business model, the other sad truth is that many entrepreneurs are ignorant and/or unconscious of their business’ model of creating and delivering value, hence the difficulty to steer their venture away through the storm. Since many physical activities will be affected due to social isolation and lockdown, as a business owner, you should reconsider how you could create, deliver and harness value for your business most importantly using bit/virtual channels to do these.

Finally, be optimistic. This pandemic will pass, although for how long its effect will last one might not be able to tell but one thing is for sure, it will definitely pass and while you wait for it to be over and your business to return back to top speed, be well assured that success in the forthcoming business era won’t be achieved by the power of brawns, but on the speed of sense.