You’ve been told that DropShipping is the ultimate way to make big money! Probably, those ‘Fake Gurus’ are offering to sell a course to you on how to Drop Ship—they’re showing you fake numbers in sales and ROI. Don’t be Scammed, here’s why Drop-shipping is a Horrible Business.

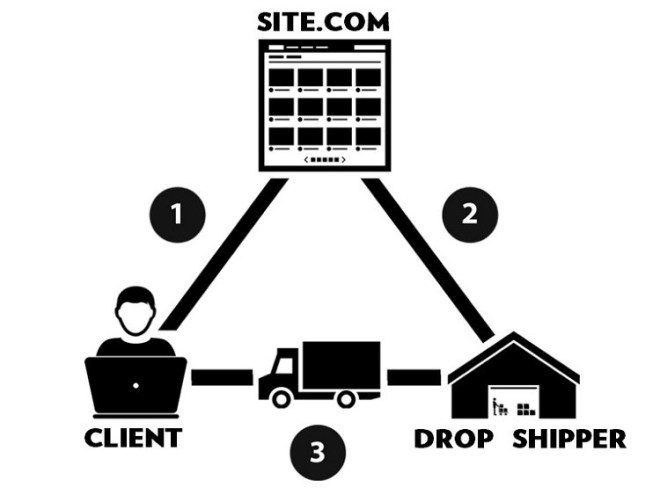

Generally, dropshipping is geared towards individual marketplaces, e-commerces, and entrepreneurs. The process consists of receiving sales orders online and forwarding them to the supplier, that is, the dropship partner, which in turn sends the product to your customer on behalf of your company.

As a result, you do not have to manipulate or have access to the product, you only do the intermediate for sale. The profit from this process comes from the price difference between the amount you disclose in your online store and what your dropshipping partner charges.

Dropshipping was one of the latest—we’ll call it “business out of a box” schemes that has been around for a few years now. This is where internet marketers claim that if you buy their course, they’ll teach you how with very little effort.

You can make money, quit your job, buy a Lambo, without much effort. There are many forms of it: eBay dropshipping, amazon dropshipping, print on demand, etc. The funny part is that the forms varies from location to location, and there’s nothing you can do about it.

Source: nestify.io

The whole premise is that you can find these so-called “winning products” from wholesale distributors, usually from China with Ali-express. You find the winning product. You get traffic to your website via paid ads on Facebook and Instagram.

People buy, you pocket the difference—aka retail arbitrage!

So Why won’t Dropshipping Last?

When you get paid at a job, you made money because you provided value to your employer in the form of your labor. Isn’t that right? You know the answer. Value—it is!

And in every other business it’s the exact same—you make money from customers when you provide enough value to them. The more value, the more money you make. So money is really just a storehouse of value. You can’t argue that—I’ve always advised that the more value = more cash!

In JeffBezos own words, “customers that buy products online only care about these three things: low prices, big selection, fast delivery.” And since that’s literally all Amazon focuses on, that’s probably why Jeff is the richest man in the world!

Yet, these are the only things people and online gurus focus with dropshipping:

— How I can do the least amount of work?

— How can I make enough money to quit my job and fire my boss?

These and more are just a tip of the iceberg—you’d be surprised as to their passion.

And there lies the problem—the entire idea and business model of dropshipping completely neglects what every customer wants. You provide next to ZERO value to customers! Which is not a good sign of a business or business leader for goodness sake, yet they’ll not listen.

How are People Making Money from Dropshipping Then?

- First -movers.

- Low margins.

- Fake numbers; and fake gurus.

Even if you can make a profitable dropshipping business, is that the best long term business model to get into? I mean really? That question defies most of them!

The Big Questions

Q: So why so many dropshipping gurus?

A: Selling online courses!

Q: Is there any case where dropshipping is viable?

A: There are other ways to provide value. Provide luxury. Find an under-served niche. Have a personal brand. That’s how you can turn up!

Conclusion

In dropshipping customers are often neglected for profit. Dropshippers tend to sell a product to a customer only once. This can lead to a poor customer experience. This has led to a lack of trust in this business model.